MetLife 2011 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetLife, Inc.

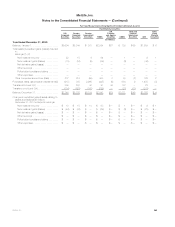

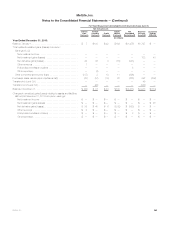

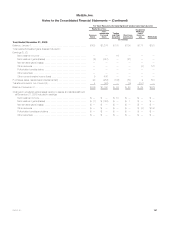

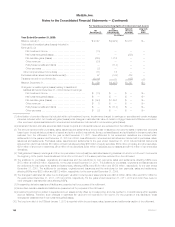

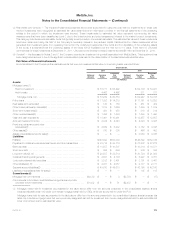

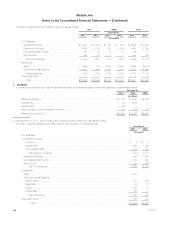

Notes to the Consolidated Financial Statements — (Continued)

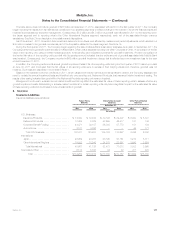

(2) Carrying values presented herein differ from those presented in the consolidated balance sheets because certain items within the respective

financial statement caption are not considered financial instruments. Financial statement captions excluded from the table above are not

considered financial instruments.

(3) Short-term investments as presented in the table above differ from the amounts presented in the consolidated balance sheets because this table

does not include short-term investments that meet the definition of a security, which are measured at estimated fair value on a recurring basis.

(4) Long-term debt as presented in the table above does not include long-term debt of CSEs, which is accounted for under the FVO.

(5) Other liabilities as presented in the table above differ from the amounts presented in the consolidated balance sheets because certain items within

other liabilities are not considered financial instruments and this table does not include the liability related to securitized reverse residential mortgage

loans, which are accounted for under the FVO.

(6) Commitments are off-balance sheet obligations. Negative estimated fair values represent off-balance sheet liabilities.

The methods and assumptions used to estimate the fair value of financial instruments are summarized as follows:

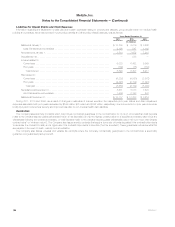

The assets and liabilities measured at estimated fair value on a recurring basis include: fixed maturity securities, equity securities, trading and other

securities, certain short-term investments, mortgage loans held by CSEs, mortgage loans held-for-sale accounted for under the FVO, MSRs, derivative

assets and liabilities, net embedded derivatives within asset and liability host contracts, separate account assets, long-term debt of CSEs and trading

liabilities. These assets and liabilities are described in the section “— Recurring Fair Value Measurements” and, therefore, are excluded from the table

above. The estimated fair value for these financial instruments approximates carrying value.

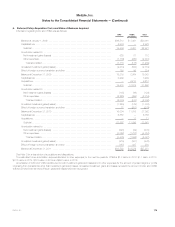

Mortgage Loans

These mortgage loans are principally comprised of commercial and agricultural mortgage loans, which are originated for investment purposes and

are primarily carried at amortized cost. Residential mortgage loans are generally purchased from third parties for investment purposes and are principally

carried at amortized cost. Mortgage loans originally held-for-investment, but subsequently held-for-sale are carried at the lower of cost or estimated fair

value, or for collateral dependent loans, estimated fair value less expected disposition costs. The estimated fair values of these mortgage loans are

determined as follows:

Mortgage loans held-for-investment. — For commercial and agricultural mortgage loans held-for-investment and carried at amortized cost, estimated

fair value was primarily determined by estimating expected future cash flows and discounting them using current interest rates for similar mortgage

loans with similar credit risk. For residential mortgage loans held-for-investment and carried at amortized cost, estimated fair value is primarily

determined from observable pricing for similar loans.

Mortgage loans held-for-sale. — Certain mortgage loans previously classified as held-for-investment have been designated as held-for-sale. For

these mortgage loans, estimated fair value is determined using independent broker quotations or values provided by independent valuation

specialists, or, when the mortgage loan is in foreclosure or otherwise determined to be collateral dependent, the fair value of the underlying collateral

is estimated using internal models.

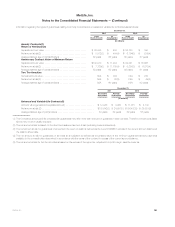

Policy Loans

For policy loans with fixed interest rates, estimated fair values are determined using a discounted cash flow model applied to groups of similar policy

loans determined by the nature of the underlying insurance liabilities. Cash flow estimates are developed by applying a weighted-average interest rate to

the outstanding principal balance of the respective group of policy loans and an estimated average maturity determined through experience studies of

the past performance of policyholder repayment behavior for similar loans. These cash flows are discounted using current risk-free interest rates with no

adjustment for borrower credit risk as these loans are fully collateralized by the cash surrender value of the underlying insurance policy. The estimated

fair value for policy loans with variable interest rates approximates carrying value due to the absence of borrower credit risk and the short time period

between interest rate resets, which presents minimal risk of a material change in estimated fair value due to changes in market interest rates.

Real Estate Joint Ventures and Other Limited Partnership Interests

Real estate joint ventures and other limited partnership interests included in the preceding table consist of those investments accounted for using the

cost method. The remaining carrying value recognized in the consolidated balance sheets represents investments in real estate carried at cost less

accumulated depreciation, or real estate joint ventures and other limited partnership interests accounted for using the equity method, which do not meet

the definition of financial instruments for which fair value is required to be disclosed.

The estimated fair values for real estate joint ventures and other limited partnership interests accounted for under the cost method are generally

based on the Company’s share of the NAV as provided in the financial statements of the investees. In certain circumstances, management may adjust

the NAV by a premium or discount when it has sufficient evidence to support applying such adjustments.

Short-term Investments

Certain short-term investments do not qualify as securities and are recognized at amortized cost in the consolidated balance sheets. For these

instruments, the Company believes that there is minimal risk of material changes in interest rates or credit of the issuer such that estimated fair value

approximates carrying value. In light of recent market conditions, short-term investments have been monitored to ensure there is sufficient demand and

maintenance of issuer credit quality and the Company has determined additional adjustment is not required.

Other Invested Assets

Other invested assets within the preceding table are principally comprised of funds withheld, various interest-bearing assets held in foreign

subsidiaries and certain amounts due under contractual indemnifications.

For funds withheld and the various interest-bearing assets held in foreign subsidiaries, the Company evaluates the specific facts and circumstances

of each instrument to determine the appropriate estimated fair values. These estimated fair values were not materially different from the recognized

carrying values.

172 MetLife, Inc.