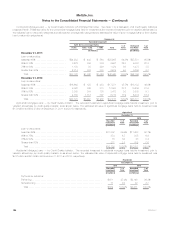

MetLife 2011 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

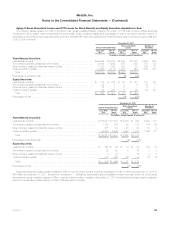

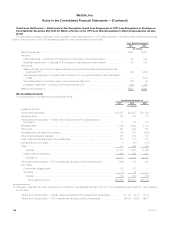

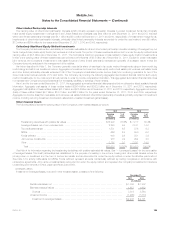

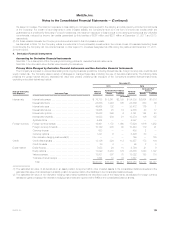

Past Due and Interest Accrual Status of Mortgage Loans. The Company has a high quality, well performing, mortgage loan portfolio, with

approximately 99% of all mortgage loans classified as performing at both December 31, 2011 and December 31, 2010. The Company defines

delinquent mortgage loans consistent with industry practice, when interest and principal payments are past due as follows: commercial mortgage loans

— 60 days or more; agricultural mortgage loans — 90 days or more; and residential mortgage loans — 60 days or more. The recorded investment in

mortgage loans held-for-investment, prior to valuation allowances, past due according to these aging categories, greater than 90 days past due and still

accruing interest and in nonaccrual status, by portfolio segment, were as follows at:

Past Due Greater than 90 Days Past Due Still

Accruing Interest Nonaccrual Status

December 31, 2011 December 31, 2010 December 31, 2011 December 31, 2010 December 31, 2011 December 31, 2010

(In millions)

Commercial .................. $ 63 $ 58 $— $ 1 $ 63 $ 7

Agricultural .................. 146 159 29 13 157 177

Residential .................. 8 79 — 11 17 25

Total ..................... $217 $296 $29 $25 $237 $209

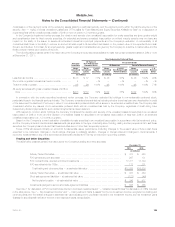

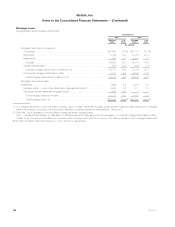

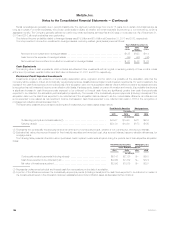

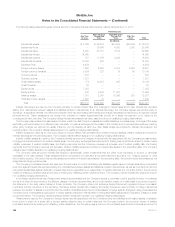

Impaired Mortgage Loans. The unpaid principal balance, recorded investment, valuation allowances and carrying value, net of valuation

allowances, for impaired mortgage loans held-for-investment, including those modified in a troubled debt restructuring, by portfolio segment, were as

follows at:

Impaired Mortgage Loans

Loans with a Valuation Allowance Loans without a

Valuation Allowance All Impaired Loans

Unpaid

Principal

Balance Recorded

Investment Valuation

Allowances Carrying

Value

Unpaid

Principal

Balance Recorded

Investment

Unpaid

Principal

Balance Carrying

Value

(In millions)

December 31, 2011:

Commercial ...................................... $ 96 $ 96 $ 59 $ 37 $252 $237 $348 $274

Agricultural ....................................... 160 159 45 114 71 69 231 183

Residential ....................................... 13 13 1 12 1 1 14 13

Total ........................................ $269 $268 $105 $163 $324 $307 $593 $470

December 31, 2010:

Commercial ...................................... $120 $120 $ 36 $ 84 $ 99 $ 87 $219 $171

Agricultural ....................................... 146 146 52 94 123 119 269 213

Residential ....................................... 3 3 — 3 16 16 19 19

Total ........................................ $269 $269 $ 88 $181 $238 $222 $507 $403

Unpaid principal balance is generally prior to any charge-offs.

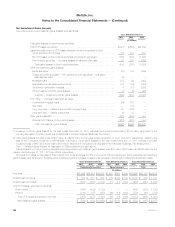

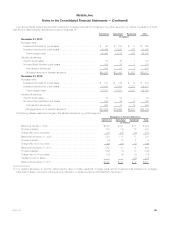

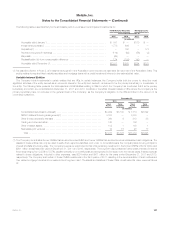

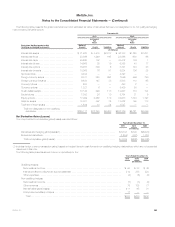

The average investment in impaired mortgage loans held-for-investment, including those modified in a troubled debt restructuring, and the related

interest income, by portfolio segment, for the years ended December 31, 2011 and 2010, respectively, and for all mortgage loans for the year ended

December 31, 2009, was:

Impaired Mortgage Loans

Average Investment Interest Income Recognized

Cash Basis Accrual Basis

(In millions)

For the Year Ended December 31, 2011:

Commercial ..................................................... $313 $ 5 $ 1

Agricultural ...................................................... 252 4 1

Residential ...................................................... 23 — —

Total ......................................................... $588 $ 9 $ 2

For the Year Ended December 31, 2010:

Commercial ..................................................... $192 $ 5 $ 1

Agricultural ...................................................... 284 6 2

Residential ...................................................... 16 — —

Total ......................................................... $492 $11 $ 3

For the Year Ended December 31, 2009 ............................. $338 $ 8 $ 1

MetLife, Inc. 133