MetLife 2011 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

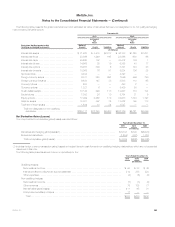

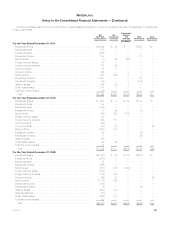

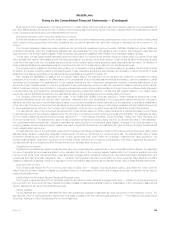

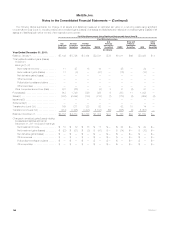

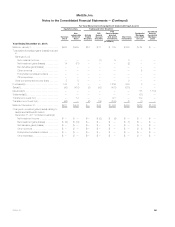

5. Fair Value

Considerable judgment is often required in interpreting market data to develop estimates of fair value, and the use of different assumptions or

valuation methodologies may have a material effect on the estimated fair value amounts.

Assets and Liabilities Measured at Fair Value

Recurring Fair Value Measurements

The assets and liabilities measured at estimated fair value on a recurring basis, including those items for which the Company has elected the FVO,

were determined as described below. These estimated fair values and their corresponding placement in the fair value hierarchy are summarized as

follows: December 31, 2011

Fair Value Measurements at Reporting Date Using

Quoted Prices in

Active Markets for

Identical Assets

and Liabilities

(Level 1)

Significant Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Estimated

Fair

Value

(In millions)

Assets

Fixed maturity securities:

U.S. corporate securities ................................................... $ — $ 99,001 $ 6,784 $105,785

Foreign corporate securities ................................................ — 59,648 4,370 64,018

Foreign government securities ............................................... 76 50,138 2,322 52,536

RMBS ................................................................. — 41,035 1,602 42,637

U.S. Treasury and agency securities .......................................... 19,911 20,070 31 40,012

CMBS ................................................................. — 18,316 753 19,069

State and political subdivision securities ....................................... — 13,182 53 13,235

ABS ................................................................... — 11,129 1,850 12,979

Other fixed maturity securities ............................................... — — — —

Total fixed maturity securities .............................................. 19,987 312,519 17,765 350,271

Equity securities:

Common stock .......................................................... 819 1,105 281 2,205

Non-redeemable preferred stock ............................................. — 380 438 818

Total equity securities .................................................... 819 1,485 719 3,023

Trading and other securities:

Actively Traded Securities .................................................. — 473 — 473

FVO general account securities .............................................. — 244 23 267

FVO contractholder-directed unit-linked investments ............................. 7,572 8,453 1,386 17,411

FVO securities held by CSEs ................................................ — 117 — 117

Total trading and other securities ........................................... 7,572 9,287 1,409 18,268

Short-term investments(1) .................................................... 8,150 8,120 590 16,860

Mortgage loans:

Commercial mortgage loans held by CSEs ..................................... — 3,138 — 3,138

Mortgage loans held-for-sale:(2)

Residential mortgage loans ............................................... — 2,836 228 3,064

Securitized reverse residential mortgage loans ................................ — 6,466 1,186 7,652

Total mortgage loans held-for-sale ........................................ — 9,302 1,414 10,716

Total mortgage loans ................................................ — 12,440 1,414 13,854

Other invested assets:

MSRs .................................................................. — — 666 666

Other investments ........................................................ 312 124 — 436

Derivative assets:(3)

Interest rate contracts ................................................... 32 10,426 338 10,796

Foreign currency contracts ............................................... 1 1,316 61 1,378

Credit contracts ........................................................ — 301 29 330

Equity market contracts .................................................. 29 2,703 964 3,696

Total derivative assets ................................................. 62 14,746 1,392 16,200

Total other invested assets ............................................ 374 14,870 2,058 17,302

Net embedded derivatives within asset host contracts(4) ............................ — 1 362 363

Separate account assets(5) .................................................. 28,191 173,507 1,325 203,023

Total assets ............................................................. $65,093 $532,229 $25,642 $622,964

MetLife, Inc. 151