MetLife 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying value as a basis for determining whether it

needs to perform the quantitative two-step goodwill impairment test. Only if an entity determines, based on qualitative assessment, that it is more likely

than not that a reporting unit’s fair value is less than its carrying value will it be required to calculate the fair value of the reporting unit. The Company does

not expect the adoption of this new guidance to have a material impact on its consolidated financial statements.

In July 2011, the FASB issued new guidance on other expenses (ASU 2011-06, Other Expenses (Topic 720): Fees Paid to the Federal Government

by Health Insurers), effective for calendar years beginning after December 31, 2013. The objective of this standard is to address how health insurers

should recognize and classify in their income statements fees mandated by the Patient Protection and Affordable Care Act, as amended by the Health

Care and Education Reconciliation Act. The amendments in this standard specify that the liability for the fee should be estimated and recorded in full

once the entity provides qualifying health insurance in the applicable calendar year in which the fee is payable with a corresponding deferred cost that is

amortized to expense using the straight-line method of allocation unless another method better allocates the fee over the calendar year that it is payable.

The Company is currently evaluating the impact of this guidance on its consolidated financial statements.

In June 2011, the FASB issued new guidance regarding comprehensive income (ASU 2011-05, Comprehensive Income (Topic 220): Presentation

of Comprehensive Income), effective for fiscal years, and interim periods within those years, beginning after December 15, 2011. The guidance should

be applied retrospectively and early adoption is permitted. The new guidance provides companies with the option to present the total of comprehensive

income, components of net income, and the components of other comprehensive income either in a single continuous statement of comprehensive

income or in two separate but consecutive statements. The objective of the standard is to increase the prominence of items reported in other

comprehensive income and to facilitate convergence of GAAP and IFRS. The standard eliminates the option to present components of other

comprehensive income as part of the statement of changes in stockholders’ equity. The amendments in ASU 2011-05 do not change the items that

must be reported in other comprehensive income or when an item of other comprehensive income must be reclassified in net income. The Company

intends to adopt the two-statement approach in the first quarter of 2012.

In May 2011, the FASB issued new guidance regarding fair value measurements (ASU 2011-04, Fair Value Measurement (Topic 820): Amendments

to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs), effective for the first interim or annual period

beginning after December 15, 2011. The guidance should be applied prospectively. The amendments in this ASU are intended to establish common

requirements for measuring fair value and for disclosing information about fair value measurements in accordance with GAAP and IFRS. Some of the

amendments clarify the FASB’s intent on the application of existing fair value measurement requirements. Other amendments change a particular

principle or requirement for measuring fair value or for disclosing information about fair value measurements. The Company does not expect the

adoption of this new guidance to have a material impact on its consolidated financial statements.

In April 2011, the FASB issued new guidance regarding effective control in repurchase agreements (ASU 2011-03, Transfers and Servicing

(Topic 860): Reconsideration of Effective Control for Repurchase Agreements), effective for the first interim or annual period beginning on or after

December 15, 2011. The guidance should be applied prospectively to transactions or modifications of existing transactions that occur on or after the

effective date. The amendments in this ASU remove from the assessment of effective control the criterion requiring the transferor to have the ability to

repurchase or redeem the financial assets. The Company does not expect the adoption of this new guidance to have a material impact on its

consolidated financial statements.

In October 2010, the FASB issued new guidance regarding accounting for deferred acquisition costs (ASU 2010-26, Financial Services —Insurance

(Topic 944): Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts) (“ASU 2010-26”), effective for fiscal years, and interim

periods within those fiscal years, beginning after December 15, 2011. ASU 2010-26 specifies that only costs related directly to successful acquisition

of new or renewal contracts can be capitalized as DAC; all other acquisition-related costs must be expensed as incurred. Under the new guidance,

advertising costs may only be included in DAC if the capitalization criteria in the direct-response advertising guidance in Subtopic 340-20, Other Assets

and Deferred Costs—Capitalized Advertising Costs, are met. As a result, certain direct marketing, sales manager compensation and administrative costs

currently capitalized by the Company will no longer be deferred. The Company will adopt ASU 2010-26 in the first quarter of 2012 and will apply it

retrospectively to all prior periods presented in its consolidated financial statements for all insurance contracts. The Company estimates that DAC will be

reduced by approximately $3.1 billion to $3.6 billion and total equity will be reduced by approximately $2.1 billion to $2.4 billion, net of income tax,asof

the date of adoption.

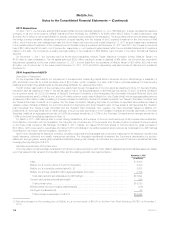

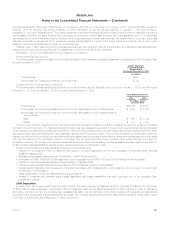

2. Acquisitions and Dispositions

Pending Dispositions

In December 2011, MetLife Bank National Association (“MetLife Bank”) and MetLife, Inc. entered into a definitive agreement to sell most of the

depository business of MetLife Bank. The transaction is expected to close in the second quarter of 2012, subject to certain regulatory approvals and

other customary closing conditions. Additionally, in January 2012, MetLife, Inc. announced it is exiting the business of originating forward residential

mortgages. In conjunction with these events, for the year ended December 31, 2011, the Company recorded charges totaling $212 million, net of

income tax, which included intent-to-sell OTTI investment charges, charges related to the de-designation of certain cash flow hedges, a goodwill

impairment charge and other employee-related charges. In addition, the Company expects to incur additional charges of $90 million to $110 million, net

of income tax, during 2012, related to exiting the forward residential mortgage origination business. The total assets and liabilities recorded in the

consolidated balance sheet related to these two businesses as of December 31, 2011 were approximately $11.0 billion and $10.0 billion, respectively.

These transactions did not qualify for discontinued operations accounting treatment under GAAP. See Notes 3 and 7.

In November 2011, the Company entered into an agreement to sell its insurance operations in the Caribbean region, Panama and Costa Rica (the

“Caribbean Business”). The total assets and liabilities recorded in the consolidated balance sheet related to these insurance operations as of

December 31, 2011 were $859 million and $707 million, respectively. Related to the pending sale, the Company recorded a loss of $21 million, net of

income tax, which included intent-to-sell OTTI investment charges, during the year ended December 31, 2011. The sale is expected to close in the

second quarter of 2012 subject to regulatory approval and other customary closing conditions. The results of the Caribbean Business are included in

continuing operations.

MetLife, Inc. 113