MetLife 2011 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

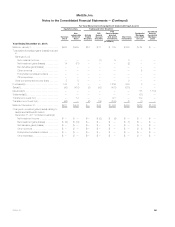

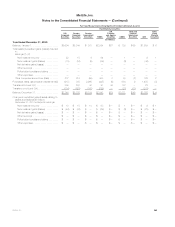

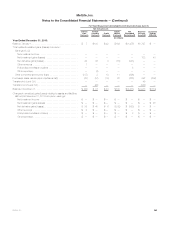

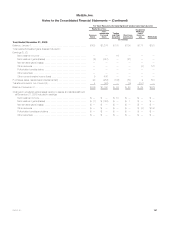

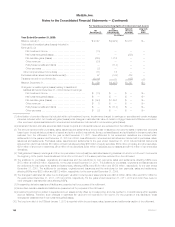

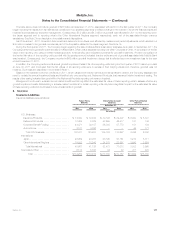

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

(3) Real estate joint ventures — The impaired investments presented above were accounted for using the cost method. Impairments on these cost

method investments were recognized at estimated fair value determined from information provided in the financial statements of the underlying

entities in the period in which the impairment was incurred. These impairments to estimated fair value represent non-recurring fair value

measurements that have been classified as Level 3 due to the limited activity and price transparency inherent in the market for such investments.

This category includes several real estate funds that typically invest primarily in commercial real estate. The estimated fair values of these investments

have been determined using the NAV of the Company’s ownership interest in the partners’ capital. Distributions from these investments will be

generated from investment gains, from operating income from the underlying investments of the funds and from liquidation of the underlying assets

of the funds. It is estimated that the underlying assets of the funds will be liquidated over the next two to 10 years. There were no unfunded

commitments for these investments at December 31, 2011. Unfunded commitments for these investments were $6 million at December 31, 2010.

(4) Goodwill — As discussed in Notes 2 and 7, the Company recorded an impairment of goodwill associated with MetLife Bank. This impairment has

been categorized as Level 3 due to the significant unobservable inputs used in the determination of the associated estimated fair value.

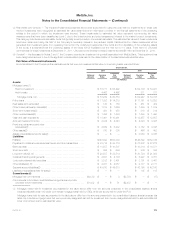

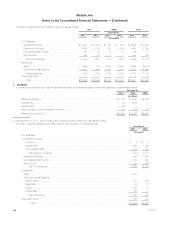

Fair Value of Financial Instruments

Amounts related to the Company’s financial instruments that were not measured at fair value on a recurring basis, were as follows:

December 31,

2011 2010

Notional

Amount Carrying

Value

Estimated

Fair

Value Notional

Amount Carrying

Value

Estimated

Fair

Value

(In millions)

Assets:

Mortgage loans:(1)

Held-for-investment ......................................... $ 53,777 $ 56,422 $ 52,136 $ 53,927

Held-for-sale .............................................. 4,462 4,462 811 811

Mortgage loans, net ....................................... $ 58,239 $ 60,884 $ 52,947 $ 54,738

Policy loans ................................................. $ 11,892 $ 14,213 $ 11,761 $ 13,253

Real estate joint ventures(2) ..................................... $ 130 $ 183 $ 451 $ 482

Other limited partnership interests(2) .............................. $ 1,318 $ 1,656 $ 1,539 $ 1,619

Short-term investments(3) ...................................... $ 450 $ 450 $ 819 $ 819

Other invested assets(2) ....................................... $ 1,434 $ 1,434 $ 1,490 $ 1,490

Cash and cash equivalents ..................................... $ 10,461 $ 10,461 $ 12,957 $ 12,957

Accrued investment income .................................... $ 4,344 $ 4,344 $ 4,328 $ 4,328

Premiums, reinsurance and other

receivables(2) .............................................. $ 4,639 $ 5,232 $ 3,752 $ 4,048

Other assets(2) .............................................. $ 310 $ 308 $ 466 $ 453

Assets of subsidiaries held-for-sale(2) ............................. $ — $ — $ 3,068 $ 3,068

Liabilities:

PABs(2) .................................................... $146,890 $153,304 $146,822 $152,745

Payables for collateral under securities loaned and other transactions .... $ 33,716 $ 33,716 $ 27,272 $ 27,272

Bank deposits ............................................... $ 10,507 $ 10,507 $ 10,316 $ 10,371

Short-term debt .............................................. $ 686 $ 686 $ 306 $ 306

Long-term debt(2), (4) ......................................... $ 20,587 $ 22,514 $ 20,734 $ 21,892

Collateral financing arrangements ................................ $ 4,647 $ 4,136 $ 5,297 $ 4,757

Junior subordinated debt securities ............................... $ 3,192 $ 3,491 $ 3,191 $ 3,461

Other liabilities(2), (5) .......................................... $ 4,087 $ 4,087 $ 2,777 $ 2,777

Separate account liabilities(2) .................................... $ 49,610 $ 49,610 $ 42,160 $ 42,160

Liabilities of subsidiaries held-for-sale(2) ........................... $ — $ — $ 105 $ 105

Commitments:(6)

Mortgage loan commitments .................................... $4,129 $ — $ 3 $3,754 $ — $ (17)

Commitments to fund bank credit facilities, bridge loans and private

corporate bond investments .................................. $1,432 $ — $ 51 $2,437 $ — $ —

(1) Mortgage loans held-for-investment as presented in the table above differ from the amounts presented in the consolidated balance sheets

because this table does not include commercial mortgage loans held by CSEs, which are accounted for under the FVO.

Mortgage loans held-for-sale as presented in the table above differ from the amounts presented in the consolidated balance sheets because this

table only includes mortgage loans that were previously designated as held-for-investment but now are designated as held-for-sale and stated at

lower of amortized cost or estimated fair value.

MetLife, Inc. 171