MetLife 2011 Annual Report Download - page 11

Download and view the complete annual report

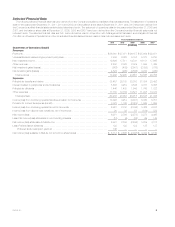

Please find page 11 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.‰Net investment income: (i) includes amounts for scheduled periodic settlement payments and amortization of premium on derivatives that are

hedges of investments but do not qualify for hedge accounting treatment, (ii) includes income from discontinued real estate operations,

(iii) excludes post-tax operating earnings adjustments relating to insurance joint ventures accounted for under the equity method, (iv) excludes

certain amounts related to contractholder-directed unit-linked investments, and (v) excludes certain amounts related to securitization entities that

are variable interest entities (“VIEs”) consolidated under GAAP; and

‰Other revenues are adjusted for settlements of foreign currency earnings hedges.

The following additional adjustments are made to GAAP expenses, in the line items indicated, in calculating operating expenses:

‰Policyholder benefits and claims and policyholder dividends excludes: (i) changes in the policyholder dividend obligation related to net investment

gains (losses) and net derivative gains (losses), (ii) inflation-indexed benefit adjustments associated with contracts backed by inflation-indexed

investments and amounts associated with periodic crediting rate adjustments based on the total return of a contractually referenced pool of

assets, (iii) benefits and hedging costs related to GMIBs (“GMIB Costs”), and (iv) market value adjustments associated with surrenders or

terminations of contracts (“Market Value Adjustments”);

‰Interest credited to policyholder account balances includes adjustments for scheduled periodic settlement payments and amortization of premium

on derivatives that are hedges of policyholder account balances (“PABs”) but do not qualify for hedge accounting treatment and excludes

amounts related to net investment income earned on contractholder-directed unit-linked investments;

‰Amortization of deferred policy acquisition costs (“DAC”) and value of business acquired (“VOBA”) excludes amounts related to: (i) net investment

gains (losses) and net derivative gains (losses), (ii) GMIB Fees and GMIB Costs, and (iii) Market Value Adjustments;

‰Amortization of negative VOBA excludes amounts related to Market Value Adjustments;

‰Interest expense on debt excludes certain amounts related to securitization entities that are VIEs consolidated under GAAP; and

‰Other expenses excludes costs related to: (i) noncontrolling interests, (ii) implementation of new insurance regulatory requirements, and

(iii) business combinations.

We believe the presentation of operating earnings and operating earnings available to common shareholders as we measure it for management

purposes enhances the understanding of our performance by highlighting the results of operations and the underlying profitability drivers of our

business. Operating revenues, operating expenses, operating earnings, and operating earnings available to common shareholders, should not be

viewed as substitutes for the following financial measures calculated in accordance with GAAP: GAAP revenues, GAAP expenses, GAAP income (loss)

from continuing operations, net of income tax, and GAAP net income (loss) available to MetLife, Inc.’s common shareholders, respectively.

Reconciliations of these measures to the most directly comparable GAAP measures are included in “— Results of Operations.”

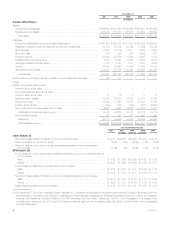

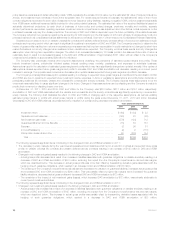

In 2011, management modified its definition of operating earnings to exclude the impacts of Divested Businesses, which includes certain operations

of MetLife Bank, National Association (“MetLife Bank”) and our insurance operations in the Caribbean region, Panama and Costa Rica (the “Caribbean

Business”), as these results are not relevant to understanding the Company’s ongoing operating results. Consequently, prior years’ results for

Corporate & Other and total consolidated operating earnings have been decreased by $111 million, net of $66 million of income tax, and $211 million,

net of $139 million of income tax, for the years ended December 31, 2010 and 2009, respectively.

In addition, in 2011, management modified its definition of operating earnings and operating earnings available to common shareholders to exclude

impacts related to certain variable annuity guarantees and Market Value Adjustments to better conform to the way it manages and assesses its

business. Accordingly, such results are no longer reported in operating earnings and operating earnings available to common shareholders.

Consequently, prior years’ results for Retirement Products and total consolidated operating earnings have been increased by $64 million, net of

$34 million of income tax, and $90 million, net of $49 million of income tax, for the years ended December 31, 2010 and 2009, respectively.

In this discussion, we sometimes refer to sales activity for various products. These sales statistics do not correspond to revenues under GAAP, but

are used as relevant measures of business activity. Additionally, the impact of changes in our foreign currency exchange rates is calculated using the

average foreign currency exchange rates for the current year and is applied to each of the comparable years.

Executive Summary

MetLife is a leading global provider of insurance, annuities and employee benefit programs throughout the United States, Japan, Latin America, Asia

Pacific, Europe and the Middle East. Through its subsidiaries and affiliates, MetLife offers life insurance, annuities, auto and homeowners insurance,

mortgage and deposit products and other financial services to individuals, as well as group insurance and retirement & savings products and services to

corporations and other institutions. MetLife is organized into six segments: Insurance Products, Retirement Products, Corporate Benefit Funding and

Auto & Home (collectively, “U.S. Business”), and Japan and Other International Regions (collectively, “International”). In addition, the Company reports

certain of its results of operations in Corporate & Other, which includes MetLife Bank and other business activities.

On November 21, 2011, MetLife, Inc. announced that it will be reorganizing its business into three broad geographic regions: The Americas; Europe,

the Middle East and Africa (“EMEA”); and Asia, and creating a global employee benefits business to better reflect its global reach. While the Company

has initiated certain changes in response to this announcement, including the appointment of certain executive leadership into some of the roles

designed for the reorganized structure, management continued to evaluate the performance of the operating segments under the existing segment

structure as of December 31, 2011. In addition, management continues to evaluate the Company’s segment performance and allocated resources and

may adjust such measurements in the future to better reflect segment profitability.

In December 2011, MetLife Bank and MetLife, Inc. entered into a definitive agreement to sell most of the depository business of MetLife Bank. The

transaction is expected to close in the second quarter of 2012, subject to certain regulatory approvals and other customary closing conditions.

Additionally, in January 2012, MetLife, Inc. announced it is exiting the business of originating forward residential mortgages (together with MetLife Bank’s

pending actions to exit the depository business, including the aforementioned December 2011 agreement, the “MetLife Bank Events”). Once MetLife

Bank has completely exited its depository business, MetLife, Inc. plans to terminate MetLife Bank’s Federal Deposit Insurance Corporation (“FDIC”)

insurance, putting MetLife, Inc. in a position to be able to deregister as a bank holding company. See “Business — U.S. Regulation — Financial Holding

Company Regulation” in the 2011 Form 10-K. The Company continues to originate reverse mortgages and will continue to service its current mortgage

customers. As a result of the MetLife Bank Events, for the year ended December 31, 2011, the Company recorded charges totaling $212 million, net of

income tax, which included intent-to-sell other-than-temporary impairment (“OTTI”) investment charges, charges related to the de-designation of certain

cash flow hedges, a goodwill impairment charge and other employee-related charges. In addition, the Company expects to incur additional charges of

$90 million to $110 million, net of income tax, during 2012, related to exiting the forward residential mortgage origination business, with no expected

impact on the Company’s operating earnings. See Note 2 of the Notes to the Consolidated Financial Statements.

MetLife, Inc. 7