MetLife 2011 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

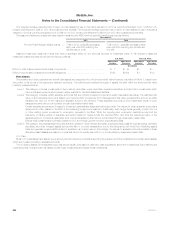

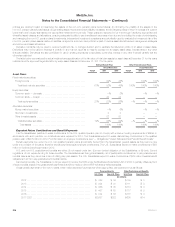

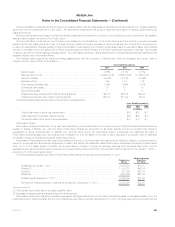

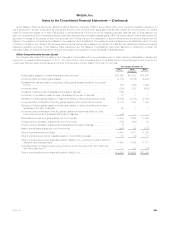

Information on the declaration, record and payment dates, as well as per share and aggregate dividend amounts, for the Preferred Shares was as

follows:

Dividend

Declaration Date Record Date Payment Date Series A Per

Share Series A

Aggregate Series B Per

Share Series B

Aggregate

(In millions, except per share data)

November 15, 2011 November 30, 2011 December 15, 2011 $0.2527777 $ 7 $0.4062500 $24

August 15, 2011 August 31, 2011 September 15, 2011 $0.2555555 6 $0.4062500 24

May 16, 2011 May 31, 2011 June 15, 2011 $0.2555555 7 $0.4062500 24

March 7, 2011 February 28, 2011 March 15, 2011 $0.2500000 6 $0.4062500 24

$26 $96

November 15, 2010 November 30, 2010 December 15, 2010 $0.2527777 $ 7 $0.4062500 $24

August 16, 2010 August 31, 2010 September 15, 2010 $0.2555555 6 $0.4062500 24

May 17, 2010 May 31, 2010 June 15, 2010 $0.2555555 7 $0.4062500 24

March 5, 2010 February 28, 2010 March 15, 2010 $0.2500000 6 $0.4062500 24

$26 $96

November 16, 2009 November 30, 2009 December 15, 2009 $0.2527777 $ 7 $0.4062500 $24

August 17, 2009 August 31, 2009 September 15, 2009 $0.2555555 6 $0.4062500 24

May 15, 2009 May 31, 2009 June 15, 2009 $0.2555555 7 $0.4062500 24

March 5, 2009 February 28, 2009 March 16, 2009 $0.2500000 6 $0.4062500 24

$26 $96

See Note 24 for information on subsequent dividends declared.

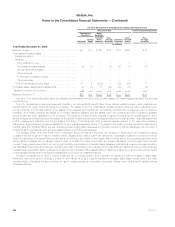

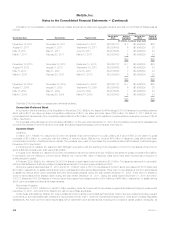

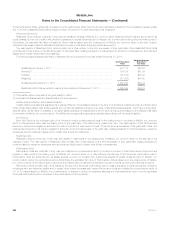

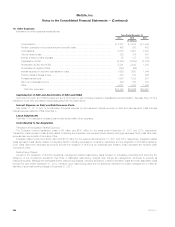

Convertible Preferred Stock

In connection with the financing of the Acquisition in November 2010, MetLife, Inc. issued to AM Holdings 6,857,000 shares of convertible preferred

stock with a $0.01 par value per share, a liquidation preference of $0.01 per share and a fair value of $2.8 billion. On March 8, 2011, MetLife, Inc.

repurchased and canceled all of the convertible preferred stock for $3.0 billion in cash, which resulted in a preferred stock redemption premium of $146

million. See Note 2.

For purposes of the earnings per common share calculation, for the year ended December 31, 2010, the convertible preferred stock was assumed

converted into shares of common stock for both basic and diluted weighted average common shares. See Note 20.

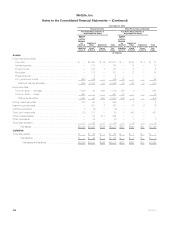

Common Stock

Issuances

In March 2011, MetLife, Inc. issued 68,570,000 new shares of its common stock in a public offering at a price of $43.25 per share for gross

proceeds of $3.0 billion. In connection with the offering of common stock, MetLife, Inc. incurred $16 million of issuance costs which have been

recorded as a reduction of additional paid-in capital. The proceeds were used to repurchase the convertible preferred stock issued to AM Holdings in

November 2010. See Note 2.

In November 2010, MetLife, Inc. issued to AM Holdings in connection with the financing of the Acquisition 78,239,712 new shares of its common

stock at $40.90 per share with a fair value of $3.2 billion.

In August 2010, MetLife, Inc. issued 86,250,000 new shares of its common stock at a price of $42.00 per share for gross proceeds of $3.6 billion.

In connection with the offering of common stock, MetLife, Inc. incurred $94 million of issuance costs which have been recorded as a reduction of

additional paid-in capital.

In February 2009, MetLife, Inc. delivered 24,343,154 shares of newly issued common stock for $1.0 billion. The issuance was made in connection

with the initial settlement of stock purchase contracts issued as part of common equity units sold in 2005.

During the years ended December 31, 2011 and 2010, 3,549,211 and 2,182,174 new shares of common stock were issued for $115 million and

$74 million, respectively, to satisfy various stock option exercises and other stock-based awards. There were no new shares of common stock issued

to satisfy the various stock option exercises and other stock-based awards during the year ended December 31, 2009. There were no shares of

common stock issued from treasury stock during the year ended December 31, 2011. During the years ended December 31, 2010 and 2009,

332,121 shares and 861,586 shares of common stock were issued from treasury stock for $18 million and $46 million, respectively, to satisfy various

stock option exercises and other stock-based awards.

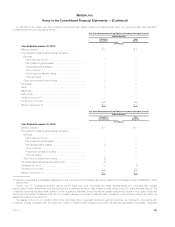

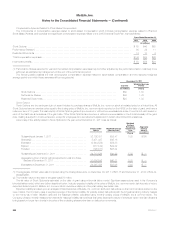

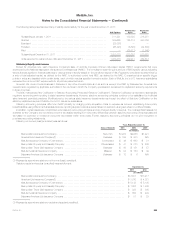

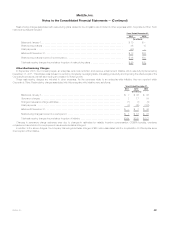

Repurchase Programs

At December 31, 2011, MetLife, Inc. had $1.3 billion remaining under its common stock repurchase program authorizations. During the years ended

December 31, 2011, 2010 and 2009, MetLife, Inc. did not repurchase any shares.

Under these authorizations, MetLife, Inc. may purchase its common stock from the MetLife Policyholder Trust, in the open market (including pursuant

to the terms of a pre-set trading plan meeting the requirements of Rule 10b5-1 under the Securities Exchange Act of 1934) and in privately negotiated

transactions. Any future common stock repurchases will be dependent upon several factors, including the Company’s capital position, its liquidity, its

218 MetLife, Inc.