MetLife 2011 Annual Report Download - page 67

Download and view the complete annual report

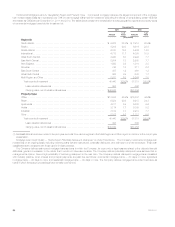

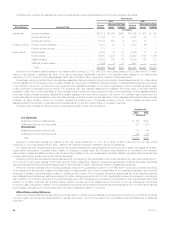

Please find page 67 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Policyholder Dividends Payable

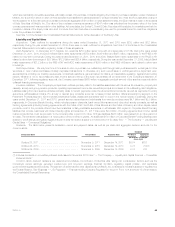

Policyholder dividends payable consists of liabilities related to dividends payable in the following calendar year on participating policies.

Liquidity and Capital Resources

Overview

Our business and results of operations are materially affected by conditions in the global capital markets and the global economy. Stressed

conditions, volatility and disruptions in global capital markets, particular markets, or financial asset classes can have an adverse effect on us, in part

because we have a large investment portfolio and our insurance liabilities are sensitive to changing market factors. The global economy and markets are

still affected by a period of significant stress that began in the second half of 2007. This disruption adversely affected the financial services sector, in

particular, and global capital markets. Consequently, financial institutions paid higher spreads over benchmark U.S. Treasury securities than before the

market disruption began.

Beginning in 2010 and continuing throughout 2011, concerns increased about capital markets and the solvency of certain European Union member

states and of financial institutions that have significant direct or indirect exposure to debt issued by these countries. The Japanese economy, to which

we face substantial exposure given our operations there, was significantly negatively impacted by the March 2011 earthquake and tsunami. Disruptions

to the Japanese economy are having, and will continue to have, negative impacts on the overall global economy, not all of which can be foreseen.

Although the August 2011 downgrade by S&P of U.S. Treasury securities initially had an adverse effect on financial markets, the extent of the longer-

term impact cannot be predicted. In November 2011, Fitch warned that it may in the future downgrade the U.S. credit rating unless action is taken to

reduce the national debt of the U.S. It is possible that the August 2011 S&P downgrade and any future downgrades, as well as continued concerns

about U.S. fiscal policy and the trajectory of the national debt of the U.S., could have severe repercussions to the U.S. and global credit and financial

markets, could further exacerbate concerns over sovereign debt of other countries and could disrupt economic activity in the U.S. and elsewhere. All of

these factors could affect the Company’s ability to meet liquidity needs and obtain capital. See “— Industry Trends” and “— Investments — Current

Environment.” See also “Risk Factors — Concerns Over U.S. Fiscal Policy and the Trajectory of the National Debt of the U.S., as well as Rating Agency

Downgrades of U.S. Treasury Securities, Could Have an Adverse Effect on Our Business, Financial Condition and Results of Operations” in the 2011

Form 10-K.

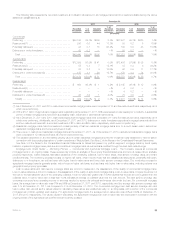

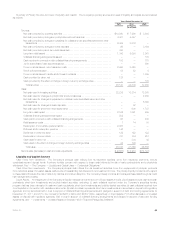

Liquidity Management

Based upon the strength of its franchise, diversification of its businesses and strong financial fundamentals, we continue to believe the Company

has ample liquidity to meet business requirements under current market conditions and unlikely but reasonably possible stress scenarios. The

Company’s short-term liquidity position includes cash and cash equivalents and short-term investments, excluding: (i) cash collateral received under the

Company’s securities lending program that has been reinvested in cash and cash equivalents, short-term investments and publicly-traded securities,

and (ii) cash collateral received from counterparties in connection with derivative instruments. At December 31, 2011 and 2010, the Company’s short-

term liquidity position was $16.2 billion and $17.6 billion, respectively. We continuously monitor and adjust our liquidity and capital plans for MetLife, Inc.

and its subsidiaries in light of changing needs and opportunities. See “— Investments — Current Environment.”

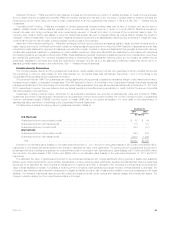

Capital Management

The Company has established several senior management committees as part of its capital management process. These committees, including the

Capital Management Committee and the Enterprise Risk Committee (comprised of members of senior management, including MetLife, Inc.’s Chief

Financial Officer, Treasurer and Chief Risk Officer and, in the case of the Enterprise Risk Committee, MetLife, Inc.’s Chief Investment Officer), regularly

review actual and projected capital levels (under a variety of scenarios including stress scenarios) and MetLife’s capital plan in accordance with its

capital policy.

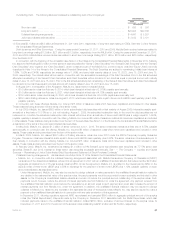

MetLife’s Board and senior management are directly involved in the development and maintenance of MetLife’s capital policy. The capital policy sets

forth, among other things, minimum and target capital levels and the governance of the capital management process. All capital actions, including

proposed changes to the capital plan, capital targets or capital policy, are reviewed by the Finance and Risk Committee of the Board prior to obtaining

full Board approval. The Board approves the capital policy and the annual capital plan and authorizes capital actions, as required.

MetLife’s 2012 capital plan, as submitted to the Federal Reserve for approval in January 2012 as part of the Federal Reserve Board’s 2012 CCAR,

was created in accordance with MetLife’s capital policy. See “Business – U.S. Regulation – Financial Holding Company Regulation” in the 2011 Form

10-K. In March 2012, the Federal Reserve informed MetLife that it objected to MetLife’s proposed capital plan. See “Business” and “— Recent

Developments.”

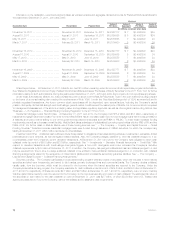

The Company

Liquidity

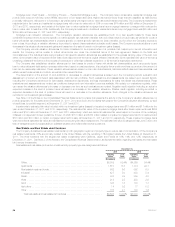

Liquidity refers to a company’s ability to generate adequate amounts of cash to meet its needs. Liquidity needs are determined from a rolling

six-month forecast by portfolio of investment assets and are monitored daily. Asset mix and maturities are adjusted based on the forecast. Cash flow

testing and stress testing provide additional perspectives on liquidity, which include various scenarios of the potential risk of early contractholder and

policyholder withdrawal. The Company includes provisions limiting withdrawal rights on many of its products, including general account institutional

pension products (generally group annuities, including funding agreements, and certain deposit fund liabilities) sold to employee benefit plan sponsors.

Certain of these provisions prevent the customer from making withdrawals prior to the maturity date of the product.

In the event of significant cash requirements beyond anticipated liquidity needs, the Company has various alternatives available depending on market

conditions and the amount and timing of the liquidity need. These options include cash flows from operations, the sale of liquid assets, global funding

sources and various credit facilities.

Under certain stressful market and economic conditions, the Company’s access to, or cost of, liquidity may deteriorate. If the Company requires

significant amounts of cash on short notice in excess of anticipated cash requirements or is required to post or return cash collateral in connection with

its investment portfolio, derivatives transactions or securities lending program, the Company may have difficulty selling investment assets in a timely

manner, be forced to sell them for less than the Company otherwise would have been able to realize, or both. In addition, in the event of such forced

sale, accounting guidance require the recognition of a loss for certain securities in an unrealized loss position and may require the impairment of other

MetLife, Inc. 63