MetLife 2011 Annual Report Download - page 82

Download and view the complete annual report

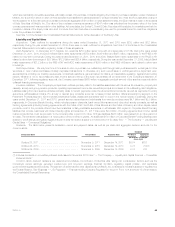

Please find page 82 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Future Adoption of New Accounting Pronouncements

See Note 1 of the Notes to the Consolidated Financial Statements.

Subsequent Events

See Note 24 of the Notes to the Consolidated Financial Statements.

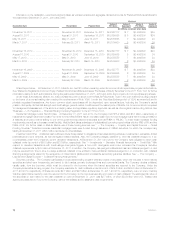

Quantitative and Qualitative Disclosures About Market Risk

Risk Management

The Company must effectively manage, measure and monitor the market risk associated with its assets and liabilities. It has developed an integrated

process for managing risk, which it conducts through its Enterprise Risk Management Department, Asset/Liability Management Unit, Treasury

Department and Investment Department along with the management of the business segments. The Company has established and implemented

comprehensive policies and procedures at both the corporate and business segment level to minimize the effects of potential market volatility.

The Company regularly analyzes its exposure to interest rate, equity market price and foreign currency exchange rate risks. As a result of that

analysis, the Company has determined that the estimated fair values of certain assets and liabilities are materially exposed to changes in interest rates,

foreign currency exchange rates and changes in the equity markets.

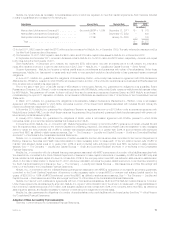

Enterprise Risk Management. MetLife has established several financial and non-financial senior management committees as part of its risk

management process. These committees manage capital and risk positions, approve ALM strategies and establish appropriate corporate business

standards. Further enhancing its committee structure, during the second quarter of 2010, MetLife created an Enterprise Risk Committee including the

following voting members: the Chief Financial Officer, the Chief Investment Officer and the Chief Risk Officer. This committee is responsible for reviewing

all material risks to the enterprise and deciding on actions if necessary, in the event risks exceed desirable targets, taking into consideration best

practices to resolve or mitigate those risks.

MetLife also has a separate Enterprise Risk Management Department, which is responsible for risk management throughout MetLife and reports to

MetLife’s Chief Risk Officer. The Enterprise Risk Management Department’s primary responsibilities consist of:

‰implementing a corporate risk framework, which outlines the Company’s approach for managing risk on an enterprise-wide basis;

‰developing policies and procedures for managing, measuring, monitoring and controlling those risks identified in the corporate risk framework;

‰establishing appropriate corporate risk tolerance levels;

‰deploying capital on an economic capital basis; and

‰reporting on a periodic basis to the Finance and Risk Committee of the Company’s Board of Directors; with respect to credit risk, reporting to the

Investment Committee of the Company’s Board of Directors; and reporting on various aspects of risk to financial and non-financial senior

management committees.

Asset/Liability Management. The Company actively manages its assets using an approach that balances quality, diversification, asset/liability

matching, liquidity, concentration and investment return. The goals of the investment process are to optimize, net of income tax, risk-adjusted

investment income and risk-adjusted total return while ensuring that the assets and liabilities are reasonably managed on a cash flow and duration basis.

The ALM process is the shared responsibility of the Financial Risk Management and Asset/Liability Management Unit, Enterprise Risk Management, the

Portfolio Management Unit, and the senior members of the business segments and is governed by the ALM Committees. The ALM Committees’ duties

include reviewing and approving target portfolios, establishing investment guidelines and limits and providing oversight of the ALM process on a periodic

basis. The directives of the ALM Committees are carried out and monitored through ALM Working Groups which are set up to manage by product type.

In addition, an ALM Steering Committee oversees the activities of the underlying ALM Committees.

MetLife establishes target asset portfolios for each major insurance product, which represent the investment strategies used to profitably fund its

liabilities within acceptable levels of risk. These strategies are monitored through regular review of portfolio metrics, such as effective duration, yield curve

sensitivity, convexity, liquidity, asset sector concentration and credit quality by the ALM Working Groups.

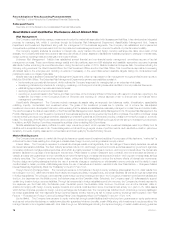

Market Risk Exposures

The Company has exposure to market risk through its insurance operations and investment activities. For purposes of this disclosure, “market risk” is

defined as the risk of loss resulting from changes in interest rates, foreign currency exchange rates and equity market.

Interest Rates. The Company’s exposure to interest rate changes results most significantly from its holdings of fixed maturity securities, as well as

its interest rate sensitive liabilities. The fixed maturity securities include U.S. and foreign government bonds, securities issued by government agencies,

corporate bonds and mortgage-backed securities, all of which are mainly exposed to changes in medium- and long-term interest rates. The interest rate

sensitive liabilities for purposes of this disclosure include debt, PABs related to certain investment type contracts, and net embedded derivativeson

variable annuities with guaranteed minimum benefits which have the same type of interest rate exposure (medium- and long-term interest rates) as fixed

maturity securities. The Company employs product design, pricing and ALM strategies to reduce the adverse effects of interest rate movements.

Product design and pricing strategies include the use of surrender charges or restrictions on withdrawals in some products and the ability to reset

credited rates for certain products. ALM strategies include the use of derivatives and duration mismatch limits. See “Risk Factors — Changes in Market

Interest Rates May Significantly Affect Our Profitability” in the 2011 Form 10-K.

Foreign Currency Exchange Rates. The Company’s exposure to fluctuations in foreign currency exchange rates against the U.S. dollar results from

its holdings in non-U.S. dollar denominated fixed maturity and equity securities, mortgage loans, and certain liabilities, as well as through its investments

in foreign subsidiaries. The principal currencies that create foreign currency exchange rate risk in the Company’s investment portfolios and liabilities are

the Euro, the Japanese yen, the British pound, the Mexican peso and the Canadian dollar. Selectively, the Company uses U.S. dollar assets to support

certain long duration foreign currency liabilities. Through its investments in foreign subsidiaries and joint ventures, the Company is primarily exposed to

the Japanese yen, the Polish zloty, the Mexican peso, the British pound, the Australian dollar, the Euro, the Korean won and the Canadian dollar. In

addition to hedging with foreign currency swaps, forwards and options, local surplus in some countries is held entirely or in part in U.S. dollar assets

which further minimizes exposure to foreign currency exchange rate fluctuation risk. The Company has matched much of its foreign currency liabilities in

its foreign subsidiaries with their respective foreign currency assets, thereby reducing its risk to foreign currency exchange rate fluctuation. See “Risk

Factors — Fluctuations in Foreign Currency Exchange Rates Could Negatively Affect Our Profitability” in the 2011 Form 10-K.

Equity Market. The Company has exposure to equity market risk through certain liabilities that involve long-term guarantees on equity performance

such as net embedded derivatives on variable annuities with guaranteed minimum benefits, certain PABs along with investments in equity securities. We

manage this risk on an integrated basis with other risks through our ALM strategies including the dynamic hedging of certain variable annuity guarantee

78 MetLife, Inc.