MetLife 2011 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

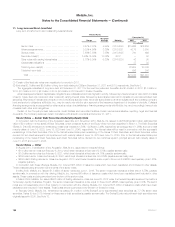

Distributions on the Purchase Contracts will be made quarterly at an average annual rate of 3.02%. The value of the Purchase Contracts at issuance

of $247 million was calculated as the present value of the future contract payments and was recorded in other liabilities with an offsetting decrease in

additional paid-in capital. The other liabilities balance will be reduced as contract payments are made. For the year ended December 31, 2011, $102

million of contract payments were made. For the year ended December 31, 2010, no contract payments were made.

Debt Securities

The Debt Securities are senior, unsecured notes of MetLife, Inc. which, in the aggregate, pay quarterly distributions at an initial average annual rate of

1.98% and are included in long-term debt (see Note 11 for further discussion of terms). The Debt Securities will be initially pledged as collateral to

secure the obligations of each Equity Unit holder under the related Purchase Contracts. Each series of the Debt Securities will be subject to a

remarketing and sold on behalf of participating holders to investors. The proceeds of a remarketing, net of any related fees, will be applied on behalf of

participating holders who so elect to settle any obligation of the holder to pay cash under the related Purchase Contract on the applicable settlement

dates. The initially-scheduled remarketing dates are October 10, 2012 for the Series C Debt Securities, September 11, 2013 for the Series D Debt

Securities and October 8, 2014 for the Series E Debt Securities, subject to delay if there are one or more unsuccessful remarketings. If the initial

attempted remarketing of a series is unsuccessful, up to two additional remarketing attempts will occur. At the remarketing date, the remarketing agent

may reset the interest rate on the Debt Securities, subject to a reset cap for each of the first two attempted remarketings of each series. If a remarketing

is successful, the reset rate will apply to all outstanding Debt Securities of the applicable tranche of the remarketed series, whether or not the holder

participated in the remarketing and will become effective on the settlement date of such remarketing. If the first remarketing attempt with respect toa

series is unsuccessful, the applicable Purchase Contract settlement date will be delayed for three calendar months, at which time a second remarketing

attempt will occur in connection with settlement. If the second remarketing attempt is unsuccessful, one additional delay may occur on the same basis.

If both additional remarketing attempts are unsuccessful, a “final failed remarketing” will have occurred, and the interest rate on such series of Debt

Securities will not be reset and the holder may put such series of Debt Securities to MetLife, Inc. at a price equal to its principal amount plus accrued

and unpaid interest, if any, and apply the principal amount against the holder’s obligations under the related Purchase Contract.

15. Income Tax

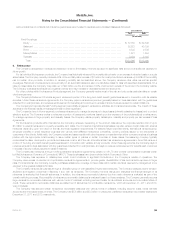

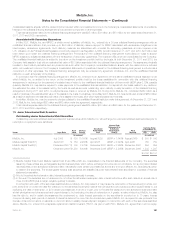

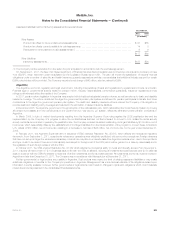

The provision for income tax from continuing operations was as follows:

Years Ended December 31,

2011 2010 2009

(In millions)

Current:

Federal ..................................................................... $ (198) $ 123 $ (237)

State and local ............................................................... (1) 21 12

Foreign ..................................................................... 614 203 227

Subtotal ................................................................... 415 347 2

Deferred:

Federal ..................................................................... 2,258 672 (2,130)

State and local ............................................................... (3) (7) 26

Foreign ..................................................................... 405 153 77

Subtotal ................................................................... 2,660 818 (2,027)

Provision for income tax expense (benefit) ....................................... $3,075 $1,165 $(2,025)

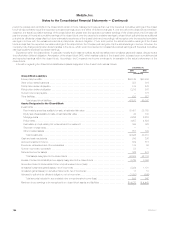

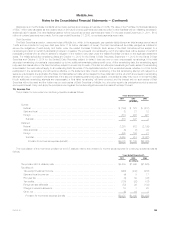

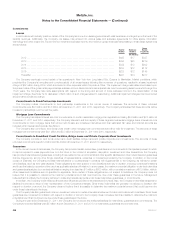

The reconciliation of the income tax provision at the U.S. statutory rate to the provision for income tax as reported for continuing operations was as

follows:

Years Ended December 31,

2011 2010 2009

(In millions)

Tax provision at U.S. statutory rate .................................................. $3,509 $1,369 $(1,526)

Tax effect of:

Tax-exempt investment income .................................................. (246) (242) (288)

State and local income tax ...................................................... (4) 9 17

Prior year tax ................................................................. (4) 59 (26)

Tax credits ................................................................... (138) (82) (87)

Foreign tax rate differential ....................................................... (53) 29 (138)

Change in valuation allowance ................................................... 16 7 20

Other, net ................................................................... (5) 16 3

Provision for income tax expense (benefit) ........................................ $3,075 $1,165 $(2,025)

MetLife, Inc. 193