MetLife 2011 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

operations. The income tax years under examination vary by jurisdiction. With a few exceptions, the Company is no longer subject to U.S. federal, state

and local, or foreign income tax examinations by tax authorities for years prior to 2000. In early 2009, the Company and the IRS completed and

substantially settled the audit years of 2000 to 2002. A few issues not settled have been escalated to the next level, IRS Appeals. The IRS exam of the

current audit cycle, years 2003 to 2006, began in April 2010.

The Company’s liability for unrecognized tax benefits may decrease in the next 12 months pending the outcome of remaining issues, tax-exempt

income and tax credits associated with the 2000 to 2002 IRS audit. A reasonable estimate of the decrease cannot be made at this time. However, the

Company continues to believe that the ultimate resolution of the issues will not result in a material change to its consolidated financial statements,

although the resolution of income tax matters could impact the Company’s effective tax rate for a particular future period.

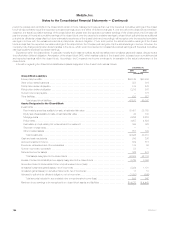

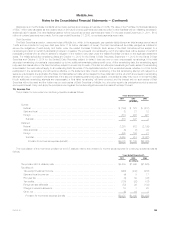

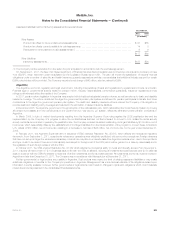

A reconciliation of the beginning and ending amount of unrecognized tax benefits was as follows:

Years Ended December 31,

2011 2010 2009

(In millions)

Balance at January 1, ................................................................. $810 $773 $766

Additions for tax positions of prior years ................................................... 30 186(1) 43

Reductions for tax positions of prior years ................................................. (161) (84) (33)

Additions for tax positions of current year .................................................. 13 13 52

Reductions for tax positions of current year ................................................ (8) (8) (9)

Settlements with tax authorities ......................................................... (5) (59) (46)

Lapses of statutes of limitations ......................................................... — (11) —

Balance at December 31, ............................................................. $679 $810 $773

Unrecognized tax benefits that, if recognized would impact the effective rate ...................... $527 $536 $583

(1) An increase of $169 million resulted from the acquisition of American Life.

The Company classifies interest accrued related to unrecognized tax benefits in interest expense, included within other expenses, while penalties are

included in income tax expense.

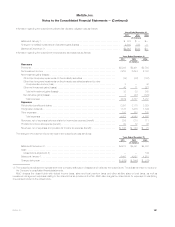

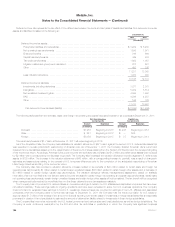

Interest and penalties were as follows:

Years Ended

December 31,

2011 2010 2009

(In millions)

Interest and penalties recognized in the consolidated statements of operations ....................... $31 $6 $21

December 31,

2011 2010

(In millions)

Interest and penalties included in other liabilities in the consolidated balance sheets ......................... $235 $221(1)

(1) An increase of $20 million resulted from the acquisition of American Life.

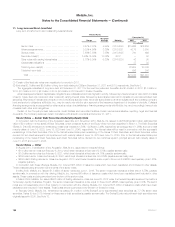

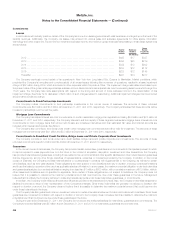

The U.S. Treasury Department and the IRS have indicated that they intend to address through regulations the methodology to be followed in

determining the dividends received deduction (“DRD”), related to variable life insurance and annuity contracts. The DRD reduces the amount of dividend

income subject to tax and is a significant component of the difference between the actual tax expense and expected amount determined using the

federal statutory tax rate of 35%. Any regulations that the IRS ultimately proposes for issuance in this area will be subject to public notice and comment,

at which time insurance companies and other interested parties will have the opportunity to raise legal and practical questions about the content, scope

and application of such regulations. As a result, the ultimate timing and substance of any such regulations are unknown at this time. For the years ended

December 31, 2011 and 2010, the Company recognized an income tax benefit of $159 million and $87 million, respectively, related to the separate

account DRD. The 2011 benefit included a benefit of $8 million related to a true-up of the 2010 tax return. The 2010 benefit included an expense of

$57 million related to a true-up of the 2009 tax return.

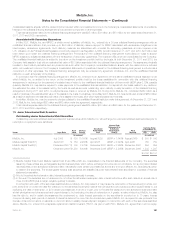

16. Contingencies, Commitments and Guarantees

Contingencies

Litigation

The Company is a defendant in a large number of litigation matters. In some of the matters, very large and/or indeterminate amounts, including

punitive and treble damages, are sought. Modern pleading practice in the U.S. permits considerable variation in the assertion of monetary damages or

other relief. Jurisdictions may permit claimants not to specify the monetary damages sought or may permit claimants to state only that the amount

sought is sufficient to invoke the jurisdiction of the trial court. In addition, jurisdictions may permit plaintiffs to allege monetary damages in amounts well

exceeding reasonably possible verdicts in the jurisdiction for similar matters. This variability in pleadings, together with the actual experience of the

Company in litigating or resolving through settlement numerous claims over an extended period of time, demonstrates to management that the monetary

relief which may be specified in a lawsuit or claim bears little relevance to its merits or disposition value.

MetLife, Inc. 195