MetLife 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

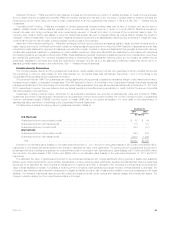

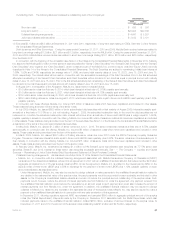

Outstanding Debt. The following table summarizes the outstanding debt of the Company at:

December 31,

2011 2010

(In millions)

Short-term debt ........................................................................ $ 686 $ 306

Long-term debt(1) ....................................................................... $20,624 $20,766

Collateral financing arrangements ........................................................... $ 4,647 $ 5,297

Junior subordinated debt securities ......................................................... $ 3,192 $ 3,191

(1) Excludes $3.1 billion and $6.8 billion at December 31, 2011 and 2010, respectively, of long-term debt relating to CSEs. See Note 3 of the Notes to

the Consolidated Financial Statements.

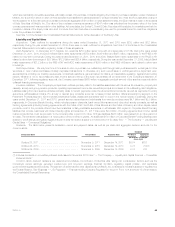

Debt Issuances and Other Borrowings. During the years ended December 31, 2011, 2010 and 2009, MetLife Bank received advances related to

long-term borrowings totaling $1.3 billion, $2.1 billion and $1.3 billion, respectively, from the FHLB of NY. During the years ended December 31, 2011,

2010 and 2009, MetLife Bank received advances related to short-term borrowings totaling $10.1 billion, $12.5 billion and $26.3 billion, respectively,

from the FHLB of NY.

In connection with the financing of the Acquisition (see Note 2 of the Notes to the Consolidated Financial Statements), in November 2010, MetLife,

Inc. issued to AM Holdings $3.0 billion in three series of debt securities (the “Series C Debt Securities,” the “Series D Debt Securities” and the “Series E

Debt Securities,” and, together, the “Debt Securities”), which constitute a part of the MetLife, Inc. common equity units (the “Equity Units”) more fully

described in Note 14 of the Notes to the Consolidated Financial Statements. The Debt Securities are subject to remarketing, initially bear interest at

1.56%, 1.92% and 2.46%, respectively (an average rate of 1.98%), and carry initial maturity dates of June 15, 2023, June 15, 2024 and June 15,

2045, respectively. The interest rates will be reset in connection with the successful remarketings of the Debt Securities. Prior to the first scheduled

attempted remarketing of the Series C Debt Securities, such Debt Securities will be divided into two tranches equal in principal amount with maturity

dates of June 15, 2018 and June 15, 2023. Prior to the first scheduled attempted remarketing of the Series E Debt Securities, such Debt Securities will

be divided into two tranches equal in principal amount with maturity dates of June 15, 2018 and June 15, 2045.

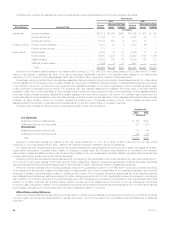

In August 2010, in anticipation of the Acquisition, MetLife, Inc. issued senior notes as follows:

‰$1.0 billion senior notes due February 6, 2014, which bear interest at a fixed rate of 2.375%, payable semi-annually;

‰$1.0 billion senior notes due February 8, 2021, which bear interest at a fixed rate of 4.75%, payable semi-annually;

‰$750 million senior notes due February 6, 2041, which bear interest at a fixed rate of 5.875%, payable semi-annually; and

‰$250 million floating rate senior notes due August 6, 2013, which bear interest at a rate equal to three-month LIBOR, reset quarterly, plus 1.25%,

payable quarterly.

In connection with these offerings, MetLife, Inc. incurred $15 million of issuance costs which have been capitalized and included in other assets.

These costs are being amortized over the terms of the senior notes.

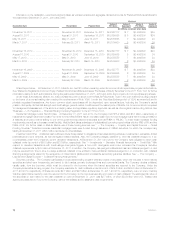

In July 2009, MetLife, Inc. issued $500 million of junior subordinated debt securities with a final maturity of August 2069. Interest is payable semi-

annually at a fixed rate of 10.75% up to, but not including, August 1, 2039, the scheduled redemption date. In the event the debt securities are not

redeemed on or before the scheduled redemption date, interest will accrue at an annual rate of three-month LIBOR plus a margin equal to 7.548%,

payable quarterly in arrears. In connection with the offering, MetLife, Inc. incurred $5 million of issuance costs which have been capitalized and included

in other assets. These costs are being amortized over the term of the securities. See Note 13 of the Notes to the Consolidated Financial Statements for

a description of the terms of the junior subordinated debt securities.

In May 2009, MetLife, Inc. issued $1.3 billion of senior notes due June 1, 2016. The senior notes bear interest at a fixed rate of 6.75%, payable

semi-annually. In connection with the offering, MetLife, Inc. incurred $6 million of issuance costs which have been capitalized and included in other

assets. These costs are being amortized over the term of the senior notes.

In March 2009, MetLife, Inc. issued $397 million of floating rate senior notes due June 2012 under the FDIC’s Temporary Liquidity Guarantee

Program. The senior notes bear interest at a rate equal to three-month LIBOR, reset quarterly, plus 0.32%. The senior notes are not redeemable prior to

their maturity. In connection with the offering, MetLife, Inc. incurred $15 million of issuance costs which have been capitalized and included in other

assets. These costs are being amortized over the term of the senior notes.

In February 2009, MetLife, Inc. remarketed its existing $1.0 billion 4.91% Series B junior subordinated debt securities as 7.717% senior debt

securities, Series B, due 2019. Interest on these senior debt securities is payable semi-annually. See “ — The Company — Liquidity and Capital

Sources — Remarketing of Junior Subordinated Debt Securities and Settlement of Stock Purchase Contracts.”

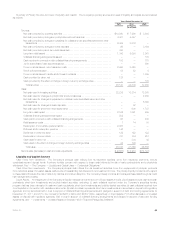

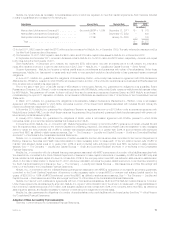

Collateral Financing Arrangements. As described more fully in Note 12 of the Notes to the Consolidated Financial Statements:

‰MetLife, Inc., in connection with the collateral financing arrangement associated with MetLife Reinsurance Company of Charleston’s (“MRC”)

reinsurance of the closed block liabilities, entered into an agreement in 2007 with an unaffiliated financial institution that referenced the $2.5 billion

aggregate principal amount of 35-year surplus notes by MRC. Under the agreement, MetLife, Inc. is entitled to the interest paid by MRC on the

surplus notes of three-month LIBOR plus 0.55% in exchange for the payment of three-month LIBOR plus 1.12%, payable quarterly on such

amount as adjusted, as described below.

Under this agreement, MetLife, Inc. may also be required to pledge collateral or make payments to the unaffiliated financial institution related to

any decline in the estimated fair value of the surplus notes. Any such payments would be accounted for as a receivable and included in other

assets on the Company’s consolidated balance sheets and would not reduce the principal amount outstanding of the surplus notes. Such

payments would, however, reduce the amount of interest payments due from MetLife, Inc. under the agreement. Any payment received from

the unaffiliated financial institution would reduce the receivable by an amount equal to such payment and would also increase the amount of

interest payments due from MetLife, Inc. under the agreement. In addition, the unaffiliated financial institution may be required to pledge

collateral to MetLife, Inc. related to any increase in the estimated fair value of the surplus notes. MetLife, Inc. may also be required to make a

payment to the unaffiliated financial institution in connection with any early termination of this agreement.

In December 2011, following regulatory approval, MRC repurchased and canceled $650 million in aggregate principal amount of the surplus

notes (the “Partial Repurchase”). Payments made by the Company in December 2011 associated with the Partial Repurchase, which also

included payments made to the unaffiliated financial institution, totaled $650 million, exclusive of accrued interest on the surplus notes. At

December 31, 2011 and 2010, the amount of the surplus notes outstanding was $1.9 billion and $2.5 billion, respectively.

MetLife, Inc. 67