MetLife 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

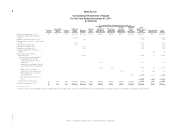

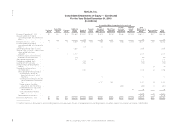

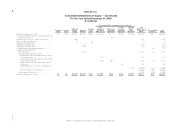

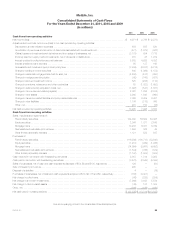

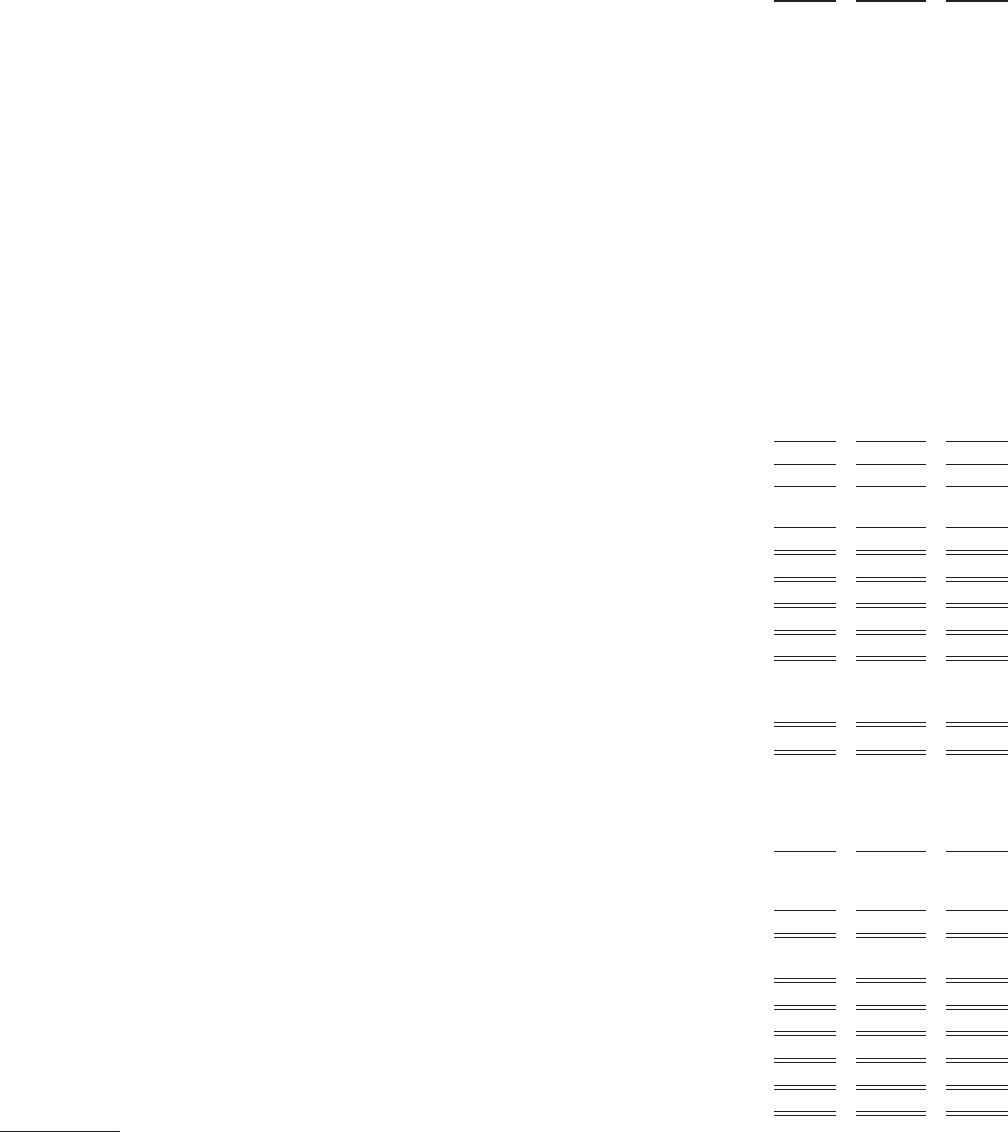

MetLife, Inc.

Consolidated Statements of Cash Flows — (Continued)

For the Years Ended December 31, 2011, 2010 and 2009

(In millions)

2011 2010 2009

Cash flows from financing activities

Policyholder account balances:

Deposits ................................................................................ $ 91,946 $ 74,296 $ 77,517

Withdrawals .............................................................................. (87,625) (69,739) (79,799)

Net change in payables for collateral under securities loaned and other transactions ........................ 6,444 3,076 (6,863)

Net change in bank deposits ................................................................... 96 (32) 3,164

Net change in short-term debt ................................................................. 380 (606) (1,747)

Long-term debt issued ....................................................................... 1,346 5,090 2,961

Long-term debt repaid ........................................................................ (2,042) (1,061) (555)

Collateral financing arrangements issued ......................................................... — — 105

Collateral financing arrangements repaid .......................................................... (502) — —

Cash received in connection with collateral financing arrangements ..................................... 100 — 775

Cash paid in connection with collateral financing arrangements ........................................ (63) — (400)

Junior subordinated debt securities issued ........................................................ — — 500

Debt issuance costs ......................................................................... (1) (14) (30)

Common stock issued, net of issuance costs ..................................................... 2,950 3,529 —

Stock options exercised ...................................................................... 88 52 8

Redemption of convertible preferred stock ........................................................ (2,805) — —

Preferred stock redemption premium ............................................................ (146) — —

Common stock issued to settle stock forward contracts ............................................. — — 1,035

Dividends on preferred stock .................................................................. (122) (122) (122)

Dividends on common stock ................................................................... (787) (784) (610)

Other, net ................................................................................. 125 (304) (42)

Net cash provided by (used in) financing activities .................................................. 9,382 13,381 (4,103)

Effect of change in foreign currency exchange rates on cash and cash equivalents balances ................. (22) (129) 108

Change in cash and cash equivalents ............................................................ (2,585) 2,934 (14,127)

Cash and cash equivalents, beginning of year ..................................................... 13,046 10,112 24,239

Cash and cash equivalents, end of year $ 10,461 $ 13,046 $ 10,112

Cash and cash equivalents, subsidiaries held-for-sale, beginning of year ................................ $ 89 $ 88 $ 108

Cash and cash equivalents, subsidiaries held-for-sale, end of year $—$ 89$88

Cash and cash equivalents, from continuing operations, beginning of year ............................... $12,957 $ 10,024 $ 24,131

Cash and cash equivalents, from continuing operations, end of year $ 10,461 $ 12,957 $ 10,024

Supplemental disclosures of cash flow information:

Net cash paid (received) during the year for:

Interest .................................................................................. $ 1,565 $ 1,489 $ 989

Income tax ............................................................................... $ 676 $ (23) $ 397

Non-cash transactions during the year:

Business acquisitions:

Assets acquired(1) ....................................................................... $ 327 $125,728 $ —

Liabilities assumed(1) ..................................................................... (94) (109,306) —

Redeemable and non-redeemable noncontrolling interests assumed ................................ — (130) —

Net assets acquired ...................................................................... 233 16,292 —

Cash paid, excluding transaction costs of $0, $88 and $0, respectively ............................. (233) (7,196) —

Other purchase price adjustments ........................................................... — 98 —

Securities issued ........................................................................ $ — $ 9,194 $ —

Remarketing of debt securities:

Fixed maturity securities redeemed .......................................................... $ — $ — $ 32

Long-term debt issued ................................................................... $ — $ — $ 1,035

Junior subordinated debt securities redeemed ................................................. $ — $ — $ 1,067

Purchase money mortgage loans on sales of real estate joint ventures ................................ $ — $ 2 $ 93

Real estate and real estate joint ventures acquired in satisfaction of debt ............................... $ 292 $ 93 $ 211

Collateral financing arrangements repaid ........................................................ $ 148 $ — —

(1) The 2010 amounts include measurement period adjustments described in Note 2.

See accompanying notes to the consolidated financial statements.

94 MetLife, Inc.