MetLife 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

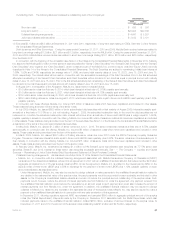

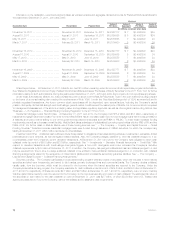

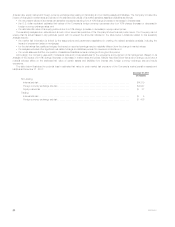

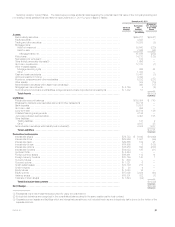

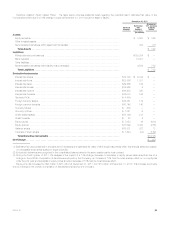

Senior Notes. The following table summarizes MetLife, Inc.’s outstanding senior notes series by maturity date, excluding any premium or discount,

at December 31, 2011:

Maturity Date Principal Interest Rate

(In millions)

2012 ................................................................ $ 400 5.38%

2012 ................................................................ $ 397 three-month LIBOR + .032%

2013 ................................................................ $ 500 5.00%

2013 ................................................................ $ 250 three-month LIBOR + 1.25%

2014 ................................................................ $ 350 5.50%

2014 ................................................................ $1,000 2.38%

2015 ................................................................ $1,000 5.00%

2016 ................................................................ $1,250 6.75%

2018 ................................................................ $1,035 6.82%

2018(1) .............................................................. $ 500 1.56%

2018(2) .............................................................. $ 500 2.46%

2019 ................................................................ $1,035 7.72%

2020 ................................................................ $ 729 5.25%

2021 ................................................................ $1,000 4.75%

2023(1) .............................................................. $ 500 1.56%

2024 ................................................................ $1,000 1.92%

2024 ................................................................ $ 673 5.38%

2032 ................................................................ $ 600 6.50%

2033 ................................................................ $ 200 5.88%

2034 ................................................................ $ 750 6.38%

2035 ................................................................ $1,000 5.70%

2041 ................................................................ $ 750 5.88%

2045(2) .............................................................. $ 500 2.46%

(1) Represents one of two tranches comprising the Series C Debt Securities.

(2) Represents one of two tranches comprising the Series E Debt Securities.

Collateral Financing Arrangements. For information on MetLife, Inc.’s collateral financing arrangements, see “— The Company — Liquidity and

Capital Sources — Collateral Financing Arrangements” and Note 12 of the Notes to the Consolidated Financial Statements.

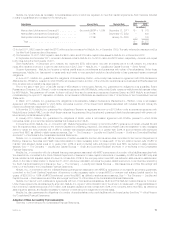

Credit and Committed Facilities. At December 31, 2011, MetLife, Inc., along with MetLife Funding, maintained $4.0 billion in unsecured credit

facilities, the proceeds of which are available to be used for general corporate purposes, to support the borrowers’ commercial paper programs and for

the issuance of letters of credit. At December 31, 2011, MetLife, Inc. had outstanding $3.1 billion in letters of credit and no drawdowns against these

facilities. Remaining unused commitments were $916 million at December 31, 2011.

MetLife, Inc. maintains committed facilities with a capacity of $300 million. At December 31, 2011, MetLife, Inc. had outstanding $300 million in

letters of credit and no drawdowns against these facilities. There were no remaining unused commitments at December 31, 2011. In addition, MetLife,

Inc. is a party to committed facilities of certain of its subsidiaries, which aggregated $12.1 billion at December 31, 2011. The committed facilities are

used as collateral for certain of the Company’s affiliated reinsurance liabilities.

See Note 11 of the Notes to the Consolidated Financial Statements for further detail on these facilities.

Covenants. Certain of MetLife, Inc.’s debt instruments, credit facilities and committed facilities contain various administrative, reporting, legal and

financial covenants. MetLife, Inc. believes it was in compliance with all such covenants at December 31, 2011.

Preferred Stock, Convertible Preferred Stock, Common Stock and Equity Units. For information on preferred stock, convertible preferred stock,

common stock and equity units issued by MetLife, Inc., see “— The Company — Liquidity and Capital Sources — Preferred Stock,” “— Convertible

Preferred Stock,” “— Common Stock,” and “— Equity Units,” respectively.

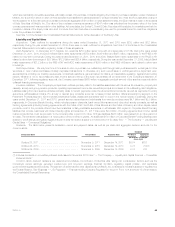

Liquidity and Capital Uses

The primary uses of liquidity of MetLife, Inc. include debt service, cash dividends on common and preferred stock, capital contributions to

subsidiaries, payment of general operating expenses and acquisitions. Based on our analysis and comparison of our current and future cash inflows

from the dividends we receive from subsidiaries that are permitted to be paid without prior insurance regulatory approval, our asset portfolio and other

cash flows and anticipated access to the capital markets, we believe there will be sufficient liquidity and capital to enable MetLife, Inc. to make

payments on debt, make cash dividend payments on its common and preferred stock, contribute capital to its subsidiaries, pay all general operating

expenses and meet its cash needs.

Acquisitions. During the years ended December 31, 2011 and 2009, there were no cash outflows for acquisitions. Cash outflows for acquisitions

during the year ended December 31, 2010 were $7.2 billion. See Note 2 of the Notes to the Consolidated Financial Statements for information

regarding certain of these acquisitions.

Affiliated Capital Transactions. During the years ended December 31, 2011, 2010 and 2009, MetLife, Inc. invested an aggregate of $1.9 billion,

$699 million (excludes the Acquisition) and $986 million, respectively, in various subsidiaries.

76 MetLife, Inc.