MetLife 2011 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

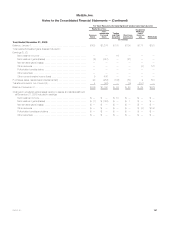

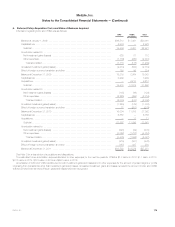

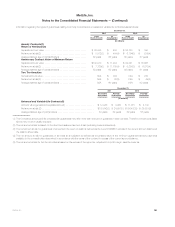

The table above does not include goodwill of $6.8 billion at December 31, 2010, associated with ALICO. In the first quarter of 2011, the Company

began reporting the results from its international operations in two separate segments to reflect a change in the manner in which the financial results are

reviewed and evaluated by executive management. Consequently, $5.2 billion and $1.8 billion of goodwill were allocated in 2011 to the reporting unit in

the Japan segment and to reporting units in the Other International Regions segment, respectively, each net of the associated foreign currency

translations. See Note 2 for a description of acquisitions and dispositions.

As of November 1, 2011, American Life’s current and deferred income taxes were affected by measurement period adjustments, which resulted in a

$39 million increase to the goodwill recorded as part of the Acquisition related to the Japan segment. See Note 15.

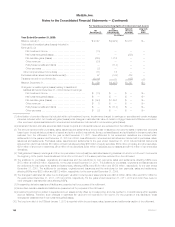

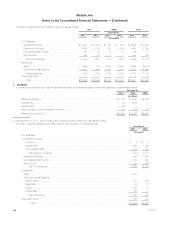

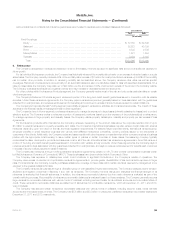

During the third quarter of 2011, the Company began exploring the sale of MetLife Bank’s depository business. As a result, in September 2011, the

Company performed a goodwill impairment test on MetLife Bank, which was a separate reporting unit within Corporate & Other. A comparison of the fair

value of the reporting unit, using a market multiple approach, to its carrying value indicated a potential for goodwill impairment. A further comparison of

the implied fair value of the reporting unit’s goodwill with its carrying amount indicated that the entire amount of goodwill associated with MetLife Bank

was impaired. Consequently, the Company recorded a $65 million goodwill impairment charge that is reflected as a net investment loss for the year

ended December 31, 2011.

In addition, the Company performed its annual goodwill impairment tests of its other reporting units during the third quarter of 2011 based upon data

at June 30, 2011 and concluded that the fair values of all reporting units were in excess of their carrying values and, therefore, goodwill was not

impaired. Such tests are described in more detail in Note 1.

Based on the adverse economic conditions in 2011, which caused both equity markets and interest rates to decline, the Company assessed the

need to update the annual impairment tests and identified only one reporting unit, Retirement Products, that warranted interim impairment testing. The

results of the testing indicated that goodwill for the Retirement Products reporting unit was not impaired.

Management continues to evaluate current market conditions that may affect the estimated fair value of these reporting units to assess whether any

goodwill impairment exists. Deteriorating or adverse market conditions for certain reporting units may have a significant impact on the estimated fair value

of these reporting units and could result in future impairments of goodwill.

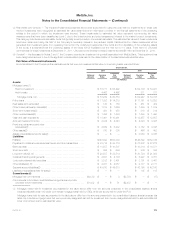

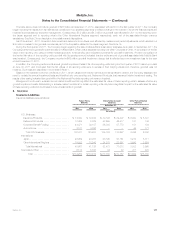

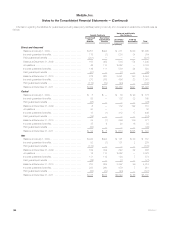

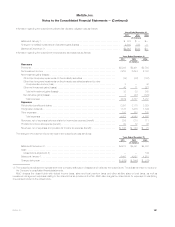

8. Insurance

Insurance Liabilities

Insurance liabilities were as follows:

Future Policy

Benefits Policyholder Account

Balances Other Policy-Related

Balances

December 31,

2011 2010 2011 2010 2011 2010

(In millions)

U.S. Business:

Insurance Products ...................... $ 74,390 $ 72,936 $ 30,196 $ 29,407 $ 6,000 $ 5,831

Retirement Products ..................... 10,455 8,829 48,689 46,517 161 146

Corporate Benefit Funding ................ 44,471 39,187 56,308 57,773 181 184

Auto & Home .......................... 3,101 3,036 — — 44 171

Total U.S. Business ................... 132,417 123,988 135,193 133,697 6,386 6,332

International:

Japan ................................ 26,659 23,083 58,195 53,161 5,212 5,311

Other International Regions ................ 19,002 18,043 24,278 23,857 3,590 3,684

Total International ..................... 45,661 41,126 82,473 77,018 8,802 8,995

Corporate & Other ........................ 6,174 5,798 34 42 411 423

Total ............................. $184,252 $170,912 $217,700 $210,757 $15,599 $15,750

MetLife, Inc. 177