MetLife 2011 Annual Report Download - page 10

Download and view the complete annual report

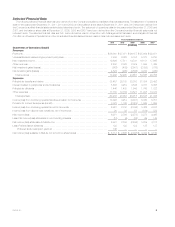

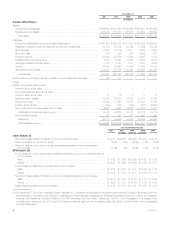

Please find page 10 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financial Statements. Operating revenues and operating earnings are performance measures that are not based on accounting principles generally

accepted in the United States of America (“GAAP”). See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for

definitions of such measures.

MetLife’s operations in the United States and in other jurisdictions are subject to regulation. See “Business — U.S. Regulation” and “Business —

International Regulation” in the 2011 Form 10-K. Each of MetLife’s insurance subsidiaries operating in the United States is licensed and regulated in

each U.S. jurisdiction where it conducts insurance business. The extent of such regulation varies, but most jurisdictions have laws and regulations

governing the financial aspects of insurers, including standards of solvency, statutory reserves, reinsurance and capital adequacy, and the business

conduct of insurers and other matters. MetLife, Inc. and its U.S. insurance subsidiaries are subject to regulation under the insurance holding company

laws of various U.S. jurisdictions. The insurance holding company laws and regulations vary from jurisdiction to jurisdiction, but generally require a

controlled insurance company (insurers that are subsidiaries of insurance holding companies) to register with state regulatory authorities and to file with

those authorities certain reports, including information concerning its capital structure, ownership, financial condition, certain intercompany transactions

and general business operations. State insurance statutes also typically place restrictions and limitations on the amount of dividends or other

distributions payable by insurance company subsidiaries to their parent companies, as well as on transactions between an insurer and its affiliates. See

“Business — U.S. Regulation — Insurance Regulation” in the 2011 Form 10-K, and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations — Liquidity and Capital Resources — MetLife, Inc. — Liquidity and Capital Sources — Dividends from Subsidiaries.”

Currently, as the owner of a federally-chartered bank, MetLife, Inc. remains a bank holding company and financial holding company. As such,

MetLife, Inc. continues to be subject to regulation under the Bank Holding Company Act of 1956, as amended (the “BHC Act”), and to inspection,

examination, and supervision by the Federal Reserve. In addition, MetLife Bank is subject to regulation and examination primarily by the Office of the

Comptroller of the Currency and the Consumer Financial Protection Bureau and secondarily by the Board of Governors of the Federal Reserve System

(the “Federal Reserve Board”) and the Federal Reserve Bank of New York (the “FRB of NY” and, collectively with the Federal Reserve Board, the “Federal

Reserve”) and the FDIC, as described under “Business — U.S. Regulation — Banking Regulation” in the 2011 Form 10-K. As a financial holding

company, MetLife, Inc.’s activities and investments are restricted by the BHC Act, as amended by the Gramm-Leach-Bliley Act of 1999, to those that

are “financial” in nature or “incidental” or “complementary” to such financial activities. MetLife, Inc. and MetLife Bank are subject to risk-based and

leverage capital guidelines issued by the federal banking regulatory agencies for banks and financial holding companies. See “Business — U.S.

Regulation — Financial Holding Company Regulation” in the 2011 Form 10-K.

In recent years, the Federal Reserve has conducted its own assessment of large bank holding companies’ internal capital planning processes,

capital adequacy and proposed capital distributions. In 2011 and 2012, the Federal Reserve conducted the Comprehensive Capital Analysis and

Review of the 19 largest bank holding companies (“CCAR”), including MetLife, Inc. See “Risk Factors — Our Insurance, Brokerage and Banking

Businesses Are Highly Regulated, and Changes in Regulation and in Supervisory and Enforcement Policies May Reduce Our Profitability and Limit Our

Growth” in the 2011 Form 10-K. In January 2012, MetLife submitted to the Federal Reserve a comprehensive capital plan, as mandated by the Federal

Reserve’s capital plans rule, and additional information required by the 2012 CCAR. The capital plan projects MetLife’s capital levels to the end of 2013

under baseline and stress scenarios, including a stress scenario developed and provided by the Federal Reserve as part of the 2012 CCAR. MetLife’s

capital plan was created in accordance with MetLife’s capital policy which addresses capital management objectives, measurement and assessment of

capital adequacy, and capital governance and other approval processes for distributions and other uses of capital. See “Management’s Discussion and

Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Capital Management” and “Quantitative and Qualitative

Disclosures About Market Risk — Risk Management.” In March 2012, the Federal Reserve informed MetLife that it objected to MetLife’s proposed

capital plan. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Recent Developments.” As a result,

MetLife is currently not able to pay an annual common stock dividend of more than $0.74 per share.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For purposes of this discussion, “MetLife,” the “Company,” “we,” “our” and “us” refer to MetLife, Inc., a Delaware corporation incorporated in 1999,

its subsidiaries and affiliates. Following this summary is a discussion addressing the consolidated results of operations and financial condition of the

Company for the periods indicated. This discussion should be read in conjunction with “Note Regarding Forward-Looking Statements,” “Selected

Financial Data” and the Company’s consolidated financial statements included elsewhere herein, and “Risk Factors” included in MetLife’s Annual Report

for the Year Ended December 31, 2011 (the “2011 Form 10-K”).

This Management’s Discussion and Analysis of Financial Condition and Results of Operations may contain or incorporate by reference information

that includes or is based upon forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking

statements give expectations or forecasts of future events. These statements can be identified by the fact that they do not relate strictly to historical or

current facts. They use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe” and other words and terms of similar

meaning in connection with a discussion of future operating or financial performance. In particular, these include statements relating to future actions,

prospective services or products, future performance or results of current and anticipated services or products, sales efforts, expenses, the outcome of

contingencies such as legal proceedings, trends in operations and financial results. Any or all forward-looking statements may turn out to be wrong.

Actual results could differ materially from those expressed or implied in the forward-looking statements. See “Note Regarding Forward-Looking

Statements.”

The following discussion includes references to our performance measures, operating earnings and operating earnings available to common

shareholders, that are not based on accounting principles generally accepted in the United States of America (“GAAP”). Operating earnings is the

measure of segment profit or loss we use to evaluate segment performance and allocate resources. Consistent with GAAP accounting guidance for

segment reporting, operating earnings is our measure of segment performance. Operating earnings is also a measure by which senior management’s

and many other employees’ performance is evaluated for the purposes of determining their compensation under applicable compensation plans.

Operating earnings is defined as operating revenues less operating expenses, both net of income tax. Operating earnings available to common

shareholders is defined as operating earnings less preferred stock dividends.

Operating revenues and operating expenses exclude results of discontinued operations and other businesses that have been or will be sold or

exited by MetLife, Inc. (“Divested Businesses”). Operating revenues also excludes net investment gains (losses) and net derivative gains (losses).

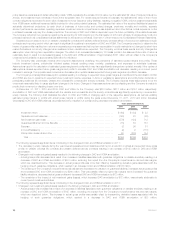

The following additional adjustments are made to GAAP revenues, in the line items indicated, in calculating operating revenues:

‰Universal life and investment-type product policy fees excludes the amortization of unearned revenue related to net investment gains (losses) and

net derivative gains (losses) and certain variable annuity guaranteed minimum income benefits (“GMIB”) fees (“GMIB Fees”);

6MetLife, Inc.