MetLife 2011 Annual Report Download - page 20

Download and view the complete annual report

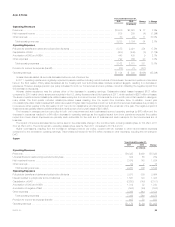

Please find page 20 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.underlying assumptions in accordance with GAAP and applicable actuarial standards. Principal assumptions used in the establishment of liabilities for

future policy benefits are mortality, morbidity, policy lapse, renewal, retirement, disability incidence, disability terminations, investment returns, inflation,

expenses and other contingent events as appropriate to the respective product type and geographical area. These assumptions are established at the

time the policy is issued and are intended to estimate the experience for the period the policy benefits are payable. Utilizing these assumptions, liabilities

are established on a block of business basis. If experience is less favorable than assumed, additional liabilities may be established, resulting in a charge

to policyholder benefits and claims.

Future policy benefit liabilities for disabled lives are estimated using the present value of benefits method and experience assumptions as to claim

terminations, expenses and interest.

Liabilities for unpaid claims are estimated based upon the Company’s historical experience and other actuarial assumptions that consider the effects

of current developments, anticipated trends and risk management programs, reduced for anticipated salvage and subrogation.

Future policy benefit liabilities for minimum death and income benefit guarantees relating to certain annuity contracts are based on estimates of the

expected value of benefits in excess of the projected account balance, recognizing the excess ratably over the accumulation period based on total

expected assessments. Liabilities for universal and variable life secondary guarantees and paid-up guarantees are determined by estimating the

expected value of death benefits payable when the account balance is projected to be zero and recognizing those benefits ratably over the

accumulation period based on total expected assessments. The assumptions used in estimating these liabilities are consistent with those used for

amortizing DAC, and are thus subject to the same variability and risk. The assumptions of investment performance and volatility for variable products are

consistent with historical experience of the appropriate underlying equity index, such as the S&P 500 Index.

The Company periodically reviews its estimates of actuarial liabilities for future policy benefits and compares them with its actual experience.

Differences between actual experience and the assumptions used in pricing these policies and guarantees, as well as in the establishment of the

related liabilities result in variances in profit and could result in losses.

See Note 8 of the Notes to the Consolidated Financial Statements for additional information on the Company’s liability for future policy benefits.

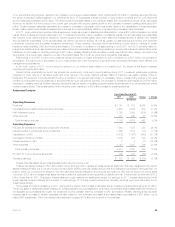

Reinsurance

Accounting for reinsurance requires extensive use of assumptions and estimates, particularly related to the future performance of the underlying

business and the potential impact of counterparty credit risks. The Company periodically reviews actual and anticipated experience compared to the

aforementioned assumptions used to establish assets and liabilities relating to ceded and assumed reinsurance and evaluates the financial strengthof

counterparties to its reinsurance agreements using criteria similar to that evaluated in the security impairment process discussed previously. Additionally,

for each of its reinsurance agreements, the Company determines whether the agreement provides indemnification against loss or liability relating to

insurance risk, in accordance with applicable accounting standards. The Company reviews all contractual features, particularly those that may limit the

amount of insurance risk to which the reinsurer is subject or features that delay the timely reimbursement of claims. If the Company determines that a

reinsurance agreement does not expose the reinsurer to a reasonable possibility of a significant loss from insurance risk, the Company records the

agreement using the deposit method of accounting.

See Note 9 of the Notes to the Consolidated Financial Statements for additional information on the Company’s reinsurance programs.

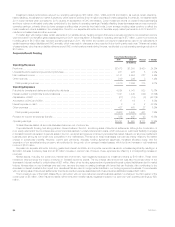

Income Taxes

The Company provides for federal, state and foreign income taxes currently payable, as well as those deferred due to temporary differences

between the financial reporting and tax bases of assets and liabilities. The Company’s accounting for income taxes represents management’s best

estimate of various events and transactions. These tax laws are complex and are subject to differing interpretations by the taxpayer and the relevant

governmental taxing authorities. In establishing a provision for income tax expense, we must make judgments and interpretations about the application

of these inherently complex tax laws. We must also make estimates about when in the future certain items will affect taxable income in the various tax

jurisdictions, both domestic and foreign.

The realization of deferred tax assets depends upon the existence of sufficient taxable income within the carryback or carryforward periods under the

tax law in the applicable tax jurisdiction. Valuation allowances are established when management determines, based on available information, that it is

more likely than not that deferred income tax assets will not be realized. Factors in management’s determination include the performance of the

business and its ability to generate capital gains. Significant judgment is required in determining whether valuation allowances should be established, as

well as the amount of such allowances. When making such determination, consideration is given to, among other things, the following:

(i) future taxable income exclusive of reversing temporary differences and carryforwards;

(ii) future reversals of existing taxable temporary differences;

(iii) taxable income in prior carryback years; and

(iv) tax planning strategies.

Disputes over interpretations of the tax laws may be subject to review and adjudication by the court systems of the various tax jurisdictions or may

be settled with the taxing authority upon audit. The Company determines whether it is more likely than not that a tax position will be sustained upon

examination by the appropriate taxing authorities before any part of the benefit is recorded in the financial statements. The Company may be required to

change its provision for income taxes when estimates used in determining valuation allowances on deferred tax assets significantly change, or when

receipt of new information indicates the need for adjustment in valuation allowances. Additionally, future events, such as changes in tax laws, tax

regulations, or interpretations of such laws or regulations, could have an impact on the provision for income tax and the effective tax rate. Any such

changes could significantly affect the amounts reported in the consolidated financial statements in the year these changes occur.

See Note 15 of the Notes to the Consolidated Financial Statements for additional information on the Company’s income taxes.

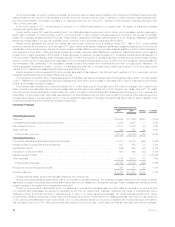

Employee Benefit Plans

Certain subsidiaries of MetLife, Inc. sponsor and/or administer pension and other postretirement benefit plans covering employees who meet

specified eligibility requirements. The obligations and expenses associated with these plans require an extensive use of assumptions such as the

discount rate, expected rate of return on plan assets, rate of future compensation increases, healthcare cost trend rates, as well as assumptions

regarding participant demographics such as rate and age of retirements, withdrawal rates and mortality. In consultation with our external consulting

actuarial firms, we determine these assumptions based upon a variety of factors such as historical performance of the plan and its assets, currently

available market and industry data, and expected benefit payout streams. We determine our expected rate of return on plan assets based upon an

approach that considers inflation, real return, term premium, credit spreads, equity risk premium and capital appreciation, as well as expenses, expected

asset manager performance and the effect of rebalancing for the equity, debt and real estate asset mix applied on a weighted average basis to our

pension asset portfolio. Given the amount of plan assets as of December 31, 2010, if we had assumed an expected rate of return for both our pension

16 MetLife, Inc.