MetLife 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

‰Effective December 31, 2009, the Company adopted guidance on: (i) measuring the fair value of investments in certain entities that calculate NAV

per share; (ii) how investments within its scope would be classified in the fair value hierarchy; and (iii) enhanced disclosure requirements, for both

interim and annual periods, about the nature and risks of investments measured at fair value on a recurring or non-recurring basis.

‰Effective December 31, 2009, the Company adopted guidance on measuring liabilities at fair value. This guidance provides clarification for

measuring fair value in circumstances in which a quoted price in an active market for the identical liability is not available. In such circumstances a

company is required to measure fair value using either a valuation technique that uses: (i) the quoted price of the identical liability when traded as

an asset; or (ii) quoted prices for similar liabilities or similar liabilities when traded as assets; or (iii) another valuation technique that is consistent with

the principles of fair value measurement such as an income approach (e.g., present value technique) or a market approach (e.g., “entry” value

technique).

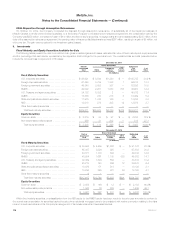

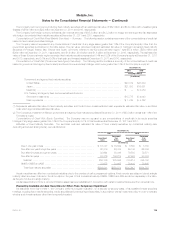

Defined Benefit and Other Postretirement Plans

Effective December 31, 2011, the Company adopted guidance regarding enhanced disclosures for employers’ participation in multiemployer

pension plans. The revised disclosures require additional qualitative and quantitative information about the employer’s involvement in significant

multiemployer pension and other postretirement plans. The adoption of this guidance did not have an impact on the Company’s consolidated financial

statements.

Effective December 31, 2009, the Company adopted guidance to enhance the transparency surrounding the types of assets and associated risks

in an employer’s defined benefit pension or other postretirement benefit plans. This guidance requires an employer to disclose information about the

valuation of plan assets similar to that required under other fair value disclosure guidance. The Company provided all of the material disclosures in its

consolidated financial statements.

Other Pronouncements

Effective January 1, 2011, the Company adopted new guidance regarding goodwill impairment testing. This guidance modifies Step 1 of the

goodwill impairment test for reporting units with zero or negative carrying amounts. For those reporting units, an entity would be required to perform Step

2 of the test if qualitative factors indicate that it is more likely than not that goodwill impairment exists. The adoption did not have an impact on the

Company’s consolidated financial statements.

Effective April 1, 2009, the Company adopted prospectively guidance which establishes general standards for accounting and disclosures of events

that occur subsequent to the balance sheet date but before financial statements are issued or available to be issued. The Company has provided all of

the material disclosures in its consolidated financial statements.

Effective January 1, 2009, the Company adopted guidance on determining whether an instrument (or embedded feature) is indexed to an entity’s

own stock. This guidance provides a framework for evaluating the terms of a particular instrument and whether such terms qualify the instrument as

being indexed to an entity’s own stock. The adoption did not have a material impact on the Company’s consolidated financial statements.

Future Adoption of New Accounting Pronouncements

In December 2011, the Financial Accounting Standards Board (“FASB”) issued new guidance regarding comprehensive income (Accounting

Standards Update (“ASU”) 2011-12, Comprehensive Income (Topic 220): Deferral of the Effective Date for Amendments to the Presentation of

Reclassifications of Items Out of Accumulated Other Comprehensive Income in Accounting Standards Update No. 2011-05). The amendments in ASU

2011-12 are effective for fiscal years and interim periods within those years beginning after December 15, 2011. Consistent with the effective date of

the amendments in ASU 2011-05 discussed below, ASU 2011-12 defers the effective date pertaining to reclassification adjustments out of

accumulated other comprehensive income in ASU 2011-05. The amendments are being made to allow the FASB time to re-deliberate whether to

present on the face of the financial statements the effects of reclassifications out of accumulated other comprehensive income on the components of

net income and other comprehensive income for all periods presented. All other requirements in ASU 2011-05 are not affected by ASU 2011-12,

including the requirement to report comprehensive income either in a single continuous financial statement or in two separate but consecutive financial

statements. The Company is currently evaluating the impact of this guidance on its consolidated financial statements.

In December 2011, the FASB issued new guidance regarding balance sheet offsetting disclosures (ASU 2011-11, Balance Sheet (Topic 210):

Disclosures about Offsetting Assets and Liabilities), effective for annual reporting periods beginning on or after January 1, 2013, and interim periods

within those annual periods. The guidance should be applied retrospectively for all comparative periods presented. The amendments in ASU 2011-11

require an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effects of

those arrangements on its financial position. Entities are required to disclose both gross information and net information about both instruments and

transactions eligible for offset in the statement of financial position and instruments and transactions subject to an agreement similar to a master netting

arrangement. The objective of ASU 2011-11 is to facilitate comparison between those entities that prepare their financial statements on the basis of

GAAP and those entities that prepare their financial statements on the basis of International Financial Reporting Standards (“IFRS”). The Company is

currently evaluating the impact of this guidance on its consolidated financial statements and related disclosures.

In December 2011, the FASB issued new guidance regarding derecognition of in substance real estate (ASU 2011-10 Property, Plant and

Equipment (Topic 360): Derecognition of in Substance Real Estate - a Scope Clarification (a consensus of the FASB Emerging Issues Task Force),

effective for fiscal years, and interim periods within those fiscal years, beginning on or after June 15, 2012. The amendments should be applied

prospectively to deconsolidation events occurring after the effective date. Under the amendments in ASU 2011-10, when a parent ceases to have a

controlling financial interest in a subsidiary that is in substance real estate as a result of a default on the subsidiary’s nonrecourse debt, the reporting

entity should apply the guidance in Subtopic 360-20 to determine whether it should derecognize the in substance real estate. Generally, a reporting

entity would not satisfy the requirements to derecognize in substance real estate before the legal transfer of the real estate to the lender and the

extinguishment of the related nonrecourse indebtedness. The Company is currently evaluating the impact of this guidance on its consolidated financial

statements.

In September 2011, the FASB issued new guidance on goodwill impairment testing (ASU 2011-08, Intangibles —Goodwill and Other (Topic 350):

Testing Goodwill for Impairment), effective for calendar years beginning after December 15, 2011. Early adoption is permitted. The objective of this

standard is to simplify how an entity tests goodwill for impairment. The amendments in this standard will allow an entity to first assess qualitative factors

112 MetLife, Inc.