MetLife 2011 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

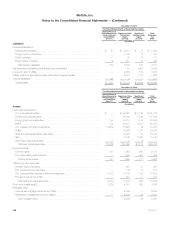

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

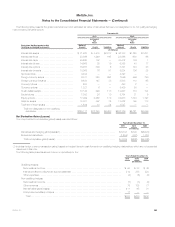

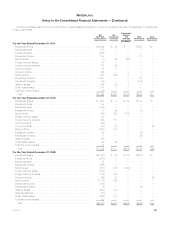

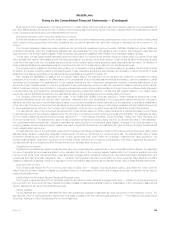

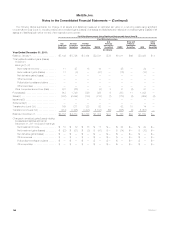

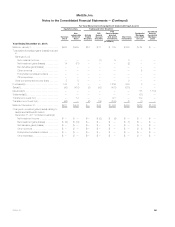

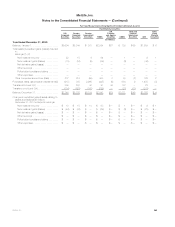

December 31, 2010

Fair Value Measurements at Reporting Date Using

Quoted Prices in

Active Markets for

Identical Assets

and Liabilities

(Level 1)

Significant Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Estimated

Fair

Value

(In millions)

Other invested assets:

MSRs .................................................................. — — 950 950

Other investments ........................................................ 373 121 — 494

Derivative assets:(3) .......................................................

Interest rate contracts ................................................... 131 3,583 39 3,753

Foreign currency contracts ............................................... 2 1,711 74 1,787

Credit contracts ........................................................ — 125 50 175

Equity market contracts .................................................. 23 1,757 282 2,062

Total derivative assets ................................................. 156 7,176 445 7,777

Total other invested assets ............................................ 529 7,297 1,395 9,221

Net embedded derivatives within asset host contracts(4) ............................ — — 185 185

Separate account assets(5) .................................................. 25,566 155,589 1,983 183,138

Total assets ............................................................. $51,247 $477,044 $29,156 $557,447

Liabilities:

Derivative liabilities:(3)

Interest rate contracts ..................................................... $ 35 $ 1,598 $ 125 $ 1,758

Foreign currency contracts ................................................. — 1,372 1 1,373

Credit contracts .......................................................... — 101 6 107

Equity market contracts .................................................... 10 1,174 140 1,324

Total derivative liabilities .................................................. 45 4,245 272 4,562

Net embedded derivatives within liability host contracts(4) ........................... — 11 2,623 2,634

Long-term debt of CSEs ..................................................... — 6,636 184 6,820

Trading liabilities(6) .......................................................... 46 — — 46

Total liabilities ............................................................ $ 91 $ 10,892 $ 3,079 $ 14,062

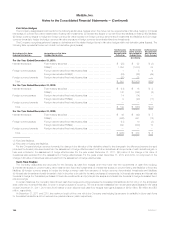

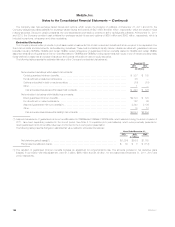

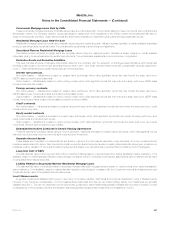

(1) Short-term investments as presented in the tables above differ from the amounts presented in the consolidated balance sheets because certain

short-term investments are not measured at estimated fair value (e.g., time deposits, etc.), and therefore are excluded from the tables presented

above.

(2) Mortgage loans held-for-sale as presented in the tables above differ from the amount presented in the consolidated balance sheets as these tables

do not include mortgage loans that were previously designated as held-for-investment, but now are designated as held-for-sale and stated at lower

of amortized cost or estimated fair value.

(3) Derivative liabilities are presented within other liabilities in the consolidated balance sheets. The amounts are presented gross in the tables above to

reflect the presentation in the consolidated balance sheets, but are presented net for purposes of the rollforward in the Fair Value Measurements

Using Significant Unobservable Inputs (Level 3) tables which follow. At December 31, 2010 there were $185 million of non-derivative hedging

instruments, carried at amortized cost, which are included within the liabilities total in Note 4 but excluded from derivative liabilities in the tables above

as they are not derivative instruments. At December 31, 2011, there were no non-derivative hedging instruments.

(4) Net embedded derivatives within asset host contracts are presented primarily within premiums, reinsurance and other receivables in the

consolidated balance sheets. Net embedded derivatives within liability host contracts are presented primarily within PABs in the consolidated

balance sheets. At December 31, 2011, fixed maturity securities and equity securities also included embedded derivatives of $2 million and

($72) million, respectively. At December 31, 2010, fixed maturity securities and equity securities included embedded derivatives of $5 million and

($62) million, respectively.

(5) Separate account assets are measured at estimated fair value. Investment performance related to separate account assets is fully offset by

corresponding amounts credited to contractholders whose liability is reflected within separate account liabilities. Separate account liabilities are set

equal to the estimated fair value of separate account assets.

(6) The liability related to securitized reverse residential mortgage loans and trading liabilities are presented within other liabilities in the consolidated

balance sheets.

See Note 3 for discussion of CSEs included in the tables above and for certain amounts in prior year footnote disclosures which have been

reclassified to conform with the 2011 presentation.

MetLife, Inc. 153