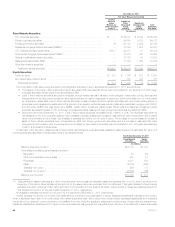

MetLife 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

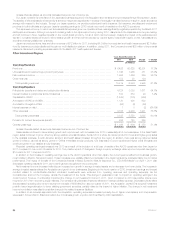

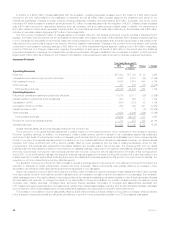

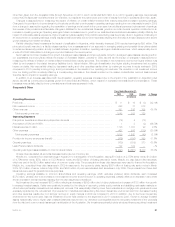

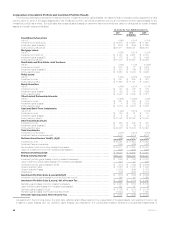

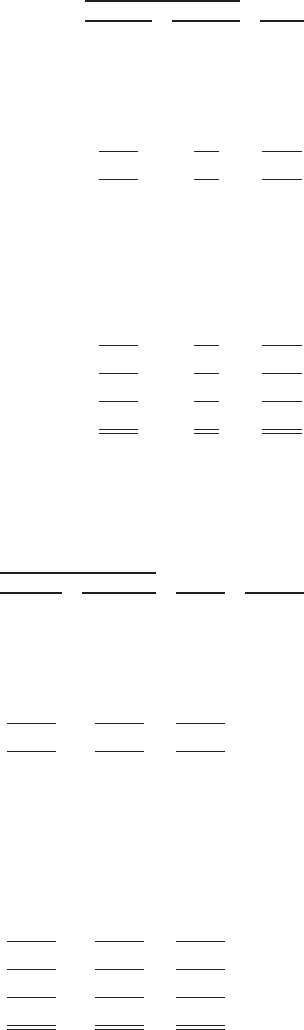

Japan

Years Ended December 31,

Change2010 2009

(In millions)

Operating Revenues

Premiums ................................................................................... $499 $— $499

Universal life and investment-type product policy fees ................................................. 55 — 55

Net investment income ......................................................................... 145 — 145

Other revenues ............................................................................... 7 — 7

Total operating revenues ...................................................................... 706 — 706

Operating Expenses

Policyholder benefits and claims and policyholder dividends ............................................ 309 — 309

Interest credited to policyholder account balances .................................................... 123 — 123

Capitalization of DAC .......................................................................... (149) — (149)

Amortization of DAC and VOBA .................................................................. 82 — 82

Amortization of negative VOBA ................................................................... (49) — (49)

Other expenses .............................................................................. 244 — 244

Total operating expenses ..................................................................... 560 — 560

Provision for income tax expense (benefit) .......................................................... 52 — 52

Operating earnings ............................................................................ $ 94 $— $ 94

Our Japan operation is comprised of the Japan business acquired in the Acquisition and is among the largest foreign life insurers in Japan. Through

our Japan operation we provide life insurance, accident and health insurance, annuities and endowment products to both individuals and groups.

Reported operating earnings reflect the operating results of ALICO from the Acquisition Date through November 30, 2010, ALICO’s fiscal year-end.

Therefore, Japan’s operating earnings for 2010 include one month of results from ALICO operations.

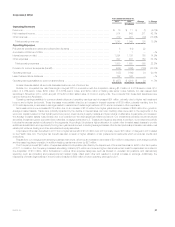

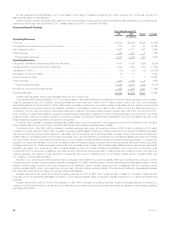

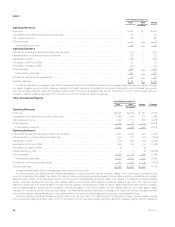

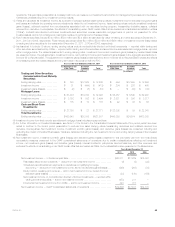

Other International Regions

Years Ended December 31,

Change % Change2010 2009

(In millions)

Operating Revenues

Premiums ......................................................................... $3,625 $2,884 $ 741 25.7%

Universal life and investment-type product policy fees ....................................... 1,265 1,055 210 19.9%

Net investment income ............................................................... 1,466 1,111 355 32.0%

Other revenues ..................................................................... 28 14 14 100.0%

Total operating revenues ............................................................ 6,384 5,064 1,320 26.1%

Operating Expenses

Policyholder benefits and claims and policyholder dividends .................................. 3,053 2,326 727 31.3%

Interest credited to policyholder account balances .......................................... 554 577 (23) (4.0)%

Capitalization of DAC ................................................................ (775) (587) (188) (32.0)%

Amortization of DAC and VOBA ........................................................ 490 397 93 23.4%

Amortization of negative VOBA ......................................................... (8) — (8)

Interest expense on debt ............................................................. 3 8 (5) (62.5)%

Other expenses .................................................................... 2,233 1,737 496 28.6%

Total operating expenses ........................................................... 5,550 4,458 1,092 24.5%

Provision for income tax expense (benefit) ................................................ 148 155 (7) (4.5)%

Operating earnings .................................................................. $ 686 $ 451 $ 235 52.1%

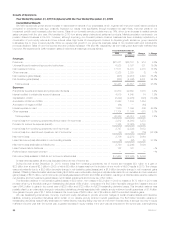

Unless otherwise stated, all amounts discussed below are net of income tax.

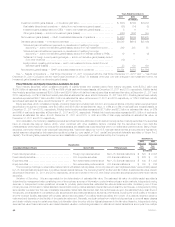

The improvement in the global financial markets has resulted in continued growth, with an increase in sales in the current period compared to the

prior period excluding the results of our Japan joint venture. Retirement and savings sales increased driven by strong annuity, universal life and pension

sales in Europe, Mexico, Chile, Korea and China. In our Europe and the Middle East operations, sales of annuities and universal life products remained

strong, more than doubling from the prior year, partially offset by lower pension and variable universal life sales in India due to the loss of a major

distributor, as well as lower credit life sales. Our Latin America operation experienced an overall increase in sales resulting from solid growth in pension

and universal life sales in Mexico and an increase in fixed annuity sales in Chile due to market recovery, slightly offset by lower bank sales in Brazil

resulting from incentives offered in the prior year. Sales in our Asia Pacific operation, excluding the results of our Japan joint venture, increased primarily

due to higher variable universal life sales in Korea, slightly offset by the decline in annuity sales and strong bank channel sales in China.

Reported operating earnings increased by $235 million over the prior year. The positive impact of changes in foreign currency exchange rates

improved reported earnings by $37 million for 2010 compared to 2009. Reported operating earnings reflect the operating results of ALICO operations

36 MetLife, Inc.