MetLife 2011 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

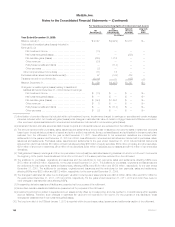

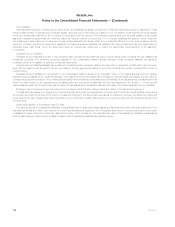

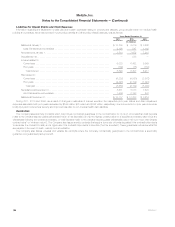

Other Liabilities

Other liabilities included in the table above reflect those other liabilities that satisfy the definition of financial instruments subject to disclosure. These

items consist primarily of interest and dividends payable, amounts due for securities purchased but not yet settled, funds withheld amounts payable

which are contractually withheld by the Company in accordance with the terms of the reinsurance agreements and amounts payable under certain

assumed reinsurance agreements are recorded using the deposit method of accounting. The Company evaluates the specific terms, facts and

circumstances of each instrument to determine the appropriate estimated fair values, which are not materially different from the carrying values, with the

exception of certain deposit type reinsurance payables. For these reinsurance payables, the estimated fair value is determined as the present value of

expected future cash flows, which are discounted using an interest rate determined to reflect the appropriate credit standing of the assuming

counterparty.

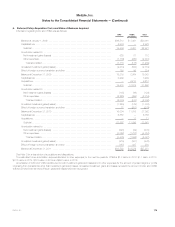

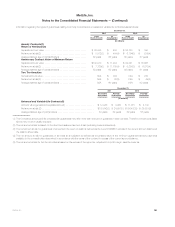

Separate Account Liabilities

Separate account liabilities included in the preceding table represent those balances due to policyholders under contracts that are classified as

investment contracts. The remaining amounts presented in the consolidated balance sheets represent those contracts classified as insurance

contracts, which do not satisfy the definition of financial instruments.

Separate account liabilities classified as investment contracts primarily represent variable annuities with no significant mortality risk to the Company

such that the death benefit is equal to the account balance, funding agreements related to group life contracts and certain contracts that provide for

benefit funding.

Separate account liabilities are recognized in the consolidated balance sheets at an equivalent value of the related separate account assets.

Separate account assets, which equal net deposits, net investment income and realized and unrealized investment gains and losses, are fully offset by

corresponding amounts credited to the contractholders’ liability which is reflected in separate account liabilities. Since separate account liabilities are fully

funded by cash flows from the separate account assets which are recognized at estimated fair value as described in the section “— Recurring Fair

Value Measurements,” the Company believes the value of those assets approximates the estimated fair value of the related separate account liabilities.

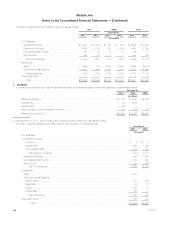

Mortgage Loan Commitments and Commitments to Fund Bank Credit Facilities, Bridge Loans and Private Corporate Bond Investments

The estimated fair values for mortgage loan commitments that will be held for investment and commitments to fund bank credit facilities, bridge loans

and private corporate bonds that will be held for investment reflected in the above table represents the difference between the discounted expected

future cash flows using interest rates that incorporate current credit risk for similar instruments on the reporting date and the principal amounts of the

commitments.

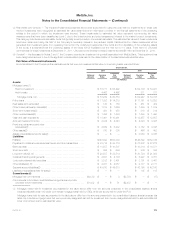

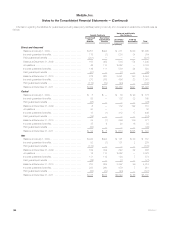

Assets and Liabilities of Subsidiaries Held-For-Sale

The carrying values of the assets and liabilities of subsidiaries held-for-sale reflect those assets and liabilities which were previously determined to be

financial instruments and which were reflected in other financial statement captions in the comparable table above in previous periods but have been

reclassified to these captions to reflect the discontinued nature of the operations. The estimated fair value of the assets and liabilities of subsidiaries

held-for-sale has been determined on a basis consistent with the assets and liabilities as described herein.

174 MetLife, Inc.