MetLife 2011 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

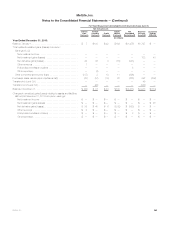

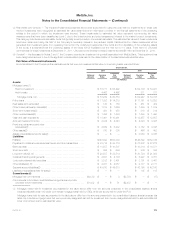

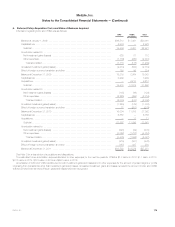

6. Deferred Policy Acquisition Costs and Value of Business Acquired

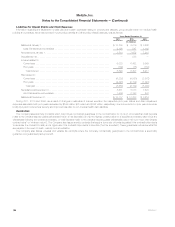

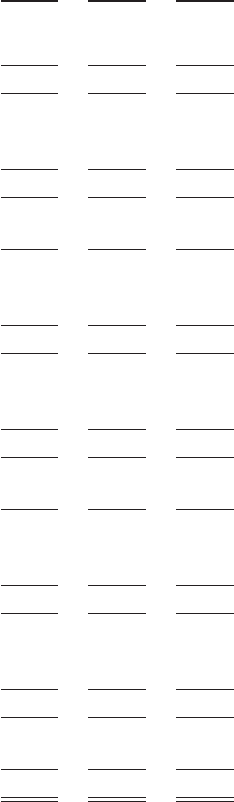

Information regarding DAC and VOBA was as follows:

DAC VOBA Total

(In millions)

Balance at January 1, 2009 .................................................... $16,510 $ 3,491 $20,001

Capitalizations ............................................................... 2,976 — 2,976

Subtotal .................................................................. 19,486 3,491 22,977

Amortization related to: ........................................................

Net investment gains (losses) ................................................. 625 87 712

Other expenses ............................................................ (1,736) (265) (2,001)

Total amortization ......................................................... (1,111) (178) (1,289)

Unrealized investment gains (losses) .............................................. (2,314) (505) (2,819)

Effect of foreign currency translation and other ...................................... 158 56 214

Balance at December 31, 2009 ................................................. 16,219 2,864 19,083

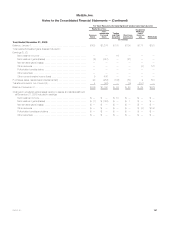

Capitalizations ............................................................... 3,299 — 3,299

Acquisitions ................................................................. — 9,210 9,210

Subtotal .................................................................. 19,518 12,074 31,592

Amortization related to: ........................................................

Net investment gains (losses) ................................................. (108) (16) (124)

Other expenses ............................................................ (2,225) (494) (2,719)

Total amortization ......................................................... (2,333) (510) (2,843)

Unrealized investment gains (losses) .............................................. (1,258) (125) (1,383)

Effect of foreign currency translation and other ...................................... 77 (351) (274)

Balance at December 31, 2010 ................................................. 16,004 11,088 27,092

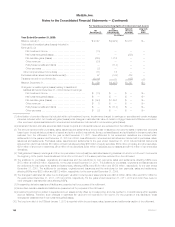

Capitalizations ............................................................... 6,858 — 6,858

Acquisitions ................................................................. — 11 11

Subtotal .................................................................. 22,862 11,099 33,961

Amortization related to: ........................................................

Net investment gains (losses) ................................................. (523) (49) (572)

Other expenses ............................................................ (3,062) (1,757) (4,819)

Total amortization ......................................................... (3,585) (1,806) (5,391)

Unrealized investment gains (losses) .............................................. (518) (361) (879)

Effect of foreign currency translation and other ...................................... (167) 447 280

Balance at December 31, 2011 ................................................. $18,592 $ 9,379 $27,971

See Note 2 for a description of acquisitions and dispositions.

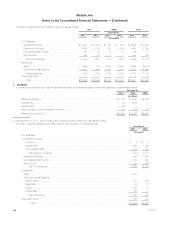

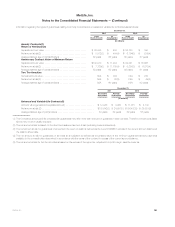

The estimated future amortization expense allocated to other expenses for the next five years for VOBA is $1.3 billion in 2012, $1.1 billion in 2013,

$917 million in 2014, $774 million in 2015 and $661 million in 2016.

Amortization of DAC and VOBA is attributed to both investment gains and losses and to other expenses for the amount of gross margins or profits

originating from transactions other than investment gains and losses. Unrealized investment gains and losses represent the amount of DAC and VOBA

that would have been amortized if such gains and losses had been recognized.

MetLife, Inc. 175