MetLife 2011 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

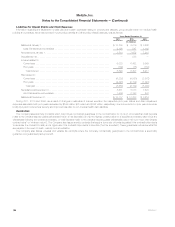

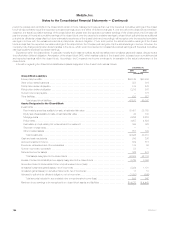

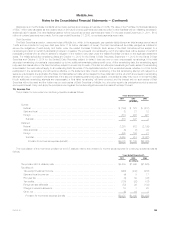

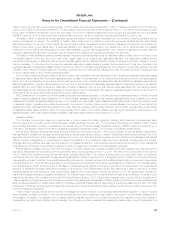

11. Long-term and Short-term Debt

Long-term and short-term debt outstanding was as follows:

Interest Rates

Range Weighted

Average

December 31,

Maturity 2011 2010

(In millions)

Senior notes .................................... 0.57%-7.72% 4.84% 2012-2045 $15,666 $16,258

Advances agreements ............................. 0.23%-4.86% 2.28% 2012-2021 4,179 3,600

Surplus notes ................................... 7.63%-7.88% 7.85% 2015-2025 700 699

Fixed rate notes(1) ................................ 7.50%-15.00% 10.02% 2012 — 82

Other notes with varying interest rates ................. 2.77%-8.00% 5.23% 2016-2030 42 95

Capital lease obligations ........................... 37 32

Total long-term debt(2) ............................ 20,624 20,766

Total short-term debt .............................. 686 306

Total ......................................... $21,310 $21,072

(1) Certain of the fixed rate notes were repaid prior to maturity in 2011.

(2) Excludes $3.1 billion and $6.8 billion of long-term debt relating to CSEs at December 31, 2011 and 2010, respectively. See Note 3.

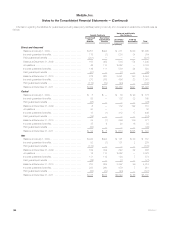

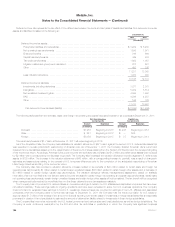

The aggregate maturities of long-term debt at December 31, 2011 for the next five years and thereafter are $1.5 billion in 2012, $1.5 billion in

2013, $1.7 billion in 2014, $2.3 billion in 2015, $2.4 billion in 2016 and $11.2 billion thereafter.

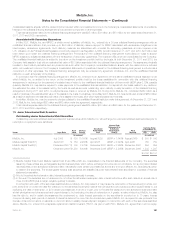

Advances agreements and capital lease obligations are collateralized and rank highest in priority, followed by unsecured senior debt which consists

of senior notes, fixed rate notes and other notes with varying interest rates, followed by subordinated debt which consists of junior subordinated debt

securities. Payments of interest and principal on the Company’s surplus notes, which are subordinate to all other obligations at the operating company

level and senior to obligations at MetLife, Inc., may be made only with the prior approval of the insurance department of the state of domicile. Collateral

financing arrangements are supported by either surplus notes of subsidiaries or financing arrangements with MetLife, Inc. and, accordingly, have priority

consistent with other such obligations.

Certain of the Company’s debt instruments, credit facilities and committed facilities contain various administrative, reporting, legal and financial

covenants. The Company believes it was in compliance with all such covenants at December 31, 2011.

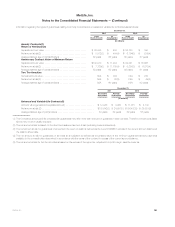

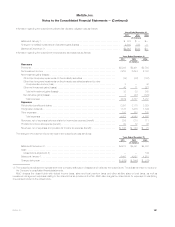

Senior Notes — Senior Debt Securities Underlying Equity Units

In connection with the financing of the Acquisition (see Note 2) in November 2010, MetLife, Inc. issued to AM Holdings $3.0 billion (estimated fair

value of $3.0 billion) in three series of Debt Securities, which constitute a part of the Equity Units more fully described in Note 14. The Debt Securities

(Series C, D and E) are subject to remarketing, initially bear interest at 1.56%, 1.92% and 2.46%, respectively (an average rate of 1.98%), and carry initial

maturity dates of June 15, 2023, June 15, 2024 and June 15, 2045, respectively. The interest rates will be reset in connection with the successful

remarketings of the Debt Securities. Prior to the first scheduled attempted remarketing of the Series C Debt Securities, such Debt Securities will be

divided into two tranches equal in principal amount with maturity dates of June 15, 2018 and June 15, 2023. Prior to the first scheduled attempted

remarketing of the Series E Debt Securities, such Debt Securities will be divided into two tranches equal in principal amount with maturity dates of

June 15, 2018 and June 15, 2045.

Senior Notes — Other

In August 2010, in anticipation of the Acquisition, MetLife, Inc. issued senior notes as follows:

‰$1.0 billion senior notes due February 6, 2014, which bear interest at a fixed rate of 2.375%, payable semiannually;

‰$1.0 billion senior notes due February 8, 2021, which bear interest at a fixed rate of 4.75%, payable semiannually;

‰$750 million senior notes due February 6, 2041, which bear interest at a fixed rate of 5.875%, payable semiannually; and

‰$250 million floating rate senior notes due August 6, 2013, which bear interest at a rate equal to three-month LIBOR, reset quarterly, plus 1.25%,

payable quarterly.

In connection with these offerings, MetLife, Inc. incurred $15 million of issuance costs which have been capitalized and included in other assets.

These costs are being amortized over the terms of the senior notes.

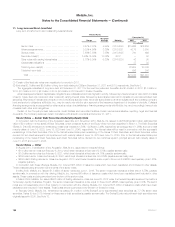

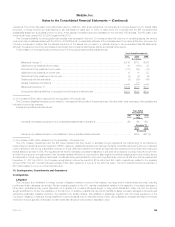

In May 2009, MetLife, Inc. issued $1.3 billion of senior notes due June 1, 2016. The senior notes bear interest at a fixed rate of 6.75%, payable

semiannually. In connection with the offering, MetLife, Inc. incurred $6 million of issuance costs which have been capitalized and included in other

assets. These costs are being amortized over the term of the senior notes.

In March 2009, MetLife, Inc. issued $397 million of floating rate senior notes due June 29, 2012 under the Federal Deposit Insurance Corporation’s

Temporary Liquidity Guarantee Program. The senior notes bear interest at a rate equal to three-month LIBOR, reset quarterly, plus 0.32%. The senior

notes are not redeemable prior to their maturity. In connection with the offering, MetLife, Inc. incurred $15 million of issuance costs which have been

capitalized and included in other assets. These costs are being amortized over the term of the senior notes.

In February 2009, MetLife, Inc. remarketed its existing $1.0 billion 4.91% Series B junior subordinated debt securities as 7.717% senior debt

securities, Series B, due 2019. Interest on these senior debt securities is payable semiannually. The Series B junior subordinated debt securities were

originally issued in 2005. See Note 13.

188 MetLife, Inc.