MetLife 2011 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.establish a procedure for early remediation based on the failure to comply with these requirements. As proposed, Regulation YY would apply the same

enhanced regulatory standards to non-bank systemically important financial institutions as would apply to systemically important banks; the Federal

Reserve Board has solicited comments on the appropriateness of this treatment. For further information regarding enhanced prudential standards and

Regulation YY, see “Business — U.S. Regulation — Dodd-Frank and Other Legislative and Regulatory Developments — Enhanced Prudential

Standards” in the 2011 Form 10-K, Dodd-Frank also includes provisions that may impact the investment and investment activities of MetLife, Inc. and its

subsidiaries, including the federal regulation of such activities. Such provisions include the regulation of the over-the-counter (“OTC”) derivatives markets

and the prohibitions on covered banking entities engaging in proprietary trading or sponsoring or investing in hedge funds or private equity funds. See

“Business — U.S. Regulation — Dodd-Frank and Other Legislative and Regulatory Developments — Regulation of Over-the-Counter Derivatives” and

“Business — U.S. Regulation — Dodd-Frank and Other Legislative and Regulatory Developments — Volcker Rule” in the 2011 Form 10-K.

Mortgage and Foreclosure-Related Exposures In 2008, MetLife Bank acquired certain assets to enter the forward and reverse residential mortgage

origination and servicing business, including rights to service residential mortgage loans. At various times since then, including most recently in the third

quarter of 2010, MetLife Bank has acquired additional residential mortgage loan servicing rights. On January 10, 2012, MetLife, Inc. announced that it is

exiting the business of originating forward residential mortgages, but will continue to service its current mortgage customers. As an originator and

servicer of mortgage loans, which are usually sold to an investor shortly after origination, MetLife Bank has obligations to repurchase loans or

compensate for losses upon demand by the investor due to defects in servicing of the loans or a determination that material representations made in

connection with the sale of the loans (relating, for example, to the underwriting and origination of the loans) are incorrect. MetLife Bank is indemnified by

the sellers of the acquired assets, for various periods depending on the transaction and the nature of the claim, for origination and servicing deficiencies

that occurred prior to MetLife Bank’s acquisition, including indemnification for any repurchase claims made from investors who purchased mortgage

loans from the sellers. Substantially all mortgage servicing rights (“MSRs”) that were acquired by MetLife Bank relate to loans sold to Federal National

Mortgage Association (“FNMA”) or Federal Home Loan Mortgage Corporation (“FHLMC”). MetLife Bank has originated and sold mortgages primarily to

FNMA and FHLMC and sold Federal Housing Administration and loans guaranteed by the United States Department of Veterans’ Affairs in mortgage-

backed securities guaranteed by Government National Mortgage Association (“GNMA”) (collectively, the “Agency Investors”) and, to a limited extent, a

small number of private investors. Currently 99.5% of MetLife Bank’s $82.0 billion servicing portfolio consists of Agency Investors’ product. Other than

repurchase obligations which are subject to indemnification by sellers of acquired assets as described above, MetLife Bank’s exposure to repurchase

obligations and losses related to origination deficiencies is limited to the approximately $58.6 billion of loans originated by MetLife Bank (all of which have

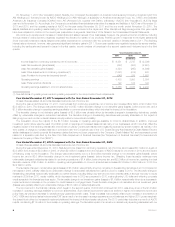

been originated since August 2008). Reserves for representation and warranty repurchases and indemnifications were $69 million and $56 million at

December 31, 2011 and 2010, respectively. MetLife Bank is exposed to losses due to servicing deficiencies on loans originated and sold, as well as

servicing acquired, to the extent such servicing deficiencies occurred after the date of acquisition. Management is satisfied that adequate provision has

been made in the Company’s consolidated financial statements for all probable and reasonably estimable repurchase obligations and losses.

Currently, MetLife Bank services approximately 1% of the aggregate principal amount of the mortgage loans serviced in the U.S. State and federal

regulatory and law enforcement authorities have initiated various inquiries, investigations or examinations of alleged irregularities in the foreclosure

practices of the residential mortgage servicing industry. Mortgage servicing practices have also been the subject of Congressional attention. Authorities

have publicly stated that the scope of the investigations extends beyond foreclosure documentation practices to include mortgage loan modification and

loss mitigation practices.

MetLife Bank’s mortgage servicing has been the subject of recent inquiries and requests by state and federal regulatory and law enforcement

authorities. MetLife Bank is cooperating with the authorities’ review of this business. On April 13, 2011, the Office of the Comptroller of the Currency (the

“OCC”) entered into consent decrees with several banks, including MetLife Bank. The consent decrees require an independent review of foreclosure

practices and set forth new residential mortgage servicing standards, including a requirement for a designated point of contact for a borrower during the

loss mitigation process. In addition, the Federal Reserve Board entered into consent decrees with the affiliated bank holding companies of these banks,

including MetLife, Inc., to enhance the supervision of the mortgage servicing activities of their banking subsidiaries. In a February 9, 2012 press release,

the Federal Reserve Board announced that it had issued monetary sanctions against five banking organizations for deficiencies in the organizations’

servicing of residential mortgage loans and processing of foreclosures. The Federal Reserve Board also stated that it plans to announce monetary

penalties against six other institutions under its supervision against whom it had issued enforcement actions in 2011 for deficiencies in servicing of

residential mortgage loans and processing foreclosures. The Federal Reserve Board did not identify these six institutions, but MetLife, Inc. is among the

institutions that entered into consent decrees with the Federal Reserve Board in 2011. MetLife Bank has also had a meeting with the Department of

Justice regarding mortgage servicing and foreclosure practices. It is possible that various state or federal regulatory and law enforcement authorities may

seek monetary penalties from MetLife Bank relating to foreclosure practices. MetLife Bank is responding to a subpoena issued by the Department of

Financial Services regarding hazard insurance and flood insurance that MetLife Bank obtains to protect the lienholder’s interest when the borrower’s

insurance has lapsed.

These consent decrees, as well as the inquiries or investigations referred to above, could adversely affect MetLife’s reputation or result in material

fines, penalties, equitable remedies or other enforcement actions, and result in significant legal costs in responding to governmental investigations or

other litigation. In addition, the changes to the mortgage servicing business required by the consent decrees and the resolution of any other inquiries or

investigations may affect the profitability of such business.

The MetLife Bank Events may not relieve MetLife from complying with the consent decrees, or protect it from the inquiries and investigations relating

to residential mortgage servicing and foreclosure activities, or any fines, penalties, equitable remedies or enforcement actions that may result, the costs

of responding to any such governmental investigations, or other litigation.

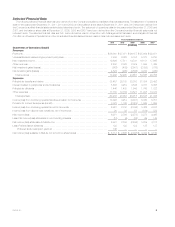

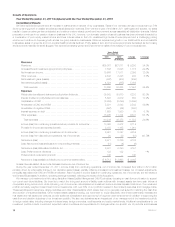

Summary of Critical Accounting Estimates

The preparation of financial statements in conformity with GAAP requires management to adopt accounting policies and make estimates and

assumptions that affect amounts reported in the consolidated financial statements. For a discussion of the Company’s significant accounting policies

see Note 1 of the Notes to the Consolidated Financial Statements. The most critical estimates include those used in determining:

(i) estimated fair values of investments in the absence of quoted market values;

(ii) investment impairments;

(iii) estimated fair values of freestanding derivatives and the recognition and estimated fair value of embedded derivatives requiring bifurcation;

(iv) amortization of DAC and the establishment and amortization of VOBA;

(v) measurement of goodwill and related impairment, if any;

(vi) liabilities for future policyholder benefits and the accounting for reinsurance;

(vii) measurement of income taxes and the valuation of deferred tax assets;

(viii) measurement of employee benefit plan liabilities; and

(ix) liabilities for litigation and regulatory matters.

MetLife, Inc. 11