MetLife 2011 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

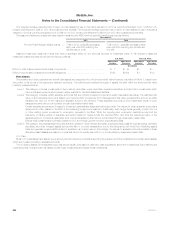

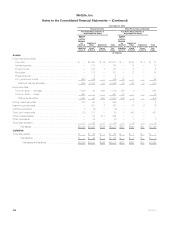

Commitments

Leases

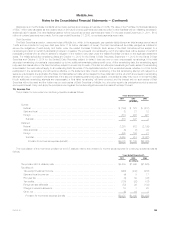

In accordance with industry practice, certain of the Company’s income from lease agreements with retail tenants are contingent upon the level of the

tenants’ revenues. Additionally, the Company, as lessee, has entered into various lease and sublease agreements for office space, information

technology and other equipment. Future minimum rental and sublease income, and minimum gross rental payments relating to these lease agreements

are as follows:

Rental

Income Sublease

Income

Gross

Rental

Payments

(In millions)

2012 ......................................................................... $425 $17 $337

2013 ......................................................................... $386 $20 $279

2014 ......................................................................... $332 $12 $202

2015 ......................................................................... $283 $12 $172

2016 ......................................................................... $223 $12 $145

Thereafter ..................................................................... $921 $74 $917

The Company previously moved certain of its operations in New York from Long Island City, Queens to Manhattan. Market conditions, which

precluded the Company’s immediate and complete sublet of all unused space following this movement of operations, resulted in a lease impairment

charge of $52 million during 2009, which is included in other expenses within Corporate & Other. The impairment charge was determined based upon

the present value of the gross rental payments less sublease income discounted at a risk-adjusted rate over the remaining lease terms which range from

15-20 years. The Company has made assumptions with respect to the timing and amount of future sublease income in the determination of this

impairment charge. See Note 19 for discussion of $28 million of such charges related to restructuring. Additional impairment charges could be incurred

should market conditions change.

Commitments to Fund Partnership Investments

The Company makes commitments to fund partnership investments in the normal course of business. The amounts of these unfunded

commitments were $4.0 billion and $3.8 billion at December 31, 2011 and 2010, respectively. The Company anticipates that these amounts will be

invested in partnerships over the next five years.

Mortgage Loan Commitments

The Company has issued interest rate lock commitments on certain residential mortgage loan applications totaling $5.6 billion and $2.5 billion at

December 31, 2011 and 2010, respectively. The Company intends to sell the majority of these originated residential mortgage loans. Interest rate lock

commitments to fund mortgage loans that will be held-for-sale are considered derivatives and their estimated fair value and notional amounts are

included within interest rate forwards. See Note 4.

The Company also commits to lend funds under certain other mortgage loan commitments that will be held-for-investment. The amounts of these

mortgage loan commitments were $4.1 billion and $3.8 billion at December 31, 2011 and 2010, respectively.

Commitments to Fund Bank Credit Facilities, Bridge Loans and Private Corporate Bond Investments

The Company commits to lend funds under bank credit facilities, bridge loans and private corporate bond investments. The amounts of these

unfunded commitments were $1.4 billion and $2.4 billion at December 31, 2011 and 2010, respectively.

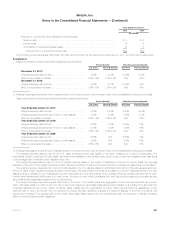

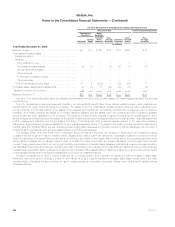

Guarantees

In the normal course of its business, the Company has provided certain indemnities, guarantees and commitments to third parties pursuant to which

it may be required to make payments now or in the future. In the context of acquisition, disposition, investment and other transactions, the Company

has provided indemnities and guarantees, including those related to tax, environmental and other specific liabilities and other indemnities and guarantees

that are triggered by, among other things, breaches of representations, warranties or covenants provided by the Company. In addition, in the normal

course of business, the Company provides indemnifications to counterparties in contracts with triggers similar to the foregoing, as well as for certain

other liabilities, such as third-party lawsuits. These obligations are often subject to time limitations that vary in duration, including contractual limitations

and those that arise by operation of law, such as applicable statutes of limitation. In some cases, the maximum potential obligation under the indemnities

and guarantees is subject to a contractual limitation ranging from less than $1 million to $800 million, with a cumulative maximum of $1.5 billion, while in

other cases such limitations are not specified or applicable. Since certain of these obligations are not subject to limitations, the Company does not

believe that it is possible to determine the maximum potential amount that could become due under these guarantees in the future. Management

believes that it is unlikely the Company will have to make any material payments under these indemnities, guarantees, or commitments.

In addition, the Company indemnifies its directors and officers as provided in its charters and by-laws. Also, the Company indemnifies its agents for

liabilities incurred as a result of their representation of the Company’s interests. Since these indemnities are generally not subject to limitation with

respect to duration or amount, the Company does not believe that it is possible to determine the maximum potential amount that could become due

under these indemnities in the future.

The Company has also guaranteed minimum investment returns on certain international retirement funds in accordance with local laws. Since these

guarantees are not subject to limitation with respect to duration or amount, the Company does not believe that it is possible to determine the maximum

potential amount that could become due under these guarantees in the future.

During the year ended December 31, 2011, the Company did not record any additional liabilities for indemnities, guarantees and commitments. The

Company’s recorded liabilities were $5 million at both December 31, 2011 and 2010, for indemnities, guarantees and commitments.

202 MetLife, Inc.