MetLife 2011 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

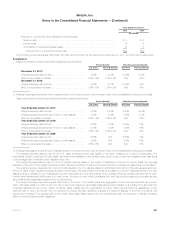

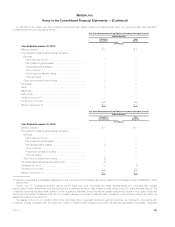

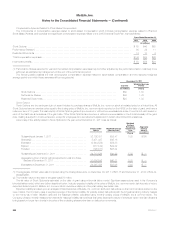

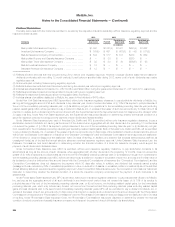

Non-U.S. Plans

The pension and postretirement plan assets and liabilities measured at estimated fair value on a recurring basis were determined as described

below. These estimated fair values and their corresponding placement in the fair value hierarchy are summarized as follows:

December 31, 2011

Pension Benefits Other Postretirement Benefits

Fair Value Measurements at

Reporting Date Using

Total

Estimated

Fair Value

Fair Value Measurements at

Reporting Date Using

Total

Estimated

Fair Value

Quoted

Prices

in Active

Markets

for

Identical

Assets and

Liabilities

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Quoted

Prices

in Active

Markets

for

Identical

Assets and

Liabilities

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(In millions)

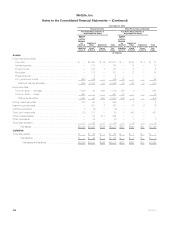

Assets:

Fixed maturity securities:

Foreign bonds ..................................... $— $ 96 $— $ 96 $— $13 $— $13

Total fixed maturity securities ........................ — 96 — 96 — 13 — 13

Equity securities:

Common stock — foreign ............................ — 43 — 43 — — — —

Total equity securities .............................. — 43 — 43 — — — —

Derivative securities ................................... — — 13 13 — — — —

Short-term investments ................................ — 6 — 6 — — — —

Other invested assets .................................. 19 — — 19 — — — —

Real estate .......................................... — — 8 8 — — — —

Total assets ..................................... $19 $145 $21 $185 $— $13 $— $13

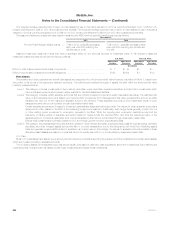

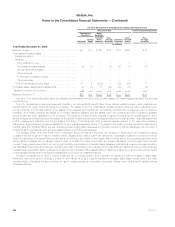

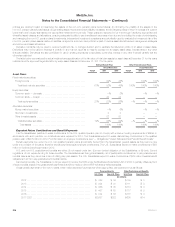

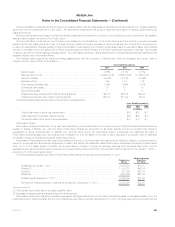

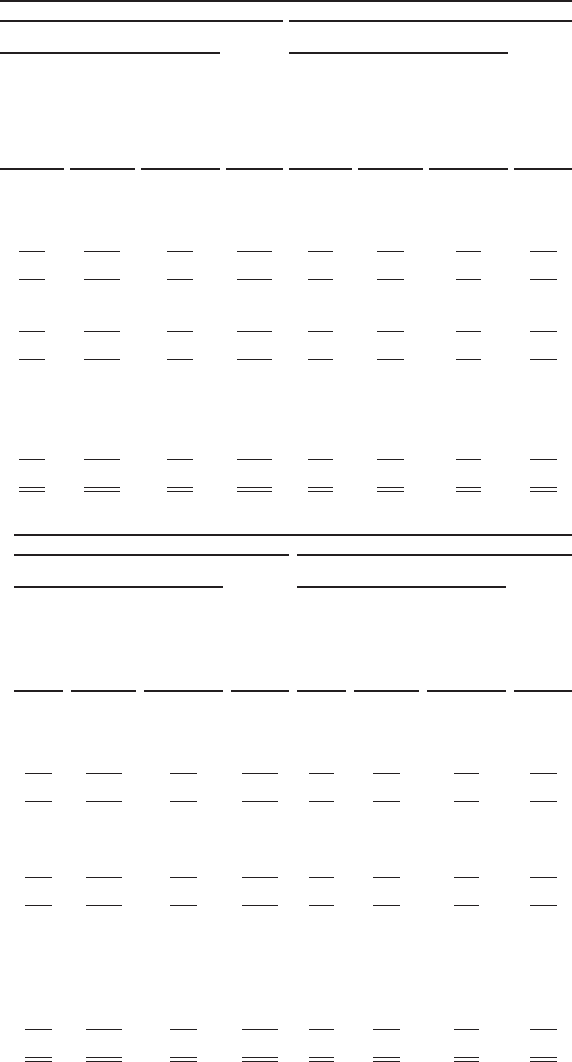

December 31, 2010

Pension Benefits Other Postretirement Benefits

Fair Value Measurements at

Reporting Date Using

Total

Estimated

Fair Value

Fair Value Measurements at

Reporting Date Using

Total

Estimated

Fair Value

Quoted

Prices

In Active

Markets

for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Quoted

Prices

In Active

Markets

for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(In millions)

Assets:

Fixed maturity securities:

Foreign bonds ..................................... $ 1 $ 79 $— $ 80 $— $15 $— $15

Total fixed maturity securities ........................ 1 79 — 80 — 15 — 15

Equity securities:

Common stock — domestic .......................... 4 — — 4 — — — —

Common stock — foreign ............................ 8 35 — 43 — — — —

Total equity securities ............................. 12 35 — 47 — — — —

Money market securities ................................. — 10 — 10 — — — —

Derivative securities ..................................... — — 11 11 — — — —

Short-term investments .................................. 2 4 — 6 — — — —

Other invested assets ................................... 16 — — 16 — — — —

Real estate ........................................... — — 8 8 — — — —

Total assets ..................................... $31 $128 $19 $178 $— $15 $— $15

214 MetLife, Inc.