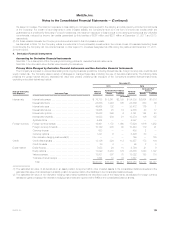

MetLife 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

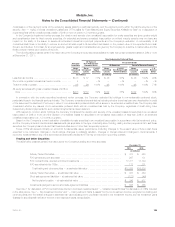

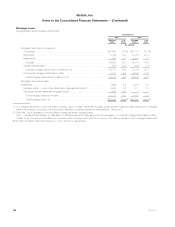

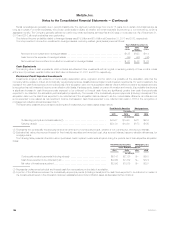

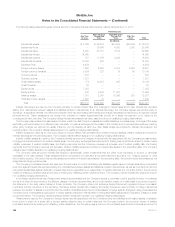

Mortgage Loans Modified in a Troubled Debt Restructuring. See Note 1 for a discussion of loan modifications that are classified as trouble debt

restructuring and the types of concession typically granted. At December 31, 2011, the number of mortgage loans and carrying value after specific

valuation allowance of mortgage loans modified during the period in a troubled debt restructuring were as follows:

Mortgage Loans Modified in a Troubled Debt

Restructuring

December 31, 2011

Number of

Mortgage

Loans Carrying Value after Specific

Valuation Allowance

Pre-

Modification Post-

Modification

(In millions)

Commercial ............................................................. 5 $147 $111

Agricultural .............................................................. 10 42 42

Residential .............................................................. — — —

Total ................................................................. 15 $189 $153

During the previous 12 months, the Company had four agricultural mortgage loans, with a carrying value after specific valuation allowance of

$13 million, modified in a troubled debt restructuring with a subsequent payment default at December 31, 2011. There were no commercial or

residential mortgage loans during the previous 12 months modified in a troubled debt restructuring with a subsequent payment default at December 31,

2011. Payment default is determined in the same manner as delinquency status — when interest and principal payments are past due as follows:

commercial mortgage loans — 60 days or more; agricultural mortgage loans — 90 days or more; and residential mortgage loans — 60 days or more.

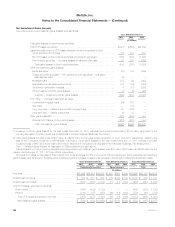

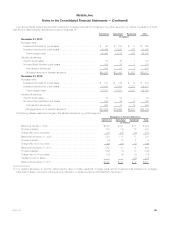

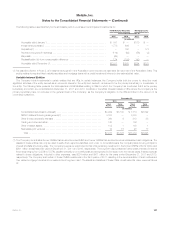

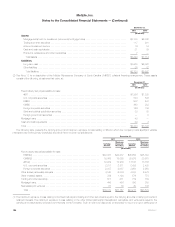

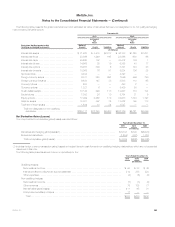

Real Estate and Real Estate Joint Ventures

Real estate investments by type consisted of the following:

December 31,

2011 2010

Carrying

Value %of

Total Carrying

Value %of

Total

(In millions) (In millions)

Traditional .......................................................... $5,958 69.6% $4,987 62.1%

Real estate joint ventures and funds ...................................... 2,340 27.3 2,707 33.7

Real estate and real estate joint ventures ................................. 8,298 96.9 7,694 95.8

Foreclosed (commercial, agricultural and residential) .......................... 264 3.1 152 1.9

Real estate held-for-investment ........................................ 8,562 100.0 7,846 97.7

Real estate held-for-sale ............................................... 1 — 184 2.3

Total real estate and real estate joint ventures ............................. $8,563 100.0% $8,030 100.0%

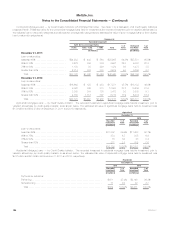

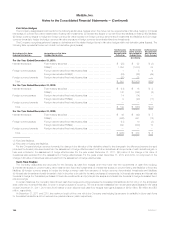

The Company classifies within traditional real estate its investment in income-producing real estate, which is comprised primarily of wholly-owned

real estate and, to a much lesser extent, joint ventures with interests in single property income-producing real estate. The estimated fair value of the

traditional real estate investment portfolio was $7.7 billion and $6.3 billion at December 31, 2011 and 2010, respectively. The Company classifies within

real estate joint ventures and funds, its investments in joint ventures with interests in multi-property projects with varying strategies ranging from the

development of properties to the operation of income-producing properties; as well as its investments in real estate private equity funds. From time to

time, the Company transfers investments from these joint ventures to traditional real estate, if the Company retains an interest in the joint venture after a

completed property commences operations and the Company intends to retain an interest in the property.

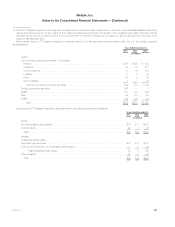

Properties acquired through foreclosure were $295 million, $165 million and $127 million for the years ended December 31, 2011, 2010 and 2009,

respectively, and include commercial, agricultural and residential properties. After the Company acquires properties through foreclosure, it evaluates

whether the properties are appropriate for retention in its traditional real estate portfolio. Foreclosed real estate held at December 31, 2011 and 2010

includes those properties the Company has not selected for retention in its traditional real estate portfolio and which do not meet the criteria to be

classified as held-for-sale.

The wholly-owned real estate within traditional real estate is net of accumulated depreciation of $1.3 billion and $1.5 billion at December 31, 2011

and 2010, respectively. Related depreciation expense on traditional wholly-owned real estate was $164 million, $151 million and $135 million for the

years ended December 31, 2011, 2010 and 2009, respectively. These amounts include depreciation expense related to discontinued operations of

$7 million, $16 million and $17 million for the years ended December 31, 2011, 2010 and 2009, respectively.

There were no impairments recognized on real estate held-for-investment for the year ended December 31, 2011. Impairments recognized on real

estate held-for-investment were $48 million and $160 million for the years ended December 31, 2010 and 2009, respectively. Impairments recognized

on real estate held-for-sale were $2 million and $1 million for the years ended December 31, 2011 and 2010, respectively. There were no impairments

recognized on real estate held-for-sale for the year ended December 31, 2009. The Company’s carrying value of real estate held-for-sale has been

reduced by impairments recorded prior to 2009 of $1 million at both December 31, 2011 and 2010. The carrying value of non-income producing real

estate was $182 million and $137 million at December 31, 2011 and 2010, respectively.

134 MetLife, Inc.