MetLife 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

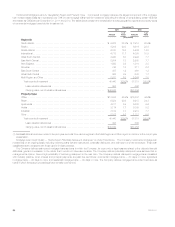

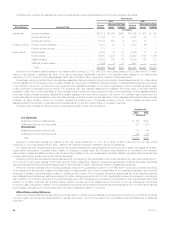

equity options with unobservable volatility inputs or that are priced via independent broker quotations; and credit forwards having unobservable

repurchase rates.

At December 31, 2011 and 2010, 5% and 2%, respectively, of the net derivative estimated fair value was priced via independent broker quotations.

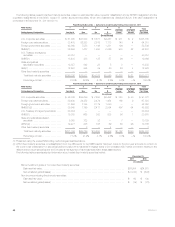

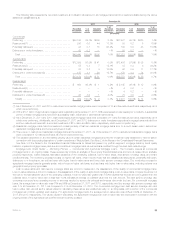

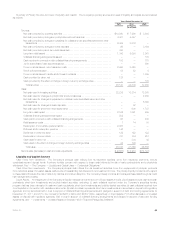

A rollforward of the fair value measurements for net derivatives measured at estimated fair value on a recurring basis using significant unobservable

(Level 3) inputs for the year ended December 31, 2011 is as follows:

Year Ended

December 31, 2011

(In millions)

Balance, beginning of period .................................................................. $ 173

Total realized/unrealized gains (losses) included in: ...............................................

Earnings .............................................................................. 637

Other comprehensive income (loss) ......................................................... 344

Purchases, sales, issuances and settlements ................................................... 156

Transfer into and/or out of Level 3 ............................................................. (76)

Balance, end of period ....................................................................... $1,234

See “— Summary of Critical Accounting Estimates — Derivative Financial Instruments” for further information on the estimates and assumptions that

affect the amounts reported above.

Credit Risk. See Note 4 of the Notes to Consolidated Financial Statements for information about how the Company manages credit risk related to

its freestanding derivatives, including the use of master netting agreements and collateral arrangements.

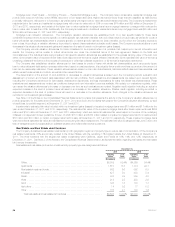

The Company’s policy is not to offset the fair value amounts recognized for derivatives executed with the same counterparty under the same master

netting agreement. This policy applies to the recognition of derivatives in the consolidated balance sheets, and does not affect the Company’s legal right

of offset. The estimated fair value of the Company’s net derivative assets and net derivative liabilities after the application of master netting agreements

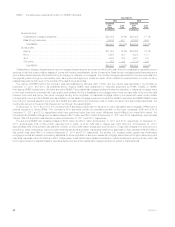

and collateral were as follows at December 31, 2011:

December 31, 2011

Net Derivative

Assets Net Derivative

Liabilities

(In millions)

Estimated Fair Value of OTC Derivatives After Application of Master Netting Agreements (1) ........ $12,905 $ 619

Cash collateral on OTC Derivatives .................................................... (9,493) (8)

Estimated Fair Value of OTC Derivatives After Application of Master Netting Agreements and Cash

Collateral(1) .................................................................... 3,412 611

Securities Collateral on OTC Derivatives(2) .............................................. (2,520) (416)

Estimated Fair Value of OTC Derivatives After Application of Master Netting Agreements and Cash

and Securities Collateral(1) ......................................................... 892 195

Estimated Fair Value of Exchange-Traded Derivatives ...................................... 54 30

Total Estimated Fair Value of Derivatives After Application of Master Netting Agreements and Cash

and Securities Collateral(1) ....................................................... $ 946 $225

(1) Includes income accruals on derivatives.

(2) The collateral is held in separate custodial accounts and is not recorded on the Company’s consolidated balance sheets.

Credit Derivatives. See Note 4 of the Notes to Consolidated Financial Statements for information about the estimated fair value and maximum

amount at risk related to the Company’s written credit default swaps.

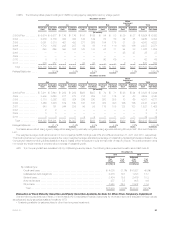

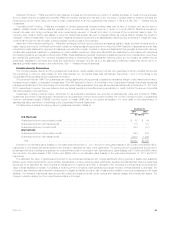

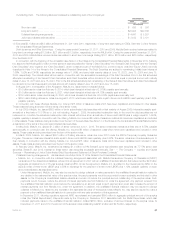

Embedded Derivatives. The embedded derivatives measured at estimated fair value on a recurring basis and their corresponding fair value

hierarchy, are presented as follows:

December 31, 2011

Net Embedded Derivatives Within

Asset Host

Contracts Liability Host

Contracts

(In millions)

Quoted prices in active markets for identical assets and liabilities (Level 1) ................. $ — —% $ — —%

Significant other observable inputs (Level 2) ......................................... 1 1 19 1

Significant unobservable inputs (Level 3) ........................................... 362 99 4,565 99

Total estimated fair value ...................................................... $363 100% $4,584 100%

58 MetLife, Inc.