MetLife 2011 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetLife, Inc.

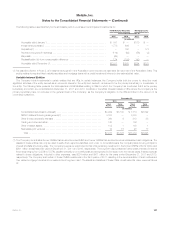

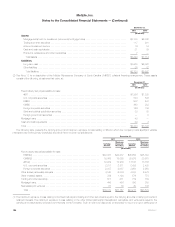

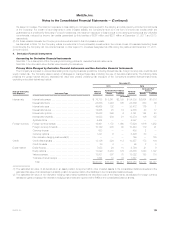

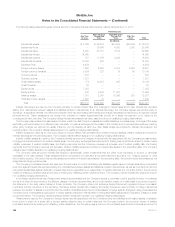

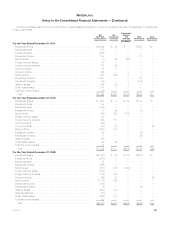

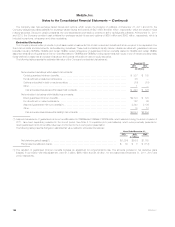

Notes to the Consolidated Financial Statements — (Continued)

written swaptions. Swaptions are included in interest rate options in the preceding table. The Company utilizes swaptions in non-qualifying hedging

relationships.

The Company writes covered call options on its portfolio of U.S. Treasury securities as an income generation strategy. In a covered call transaction,

the Company receives a premium at the inception of the contract in exchange for giving the derivative counterparty the right to purchase the referenced

security from the Company at a predetermined price. The call option is “covered” because the Company owns the referenced security over the term of

the option. Covered call options are included in interest rate options in the preceding table. The Company utilizes covered call options in non-qualifying

hedging relationships.

The Company enters into interest rate forwards to buy and sell securities. The price is agreed upon at the time of the contract and payment for such

a contract is made at a specified future date. The Company also uses interest rate forwards to sell to be announced securities as economic hedges

against the risk of changes in the fair value of mortgage loans held-for-sale and interest rate lock commitments. The Company utilizes interest rate

forwards in cash flow and non-qualifying hedging relationships.

Interest rate lock commitments are short-term commitments to fund mortgage loan applications in process (the pipeline) for a fixed term for a fixed

rate or spread. During the term of an interest rate lock commitment, the Company is exposed to the risk that interest rates will change from the rate

quoted to the potential borrower. Interest rate lock commitments to fund mortgage loans that will be held-for-sale are considered derivative instruments.

Interest rate lock commitments are included in interest rate forwards in the preceding table. Interest rate lock commitments are not designated as

hedging instruments.

A synthetic GIC is a contract that simulates the performance of a traditional guaranteed interest contract through the use of financial instruments.

Under a synthetic GIC, the policyholder owns the underlying assets. The Company guarantees a rate return on those assets for a premium. Synthetic

GICs are not designated as hedging instruments.

Foreign currency derivatives, including foreign currency swaps, foreign currency forwards, currency options, and currency futures contracts, are

used by the Company to reduce the risk from fluctuations in foreign currency exchange rates associated with its assets and liabilities denominated in

foreign currencies. The Company also uses foreign currency forwards and swaps to hedge the foreign currency risk associated with certain of its net

investments in foreign operations.

In a foreign currency swap transaction, the Company agrees with another party to exchange, at specified intervals, the difference between one

currency and another at a fixed exchange rate, generally set at inception, calculated by reference to an agreed upon principal amount. The principal

amount of each currency is exchanged at the inception and termination of the currency swap by each party. The Company utilizes foreign currency

swaps in fair value, cash flow, net investment in foreign operations and non-qualifying hedging relationships.

In a foreign currency forward transaction, the Company agrees with another party to deliver a specified amount of an identified currency at a

specified future date. The price is agreed upon at the time of the contract and payment for such a contract is made in a different currency at the

specified future date. The Company utilizes foreign currency forwards in fair value, net investment in foreign operations and non-qualifying hedging

relationships.

In exchange-traded currency futures transactions, the Company agrees to purchase or sell a specified number of contracts, the value of which is

determined by referenced currencies, and to post variation margin on a daily basis in an amount equal to the difference in the daily market values of

those contracts. The Company enters into exchange-traded futures with regulated futures commission merchants that are members of the exchange.

Exchange-traded currency futures are used primarily to hedge currency mismatches between assets and liabilities. The Company utilizes exchange-

traded currency futures in non-qualifying hedging relationships.

The Company enters into currency option contracts that give it the right, but not the obligation, to sell the foreign currency amount in exchange for a

functional currency amount within a limited time at a contracted price. The contracts may also be net settled in cash, based on differentials in the foreign

exchange rate and the strike price. The Company uses currency options to hedge against the foreign currency exposure inherent in certain of its

variable annuity products. The Company also uses currency options as an economic hedge of foreign currency exposure related to the Company’s

international subsidiaries. The Company utilizes currency options in non-qualifying hedging relationships.

The Company uses certain of its foreign currency denominated funding agreements to hedge portions of its net investments in foreign operations

against adverse movements in exchange rates. Such contracts are included in non-derivative hedging instruments in the preceding table.

Swap spreadlocks are used by the Company to hedge invested assets on an economic basis against the risk of changes in credit spreads. Swap

spreadlocks are forward transactions between two parties whose underlying reference index is a forward starting interest rate swap where the Company

agrees to pay a coupon based on a predetermined reference swap spread in exchange for receiving a coupon based on a floating rate. The Company

has the option to cash settle with the counterparty in lieu of maintaining the swap after the effective date. The Company utilizes swap spreadlocks in

non-qualifying hedging relationships.

Certain credit default swaps are used by the Company to hedge against credit-related changes in the value of its investments. In a credit default

swap transaction, the Company agrees with another party, at specified intervals, to pay a premium to hedge credit risk. If a credit event, as defined by

the contract, occurs, the contract may be cash settled or it may be settled gross by the delivery of par quantities of the referenced investment equal to

the specified swap notional in exchange for the payment of cash amounts by the counterparty equal to the par value of the investment surrendered. The

Company utilizes credit default swaps in non-qualifying hedging relationships.

Credit default swaps are also used to synthetically create investments that are either more expensive to acquire or otherwise unavailable in the cash

markets. These transactions are a combination of a derivative and one or more cash instruments such as U.S. Treasury securities, agency securities or

other fixed maturity securities. The Company also enters into certain credit default swaps held in relation to trading portfolios for the purpose of

generating profits on short-term differences in price. These credit default swaps are not designated as hedging instruments.

The Company enters into forwards to lock in the price to be paid for forward purchases of certain securities. The price is agreed upon at the time of

the contract and payment for the contract is made at a specified future date. When the primary purpose of entering into these transactions is to hedge

against the risk of changes in purchase price due to changes in credit spreads, the Company designates these as credit forwards. The Company

utilizes credit forwards in cash flow hedging relationships.

In exchange-traded equity futures transactions, the Company agrees to purchase or sell a specified number of contracts, the value of which is

determined by the different classes of equity securities, and to post variation margin on a daily basis in an amount equal to the difference in the daily

MetLife, Inc. 141