MetLife 2011 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

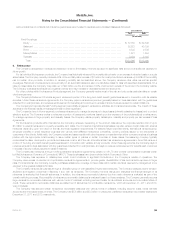

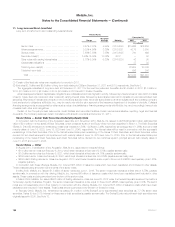

redeem, or purchase the securities on or before a date 10 years prior to the final maturity date of each issuance, unless, subject to certain limitations, it

has received cash proceeds during a specified period from the sale of specified replacement securities. Each RCC will terminate upon the occurrence

of certain events, including an acceleration of the applicable securities due to the occurrence of an event of default. The RCCs are not intended for the

benefit of holders of the securities and may not be enforced by them. Rather, each RCC is for the benefit of the holders of a designated series of

MetLife, Inc.’s other indebtedness (the “Covered Debt”). Initially, the Covered Debt for each of the securities described above was MetLife, Inc.’s 5.70%

senior notes due 2035 (the “Senior Notes”). As a result of the issuance of MetLife, Inc.’s 10.750% Fixed-to-Floating Rate Junior Subordinated

Debentures due 2069 (the “10.750% JSDs”), the 10.750% JSDs became the Covered Debt with respect to, and in accordance with, the terms of the

RCC relating to MetLife, Inc.’s 6.40% Fixed-to-Floating Rate Junior Subordinated Debentures due 2066. The Senior Notes continue to be the Covered

Debt with respect to, and in accordance with, the terms of the RCCs relating to each of MetLife Capital Trust IV’s 7.875% Fixed-to-Floating Rate

Exchangeable Surplus Trust Securities, MetLife Capital Trust X’s 9.250% Fixed-to-Floating Rate Exchangeable Surplus Trust Securities and the

10.750% JSDs. MetLife, Inc. also entered into a replacement capital obligation which will commence during the six month period prior to the scheduled

redemption date of each of the securities described above and under which MetLife, Inc. must use reasonable commercial efforts to raise replacement

capital to permit repayment of the securities through the issuance of certain qualifying capital securities.

Issuance costs associated with the issuance of the securities of $5 million were incurred during the year ended December 31, 2009. These

issuance costs have been capitalized, are included in other assets, and are amortized over the period from the issuance date until the scheduled

redemption date of the issuance. Interest expense on outstanding junior subordinated debt securities was $258 million, $258 million and $231 million

for the years ended December 31, 2011, 2010, and 2009, respectively.

Other Junior Subordinated Debt Securities

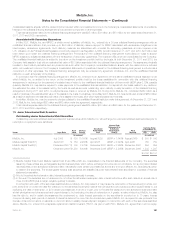

In June 2005, MetLife, Inc. issued $1.1 billion 4.91% Series B junior subordinated debt securities due no later than February 2040, in exchange for

$32 million in trust common securities of MetLife Capital Trust III (“Series B Trust”), a subsidiary trust of MetLife, Inc., and $1.0 billion in aggregate cash

proceeds from the sale by the subsidiary trust of trust preferred securities.

In February 2009, the Series B Trust was dissolved and $32 million of the Series B junior subordinated debt securities were returned to MetLife, Inc.

concurrently with the cancellation of the $32 million of trust common securities of the Series B Trust held by MetLife, Inc. Upon dissolution of the

Series B Trust, the remaining $1.0 billion of Series B junior subordinated debt securities were distributed to the holders of the trust preferred securities

and such trust preferred securities were canceled. In connection with the remarketing transaction in February 2009, the remaining $1.0 billion of MetLife,

Inc. Series B junior subordinated debt securities were modified, as permitted by their terms, to be 7.717% senior debt securities, Series B, due

February 2019. The Company did not receive any proceeds from the remarketing. See Note 11.

Interest expense on these junior subordinated debt securities was $6 million for the year ended December 31, 2009.

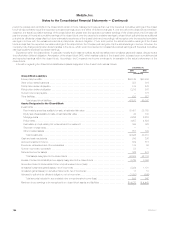

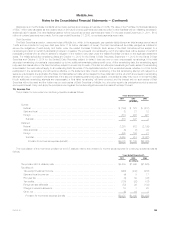

14. Common Equity Units

Acquisition of ALICO

In connection with the financing of the Acquisition (see Note 2) in November 2010, MetLife, Inc. issued to AM Holdings 40.0 million Equity Units with

an aggregate stated amount at issuance of $3.0 billion and an estimated fair value of $3.2 billion. Each Equity Unit has an initial stated amount of $75

per unit and initially consists of: (i) three Purchase Contracts, each of which obligates the holder to purchase, on a subsequent settlement date, a

variable number of shares of MetLife, Inc. common stock, par value $0.01 per share, for a purchase price of $25 ($75 in the aggregate); and (ii) a 1/40

undivided beneficial ownership interest in each of three series of Debt Securities issued by MetLife, Inc., each series of Debt Securities having an

aggregate principal amount of $1.0 billion. Distributions on the Equity Units will be made quarterly, and will consist of contract payments on the

Purchase Contracts and interest payments on the Debt Securities, at an aggregate annual rate of 5.00% of the stated amount at any time. The excess

of the estimated fair value of the Equity Units over the estimated fair value of the Debt Securities (see Note 11), after accounting for the present valueof

future contract payments recorded in other liabilities, resulted in a net decrease to additional paid-in capital of $69 million, representing the fair value of

the Purchase Contracts discussed below. On March 8, 2011, AM Holdings sold, in a public offering, all the Equity Units it received as consideration

from MetLife in connection with the Acquisition. The Equity Units are listed on the New York Stock Exchange.

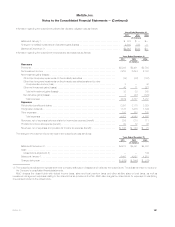

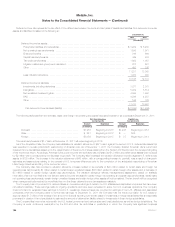

Purchase Contracts

Settlement of the Purchase Contracts of each series will occur upon the successful remarketing of the related series of Debt Securities, or upon a

final failed remarketing of the related series, as described below under “— Debt Securities.” On each settlement date subsequent to a successful

remarketing, the holder will pay $25 per Equity Unit and MetLife, Inc. will issue to such holder a variable number of shares of its common stock in

settlement of the applicable Purchase Contract. The number of shares to be issued will depend on the average of the daily volume-weighted average

prices of MetLife, Inc.’s common stock during the 20 trading day periods ending on, and including, the third day prior to the initial scheduled settlement

date for each series of Purchase Contracts. The initially-scheduled settlement dates are October 10, 2012 for the Series C Purchase Contracts,

September 11, 2013 for the Series D Purchase Contracts and October 8, 2014 for the Series E Purchase Contracts. If the average value of MetLife,

Inc.’s common stock as calculated pursuant to the Stock Purchase Agreement during the applicable 20 trading day period is less than or equal to

$35.42, as such amount may be adjusted (the “Reference Price”), the number of shares to be issued in settlement of the Purchase Contract will equal

$25 divided by the Reference Price, as calculated pursuant to the Stock Purchase Agreement (the “Maximum Settlement Rate”). If the market value of

MetLife, Inc.’s common stock is greater than or equal to $44.275, as such amount may be adjusted (the “Threshold Appreciation Price”), the number of

shares to be issued in settlement of the Purchase Contract will equal $25 divided by the Threshold Appreciation Price, as so calculated (the “Minimum

Settlement Rate”). If the market value of MetLife, Inc.’s common stock is greater than the Reference Price and less than the Threshold Appreciation

Price, the number of shares to be issued will equal $25 divided by the applicable market value, as so calculated. In the event of an unsuccessful

remarketing of any series of Debt Securities and the postponement of settlement to a later date, the average market value used to calculate the

settlement rate for a particular series will not be recalculated, although certain corporate events may require adjustments to the settlement rate. After

settlement of all the Purchase Contracts, MetLife, Inc. will receive proceeds of $3.0 billion and issue between 67.8 million and 84.7 million shares of its

common stock, subject to certain adjustments. The holder of an Equity Unit may, at its option, settle the related Purchase Contracts before the

applicable settlement date. However, upon early settlement, the holder will receive the Minimum Settlement Rate.

192 MetLife, Inc.