MetLife 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

2011 Dispositions

On April 1, 2011, the Company sold its 50% interest in Mitsui Sumitomo MetLife Insurance Co., Ltd. (“MSI MetLife”), a Japan domiciled life insurance

company, to its joint venture partner, MS&AD Insurance Group Holdings, Inc. (“MS&AD”), for $269 million (Ą22.5 billion) in cash consideration, less

$4 million (Ą310 million) to reimburse MS&AD for specific expenses incurred related to the transaction. The accumulated other comprehensive losses in

the foreign currency translation adjustment component of equity resulting from the hedges of the Company’s investment in the joint venture of $46

million, net of income tax, were released upon sale but did not impact net income for year ended December 31, 2011 as such losses were considered

in the overall impairment evaluation of the investment prior to the sale. During the years ended December 31, 2011 and 2010, the Company recorded a

loss of $57 million and $136 million, net of income tax, respectively, in net investment gains (losses) within the consolidated statements of operations

related to the sale. The Company’s operating earnings relating to its investment in MSI MetLife were included in the Other International Regions

segment.

On November 1, 2011, the Company sold its wholly-owned subsidiary, MetLife Taiwan Insurance Company Limited (“MetLife Taiwan”) for

$180 million in cash consideration. The net assets sold were $282 million, resulting in a loss on disposal of $64 million, net of income tax, recorded in

discontinued operations, for the year ended December 31, 2011. Income (loss) from the operations of MetLife Taiwan of $20 million, $22 million and

$9 million, net of income tax, for the years ended December 31, 2011, 2010 and 2009, respectively, was also recorded in discontinued operations.

See Note 23.

2010 Acquisition of ALICO

Description of Transaction

On the Acquisition Date, MetLife, Inc. acquired all of the issued and outstanding capital stock of American Life from AM Holdings, a subsidiary of

AIG, and DelAm from AIG for a total purchase price of $16.4 billion, which consisted of (i) cash of $7.2 billion (includes settlement of intercompany

balances and certain other adjustments), and (ii) securities of MetLife, Inc. valued at $9.2 billion.

The $7.2 billion cash portion of the purchase price was funded through the issuance of common stock as described in Note 18, fixed and floating

rate senior debt as described in Note 11 as well as cash on hand. The securities issued to AM Holdings included (a) 78,239,712 shares of MetLife,

Inc.’s common stock; (b) 6,857,000 shares of Series B Contingent Convertible Junior Participating Non-Cumulative Perpetual Preferred Stock (the

“convertible preferred stock”) of MetLife, Inc.; and (c) 40 million common equity units of MetLife, Inc. (the “Equity Units”) with an aggregate stated amount

at issuance of $3.0 billion, initially consisting of (i) three purchase contracts (the “Series C Purchase Contracts,” the “Series D Purchase Contracts” and

the “Series E Purchase Contracts” and, together, the “Purchase Contracts”), obligating the holder to purchase, on specified future settlement dates, a

variable number of shares of MetLife, Inc.’s common stock for a fixed price; and (ii) an interest in each of three series of debt securities (the “Series C

Debt Securities,” the “Series D Debt Securities” and the “Series E Debt Securities,” and, together, the “Debt Securities”) issued by MetLife, Inc.

Distributions on the Equity Units will be made quarterly, through contract payments on the Purchase Contracts and interest payments on the Debt

Securities, initially at an aggregate annual rate of 5.00% (an average annual rate of 3.02% on the Purchase Contracts and an average annual rate of

1.98% on the Debt Securities) as described in Note 14.

On March 8, 2011, AM Holdings sold, in public offering transactions, all the shares of common stock and Equity Units it received as consideration

from MetLife in connection with the Acquisition. The Company did not receive any of the proceeds from the sale of either the shares of common stock

or the Equity Units owned by AM Holdings. On March 8, 2011, MetLife, Inc. issued 68,570,000 shares of common stock for gross proceeds of

$3.0 billion, which were used to repurchase and cancel 6,857,000 shares of convertible preferred stock received as consideration by AM Holdings

from MetLife in connection with the Acquisition. See Note 18.

ALICO is an international life insurance company, providing consumers and businesses with products and services for life insurance, accident and

health insurance, retirement and wealth management solutions. The Acquisition significantly broadened the Company’s diversification by product,

distribution and geography, meaningfully accelerated MetLife’s global growth strategy, and provides the opportunity to build an international franchise

leveraging the key strengths of ALICO.

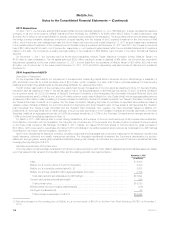

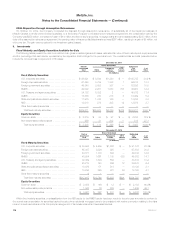

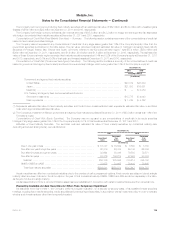

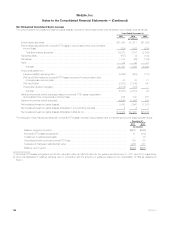

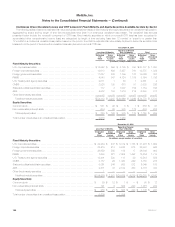

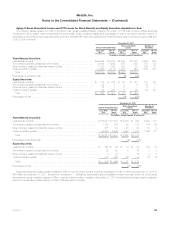

Fair Value and Allocation of Purchase Price

The computation of total purchase consideration and the amounts recognized for each major class of assets acquired and liabilities assumed, based

upon their respective fair values at the Acquisition Date, and the resulting goodwill, are presented below:

November 1, 2010

(In millions)

Cash ............................................................................ $ 6,800

MetLife, Inc.’s common stock (78,239,712 shares)(1) ...................................... 3,200

MetLife, Inc.’s convertible preferred stock(1), (2) .......................................... 2,805

MetLife, Inc.’s Equity Units ($3.0 billion aggregate stated amount)(3) ........................... 3,189

Total cash paid and securities issued to AM Holdings .................................... $15,994

Contractual purchase price adjustments(4) .............................................. 396

Total purchase price .............................................................. $16,390

Effective settlement of pre-existing relationships(5) ......................................... (186)

Contingent consideration(6) .......................................................... 88

Total purchase consideration for ALICO ............................................... $16,292

(1) Fair value is based on the opening price of MetLife, Inc.’s common stock of $40.90 on the New York Stock Exchange (“NYSE”) on November 1,

2010.

114 MetLife, Inc.