MetLife 2011 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

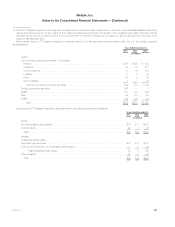

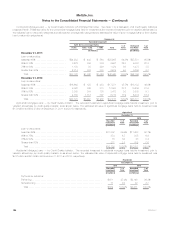

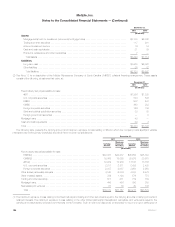

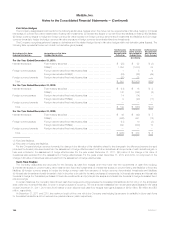

The following table presents activity for the accretable yield on purchased credit impaired investments for:

Fixed Maturity Securities Mortgage Loans

Years Ended December 31,

2011 2010 2011 2010

(In millions)

Accretable yield, January 1, ................................................ $ 541 $ — $170 $ —

Investments purchased ................................................... 1,775 606 — —

Acquisition(1) ........................................................... — 100 — 173

Accretion recognized in earnings ............................................ (114) (62) (56) (3)

Disposals .............................................................. (65) — — —

Reclassification (to) from nonaccretable difference .............................. 174 (103) 140 —

Accretable yield, December 31, ............................................. $2,311 $ 541 $254 $170

(1) As described further in Note 2, all investments acquired in the Acquisition were recorded at estimated fair value as of the Acquisition Date. This

activity relates to acquired fixed maturity securities and mortgage loans with a credit impairment inherent in the estimated fair value.

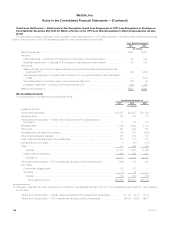

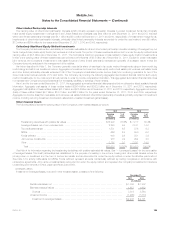

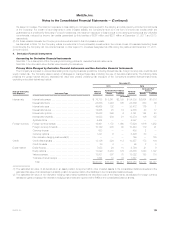

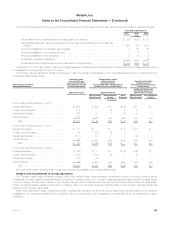

Variable Interest Entities

The Company holds investments in certain entities that are VIEs. In certain instances, the Company holds both the power to direct the most

significant activities of the entity, as well as an economic interest in the entity and, as such, is deemed to be the primary beneficiary or consolidatorof

the entity. The following table presents the total assets and total liabilities relating to VIEs for which the Company has concluded that it is the primary

beneficiary and which are consolidated at December 31, 2011 and 2010. Creditors or beneficial interest holders of VIEs where the Company is the

primary beneficiary have no recourse to the general credit of the Company, as the Company’s obligation to the VIEs is limited to the amount of its

committed investment.

December 31,

2011 2010

Total

Assets Total

Liabilities Total

Assets Total

Liabilities

(In millions)

Consolidated securitization entities(1) ..................................... $3,299 $3,103 $ 7,114 $6,892

MRSC collateral financing arrangement(2) ................................. 3,333 — 3,333 —

Other limited partnership interests ....................................... 360 6 319 85

Trading and other securities ............................................ 163 — 186 —

Other invested assets ................................................. 102 1 108 1

Real estate joint ventures .............................................. 16 18 20 17

Total ............................................................ $7,273 $3,128 $11,080 $6,995

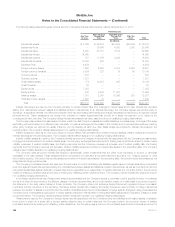

(1) The Company consolidates former QSPEs that are structured as CMBS and former QSPEs that are structured as collateralized debt obligations. The

assets of these entities can only be used to settle their respective liabilities, and under no circumstances is the Company liable for any principal or

interest shortfalls should any arise. The Company’s exposure was limited to that of its remaining investment in the former QSPEs of $172 million and

$201 million at estimated fair value at December 31, 2011 and 2010, respectively. The long-term debt presented below bears interest primarily at

fixed rates ranging from 2.25% to 5.57%, payable primarily on a monthly basis and is expected to be repaid over the next six years. Interest expense

related to these obligations, included in other expenses, was $324 million and $411 million for the years ended December 31, 2011 and 2010,

respectively. The Company sold certain of these CMBS investments in the third quarter of 2011, resulting in the deconsolidation of such entities and

their related mortgage loans held-for-investment and long-term debt. The assets and liabilities of these CSEs, at estimated fair value, were as follows

at:

MetLife, Inc. 137