MetLife 2011 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annuity guaranteed benefit liabilities, net of a decrease in paid claims, increased benefits by $13 million primarily from our annual unlocking of

assumptions related to these liabilities.

Interest credited expense decreased $49 million driven by lower average crediting rates on fixed annuities and higher amortization of excess interest

reserve due to one large case surrender in 2010, partially offset by growth in our fixed annuity PABs.

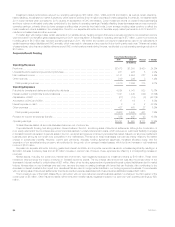

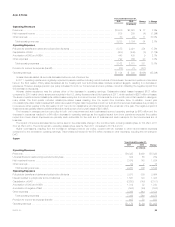

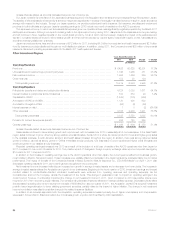

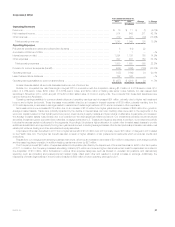

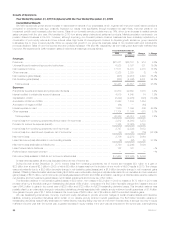

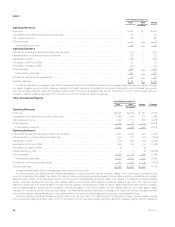

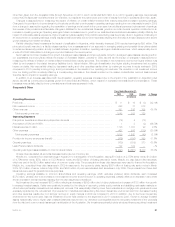

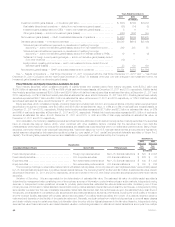

Corporate Benefit Funding

Years Ended December 31,

Change % Change2010 2009

(In millions)

Operating Revenues

Premiums .......................................................................... $1,938 $2,264 $(326) (14.4)%

Universal life and investment-type product policy fees ........................................ 226 176 50 28.4%

Net investment income ............................................................... 4,954 4,527 427 9.4%

Other revenues ..................................................................... 246 238 8 3.4%

Total operating revenues ............................................................ 7,364 7,205 159 2.2%

Operating Expenses

Policyholder benefits and claims and policyholder dividends ................................... 4,041 4,245 (204) (4.8)%

Interest credited to policyholder account balances .......................................... 1,445 1,632 (187) (11.5)%

Capitalization of DAC ................................................................. (19) (14) (5) (35.7)%

Amortization of DAC and VOBA ......................................................... 16 15 1 6.7%

Interest expense on debt .............................................................. 6 3 3 100.0%

Other expenses ..................................................................... 460 456 4 0.9%

Total operating expenses ............................................................ 5,949 6,337 (388) (6.1)%

Provision for income tax expense (benefit) ................................................. 495 288 207 71.9%

Operating earnings ................................................................... $ 920 $ 580 $340 58.6%

Unless otherwise stated, all amounts discussed below are net of income tax.

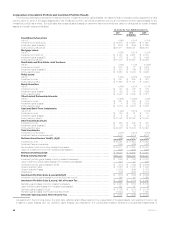

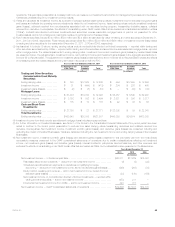

Corporate Benefit Funding benefited in 2010 from strong sales of structured settlement products and continued market penetration of our pension

closeout business in the U.K. However, structured settlement premiums have declined $174 million, before income tax, from 2009 reflecting

extraordinary sales in the fourth quarter of 2009. While market penetration continued in our pension closeout business in the U.K. as the number of sold

cases increased, the average premium has declined, resulting in a decrease in premiums of $216 million, before income tax. Although improving, a

combination of poor equity returns and lower interest rates have contributed to pension plans remaining underfunded, both in the U.S. and in the U.K.,

which reduces our customers’ flexibility to engage in transactions such as pension closeouts. For each of these businesses, the movement in premiums

is almost entirely offset by the related change in policyholder benefits. The insurance liability that is established at the time we assume the risk under

these contracts is typically equivalent to the premium recognized.

The $340 million increase in operating earnings was primarily driven by an improvement in net investment income and the impact of lower crediting

rates, partially offset by the impact of prior period favorable liability refinements and less favorable mortality.

The primary driver of the $340 million increase in operating earnings was higher net investment income of $278 million, reflecting a $187 million

increase from higher yields and a $91 million increase in average invested assets. Yields were positively impacted by the effects of stabilizing real estate

markets and recovering private equity markets on real estate joint ventures and other limited partnership interests. These improvements in yields were

partially offset by decreased yields on fixed maturity securities due to the reinvestment of proceeds from maturities and sales during this lower interest

rate environment. Growth in the investment portfolio is due to an increase in average PABs and growth in the securities lending program. To manage the

needs of our longer-term liabilities, our portfolio consists primarily of investment grade corporate fixed maturity securities, structured finance securities,

mortgage loans and U.S. Treasury and agency securities, and, to a lesser extent, certain other invested asset classes including other limited partnership

interests, real estate joint ventures and other invested assets in order to provide additional diversification and opportunity for long-term yield

enhancement. For our short-term obligations, we invest primarily in structured finance securities, mortgage loans and investment grade corporate fixed

maturity securities. The yields on these short-term investments have moved consistently with the underlying market indices, primarily LIBOR and

U.S. Treasury, on which they are based.

As many of our products are interest spread-based, changes in net investment income are typically offset by a corresponding change in interest

credited expense. However, interest credited expense decreased $122 million, primarily related to our funding agreement business as a result of lower

average crediting rates combined with lower average account balances. Certain crediting rates can move consistently with the underlying market

indices, primarily LIBOR, which were lower than the prior year. Interest credited expense related to the structured settlement businesses increased

$40 million as a result of the increase in the average policyholder liabilities.

Mortality experience was mixed and reduced operating earnings in 2010 by $26 million. Less favorable mortality in our pension closeouts and

corporate owned life insurance businesses compared to 2009 was only slightly offset by favorable mortality experience in our structured settlements

business.

Liability refinements in both 2010 and 2009 resulted in a $28 million decrease to operating earnings. These were largely offset by the impact of a

charge in the 2009 period related to a refinement of a reinsurance recoverable in the small business recordkeeping business which increased operating

earnings by $20 million.

34 MetLife, Inc.