MetLife 2011 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

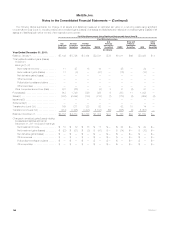

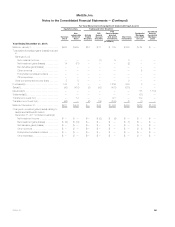

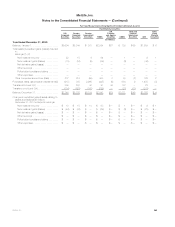

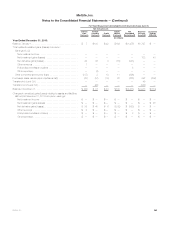

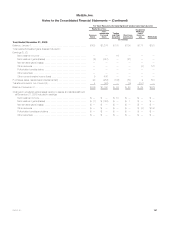

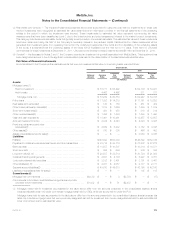

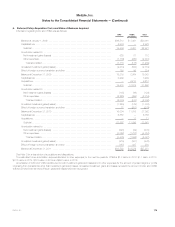

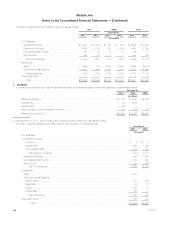

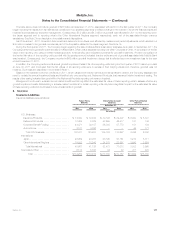

Fair Value Measurements Using Significant Unobservable Inputs (Level 3)

Net

Derivatives(7)

Net

Embedded

Derivatives(8)

Separate

Account

Assets(9)

Long-term

Debt

CSEs

(In millions)

Year Ended December 31, 2009:

Balance, January 1, ..................................... $2,547 $(2,929) $1,677 $—

Total realized/unrealized gains (losses) included in:

Earnings:(1), (2)

Net investment income .............................. (13) — — —

Net investment gains (losses) .......................... — — (223) —

Net derivative gains (losses) ........................... (225) 1,716 — —

Other revenues .................................... (33) — — —

Policyholder benefits and claims ....................... — (114) — —

Other expenses .................................... (2) — — —

Other comprehensive income (loss) ....................... (11) 15 — —

Purchases, sales, issuances and settlements(3) ............... 97 (143) 478 —

Transfers into and/or out of level 3(4) ........................ (2,004) — (135) —

Balance, December 31, .................................. $ 356 $(1,455) $1,797 $—

Changes in unrealized gains (losses) relating to assets and

liabilities still held at December 31, 2009 included in earnings:

Net investment income .............................. $ (13) $ — $ — $—

Net investment gains (losses) .......................... $ — $ — $ — $—

Net derivative gains (losses) ........................... $ (194) $ 1,697 $ — $—

Other revenues .................................... $ 5 $ — $ — $—

Policyholder benefits and claims ....................... $ — $ (114) $ — $—

Other expenses .................................... $ (2) $ — $ — $—

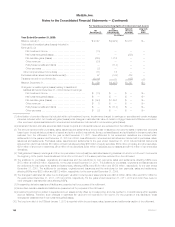

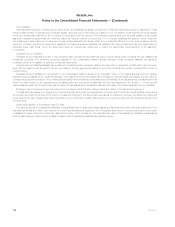

(1) Amortization of premium/discount is included within net investment income. Impairments charged to earnings on securities and certain mortgage

loans are included within net investment gains (losses) while changes in estimated fair value of certain mortgage loans and MSRs are recorded in

other revenues. Lapses associated with net embedded derivatives are included within net derivative gains (losses).

(2) Interest and dividend accruals, as well as cash interest coupons and dividends received, are excluded from the rollforward.

(3) The amount reported within purchases, sales, issuances and settlements is the purchase or issuance price and the sales or settlement proceeds

based upon the actual date purchased or issued and sold or settled, respectively. Items purchased/issued and sold/settled in the same period are

excluded from the rollforward. For the year ended December 31, 2011, fees attributed to net embedded derivatives are included within

settlements. For the years ended December 31, 2010 and 2009, fees attributed to net embedded derivatives are included within purchases, sales,

issuances and settlements. Purchases, sales, issuances and settlements for the year ended December 31, 2010 include financial instruments

acquired from ALICO as follows: $5.4 billion of fixed maturity securities, $68 million of equity securities, $582 million of trading and other securities,

$216 million of short-term investments, ($10) million of net derivatives, $244 million of separate account assets and ($116) million of net embedded

derivatives.

(4) Total gains and losses (in earnings and other comprehensive income (loss)) are calculated assuming transfers into and/or out of Level 3 occurred at

the beginning of the period. Items transferred into and/or out of Level 3 in the same period are excluded from the rollforward.

(5) The additions for purchases, originations and issuances and the reductions for loan payments, sales and settlements, affecting MSRs were

$173 million and ($143) million, respectively, for the year ended December 31, 2011. The additions for purchases, originations and issuances and

the reductions for loan payments, sales and settlements, affecting MSRs were $330 million and ($179) million, respectively, for the year ended

December 31, 2010. The additions for purchases, originations and issuances and the reductions for loan payments, sales and settlements,

affecting MSRs were $628 million and ($113) million, respectively, for the year ended December 31, 2009.

(6) The changes in estimated fair value due to changes in valuation model inputs or assumptions were ($314) million, ($79) million and $172 million for

the years ended December 31, 2011, 2010 and 2009, respectively. For the years ended December 31, 2011, 2010 and 2009 there were no

other changes in estimated fair value affecting MSRs.

(7) Freestanding derivative assets and liabilities are presented net for purposes of the rollforward.

(8) Embedded derivative assets and liabilities are presented net for purposes of the rollforward.

(9) Investment performance related to separate account assets is fully offset by corresponding amounts credited to contractholders within separate

account liabilities. Therefore, such changes in estimated fair value are not recorded in net income. For the purpose of this disclosure, these

changes are presented within net investment gains (losses).

(10) The long-term debt of the CSEs at January 1, 2010 is reported within the purchases, sales, issuances and settlements caption of the rollforward.

168 MetLife, Inc.