MetLife 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.on the pricing levels of risk-bearing investments. See “Risk Factors — Governmental and Regulatory Actions for the Purpose of Stabilizing and

Revitalizing the Financial Markets and Protecting Investors and Consumers May Not Achieve the Intended Effect or Could Adversely Affect Our

Competitive Position” in the 2011 Form 10-K.

Beginning in 2010 and continuing throughout 2011, concerns increased about capital markets and the solvency of certain European Union member

states, including Portugal, Ireland, Italy, Greece and Spain, and of financial institutions that have significant direct or indirect exposure to their sovereign

debt. This, in turn, increased market volatility that will continue to affect the performance of various asset classes in 2012, and perhaps longer, until there

is an ultimate resolution of these European Union sovereign debt-related concerns.

As a result of concerns about the ability of Portugal, Ireland, Italy, Greece and Spain, commonly referred to as “Europe’s perimeter region,” to service

their sovereign debt, these countries have experienced credit ratings downgrades, including the downgrade of Greece’s sovereign debt in July 2011 by

Moody’s Investors Service, Inc. (“Moody’s”) and S&P to Ca and CC ratings, respectively — rating designations of likely in, or very near, default, following

the announcement of the debt exchange proposal summarized below. In February 2012, S&P further downgraded Greece, as described below.

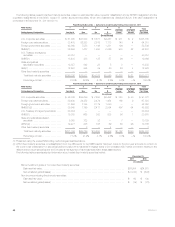

Despite support programs for Europe’s perimeter region, concerns about the ability to service sovereign debt subsequently expanded to other European

Union member states. As a result, in late 2011 and early 2012, several other European Union member states have experienced credit ratings

downgrades or have had their credit ratings outlook changed to negative. As summarized below, at December 31, 2011, the Company did not have

significant exposure to the sovereign debt of Europe’s perimeter region. Accordingly, we do not expect such investments to have a material adverse

effect on our results of operations or financial condition. Outside of Europe’s perimeter region, the Company’s sovereign debt, corporate debt and

perpetual hybrid securities in Europe were concentrated in the United Kingdom, Germany, France, the Netherlands and Poland, which are higher-rated

countries within the European Union, as well in Switzerland and Norway, which are two higher-rated non-European Union countries.

Greece Support Program. In July 2011, a public sector support program for Greece of €109 billion was announced, as well as a separate,

voluntary debt exchange proposal for private sector holders of Greece sovereign debt (known as Private Sector Involvement, or “PSI”). Private investors

that voluntarily participate in the initially proposed July PSI proposal, which was expected to apply to Greece’s sovereign debt maturing through 2019,

were expected to incur losses on a net present value basis of approximately 20% on such securities. In October 2011, a revision of the July PSI

proposal was announced which included a voluntary 50% nominal discount on all maturities of Greece sovereign debt held by the private sector. In

addition to this, the public sector Greece financing package was revised to €100 billion plus a contribution of €30 billion from Greece’s public sector

creditors to provide collateral enhancements on the exchanged Greece sovereign bonds under the October PSI proposal. On February 21, 2012, the

Euro Group, which is comprised of the finance ministers of the member states of the European Union, representatives of the European Commission and

the European Central Bank, announced a €130 billion support program that contains a PSI proposal for a voluntary 53.5% nominal discount on all

maturities of Greece sovereign debt held by the private sector. On February 23, 2012, Greece’s Parliament retroactively inserted collective action

clauses in the documentation of certain series of its sovereign debt, which has the effect of binding all private sector investors to accept the terms ofa

debt exchange, if a quorum of private sector investors accepts the debt exchange proposal. Greece launched a sovereign debt exchange offer on

February 24, 2012. On February 27, 2012, as a result of the retroactive insertion of such collective action clauses, S&P downgraded Greece’s credit

rating to SD, a rating of selective default. If the Greece sovereign debt exchange offer is consummated, S&P has stated it will likely consider the

selective default to have been cured and would likely raise the sovereign credit rating on Greece.

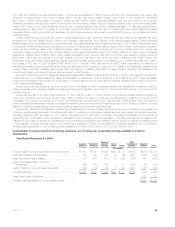

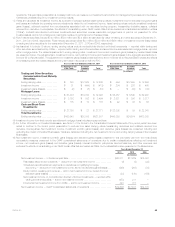

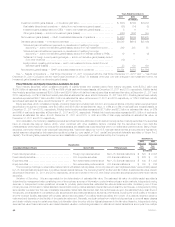

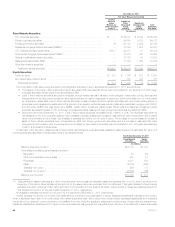

Europe’s Perimeter Region Sovereign Debt Securities. Our holdings of Greece sovereign debt were acquired in the Acquisition and our amortized

cost basis reflects recording such securities at estimated fair value on November 1, 2010, which was substantially below par, partially mitigating our

impairment exposure. During the year ended December 31, 2011, we recorded non-cash impairment charges of $405 million on our holdings of

Greece’s sovereign debt. In addition, during the year ended December 31, 2011, we sold a significant portion of our Europe’s perimeter region

sovereign debt, thereby substantially reducing our exposure. The par value, amortized cost and estimated fair value of holdings in sovereign debt of

Europe’s perimeter region were $874 million, $254 million and $264 million at December 31, 2011, respectively, and $1.9 billion, $1.6 billion and $1.6

billion at December 31, 2010, respectively.

MetLife, Inc. 39