MetLife 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT

MetLife, Inc. 2011

Table of contents

-

Page 1

ANNUAL REPORT MetLife, Inc. 2011 -

Page 2

... that MetLife's global operations will continue to drive profitable growth for the company. Our Key Strengths As I have been telling investors and analysts since last fall, I believe MetLife has the strongest platform for shareholder value creation in the life insurance industry. That platform... -

Page 3

... the long-term care business in 2010. You can see them in our decision in 2011 to sell businesses in the Caribbean and Taiwan, and sell certain blocks in the U.K., which will free up more than $1 billion of capital. Finally, you can see them in our decision to re-price our leading variable annuity... -

Page 4

From the entire team here at MetLife, thank you for entrusting us to run your company. Sincerely, Steven A. Kandarian Chairman of the Board, President and Chief Executive Officer MetLife, Inc. March 16, 2012 -

Page 5

... Annual Report on Internal Control Over Financial Reporting ...Attestation Report of the Company's Registered Public Accounting Firm ...Financial Statements ...Board of Directors ...Executive Officers ...Contact Information ...Corporate Information ... 2 3 5 6 78 84 84 84 86 236 236 237 237 MetLife... -

Page 6

... the performance of financial markets and interest rates, which may affect our ability to raise capital, generate fee income and market-related revenue and finance statutory reserve requirements and may require us to pledge collateral or make payments related to declines in value of specified assets... -

Page 7

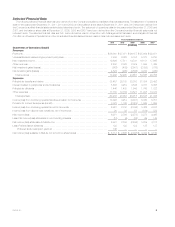

...and related notes included elsewhere herein. Years Ended December 31, 2011 2010 2009 (In millions) 2008 2007 Statements of Operations Data(1) Revenues Premiums ...$ 36,361 $ 27,071 $ 26,157 $ 25,604 $ 22,671 Universal life and investment-type product policy fees ...7,806 6,028 5,197 5,373 5,233 Net... -

Page 8

... of American International Group, Inc. ("AIG"), and Delaware American Life Insurance Company ("DelAm") from AIG (American Life with DelAm, collectively, "ALICO") ( the "Acquisition"). The results of the Acquisition are reflected in the 2011 and 2010 selected financial data from the Acquisition Date... -

Page 9

...® companies, and provides protection and retirement solutions to millions of individuals. U.S. Business markets our products and services through various distribution groups. Our life insurance and retirement products targeted to individuals are sold via sales forces, comprised of MetLife employees... -

Page 10

...capital structure, ownership, financial condition, certain intercompany transactions and general business operations. State insurance statutes also typically place restrictions and limitations on the amount of dividends or other distributions payable by insurance company subsidiaries to their parent... -

Page 11

...America, Asia Pacific, Europe and the Middle East. Through its subsidiaries and affiliates, MetLife offers life insurance, annuities, auto and homeowners insurance, mortgage and deposit products and other financial services to individuals, as well as group insurance and retirement & savings products... -

Page 12

...insurance claims that have not been presented to the Company ("Death Master File") and expenses incurred related to a liquidation plan filed by the New York State Department of Financial Services (the "Department of Financial Services") for Executive Life Insurance Company of New York ("ELNY"). Year... -

Page 13

... markets, or financial asset classes can have an adverse effect on us, in part because we have a large investment portfolio and our insurance liabilities are sensitive to changing market factors. Global market factors, including interest rates, credit spreads, equity prices, real estate markets... -

Page 14

... Our Profitability and Limit Our Growth" and "Risk Factors - Changes in U.S. Federal and State Securities Laws and Regulations, and State Insurance Regulations Regarding Suitability of Annuity Product Sales, May Affect Our Operations and Our Profitability" in the 2011 Form 10-K. The Dodd-Frank Wall... -

Page 15

...in mortgagebacked securities guaranteed by Government National Mortgage Association ("GNMA") (collectively, the "Agency Investors") and, to a limited extent, a small number of private investors. Currently 99.5% of MetLife Bank's $82.0 billion servicing portfolio consists of Agency Investors' product... -

Page 16

...in the insurance and financial services industries; others are specific to the Company's business and operations. Actual results could differ from these estimates. Estimated Fair Value of Investments In determining the estimated fair value of fixed maturity securities, equity securities, trading and... -

Page 17

... derivative pricing models and credit risk adjustment. The Company issues certain variable annuity products with guaranteed minimum benefits, which are measured at estimated fair value separately from the host variable annuity product, with changes in estimated fair value reported in net derivative... -

Page 18

... financial statements for all insurance contracts. See Note 1 of the Notes to the Consolidated Financial Statements. Separate account rates of return on variable universal life contracts and variable deferred annuity contracts affect in-force account balances on such contracts each reporting... -

Page 19

... of economic capital required to support the mix of business, longterm growth rates, comparative market multiples, the account value of in-force business, projections of new and renewal business, as well as margins on such business, the level of interest rates, credit spreads, equity market levels... -

Page 20

...of a significant loss from insurance risk, the Company records the agreement using the deposit method of accounting. See Note 9 of the Notes to the Consolidated Financial Statements for additional information on the Company's reinsurance programs. Income Taxes The Company provides for federal, state... -

Page 21

... 2011, American Life agreed to sell certain closed blocks of business in the United Kingdom ("U.K."). Finally, in 2011, Punjab National Bank ("PNB") agreed to acquire a 30% stake in MetLife India Insurance Company Limited ("MetLife India") and to enter into a separate exclusive 10-year distribution... -

Page 22

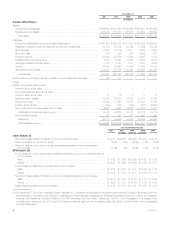

...) Change % Change Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Net derivative gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims and policyholder dividends... -

Page 23

... Businesses, and lower net gains on sales of fixed maturity and equity securities. These losses were partially offset by net gains on the sales of certain real estate investments and reductions in the mortgage valuation allowance reflecting improving real estate market fundamentals. Income (loss... -

Page 24

...GAAP revenues to operating revenues and GAAP expenses to operating expenses Year Ended December 31, 2011 Insurance Products Retirement Products Corporate Benefit Funding Auto & Home Japan Other International Regions Corporate & Other Total (In millions) Total revenues ...Less: Net investment gains... -

Page 25

...2011 2010 (In millions) Change % Change Operating Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and claims and policyholder dividends ...Interest credited... -

Page 26

...2011 2010 (In millions) Change % Change Operating Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and claims and policyholder dividends ...Interest credited... -

Page 27

...2011 2010 (In millions) Change % Change Operating Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and claims and policyholder dividends ...Interest credited... -

Page 28

...2011 2010 (In millions) Change % Change Operating Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and claims and policyholder dividends ...Interest credited... -

Page 29

Auto & Home Years Ended December 31, 2011 2010 (In millions) Change % Change Operating Revenues Premiums ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and claims and policyholder dividends ...Capitalization of DAC ...Amortization ... -

Page 30

...2011 2010 (In millions) Change % Change Operating Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and claims and policyholder dividends ...Interest credited... -

Page 31

Corporate & Other Years Ended December 31, 2011 2010 (In millions) Change % Change Operating Revenues Premiums ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and claims and policyholder dividends ...Amortization of DAC and VOBA ...... -

Page 32

... retirement and savings products abroad. Years Ended December 31, 2010 2009 (In millions) Change % Change Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Net derivative gains (losses) ...Total... -

Page 33

... million on our purchased protection credit derivatives. Certain variable annuity products with minimum benefit guarantees contain embedded derivatives that are measured at estimated fair value separately from the host variable annuity contract, with changes in estimated fair value reported in net... -

Page 34

...GAAP revenues to operating revenues and GAAP expenses to operating expenses Year Ended December 31, 2010 Insurance Products Retirement Products Corporate Benefit Funding Auto & Home Japan Other International Regions Corporate & Other Total (In millions) Total revenues ...Less: Net investment gains... -

Page 35

...Change % Change Operating Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and claims and policyholder dividends ...Interest credited to policyholder account... -

Page 36

...Change % Change Operating Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and claims and policyholder dividends ...Interest credited to policyholder account... -

Page 37

...Change % Change Operating Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and claims and policyholder dividends ...Interest credited to policyholder account... -

Page 38

... by growth in our fixed annuity PABs. Corporate Benefit Funding Years Ended December 31, 2010 2009 (In millions) Change % Change Operating Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Total operating revenues ...Operating... -

Page 39

Auto & Home Years Ended December 31, 2010 2009 (In millions) Change % Change Operating Revenues Premiums ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and claims and policyholder dividends ...Capitalization of DAC ...Amortization ... -

Page 40

...Change % Change Operating Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and claims and policyholder dividends ...Interest credited to policyholder account... -

Page 41

... in India. Corporate & Other Years Ended December 31, 2010 2009 (In millions) Change % Change Operating Revenues Premiums ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and claims and policyholder dividends ...Amortization of DAC... -

Page 42

.... The Company also uses certain derivative instruments in the management of credit, interest rate, currency and equity market risks. Purchased credit default swaps are utilized by the Company to mitigate credit risk in its investment portfolio. Generally, the Company purchases credit protection by... -

Page 43

...incur losses on a net present value basis of approximately 20% on such securities. In October 2011, a revision of the July PSI proposal was announced which included a voluntary 50% nominal discount on all maturities of Greece sovereign debt held by the private sector. In addition to this, the public... -

Page 44

... Financial Statements for an explanation of the carrying value for these invested asset classes. (5) Excludes FVO contractholder-directed unit-linked investments of $667 million, which support unit-linked variable annuity type liabilities and do not qualify for separate account summary total assets... -

Page 45

... Over U.S. Fiscal Policy and the Trajectory of the National Debt of the U.S., as well as Rating Agency Downgrades of U.S. Treasury Securities Could Have an Adverse Effect on Our Business, Financial Condition and Results of Operations" in the 2011 Form 10-K. Japan Investments. The Japanese economy... -

Page 46

... used to manage risk for certain invested assets and certain insurance liabilities: At and for the Years Ended December 31, 2011 2010 (In millions) 2009 Fixed Maturity Securities: Yield (1) ...Investment income(2),(3),(4) ...Investment gains (losses)(3) ...Ending carrying value(2),(3) ...Mortgage... -

Page 47

...$ 22,341 $473,263 $28,339 $24,874 (4) Investment income from fixed maturity securities and mortgage loans includes prepayment fees. (5) For further information on Divested Businesses, see Note 2 of the Notes to the Consolidated Financial Statements. Prior period yields have been recast to conform... -

Page 48

...the year over year changes in net investment income, net investment gains (losses) and net derivative gains (losses). Fixed Maturity and Equity Securities Available-for-Sale Fixed maturity securities, which consisted principally of publicly-traded and privately placed fixed maturity securities, were... -

Page 49

... fixed maturity securities were valued using non-binding quotations from independent brokers at December 31, 2011. Senior management, independent of the trading and investing functions, is responsible for the oversight of control systems and valuation policies, including reviewing and approving new... -

Page 50

...Level 3) inputs is as follows: Year Ended December 31, 2011 Fixed Maturity Securities Equity Securities (In millions) Balance, beginning of period ...Total realized/unrealized gains (losses) included in: Earnings(1) ...Other comprehensive income (loss) ...Purchases ...Sales ...Transfers into Level... -

Page 51

..., an internally developed rating is used. The NAIC ratings are generally similar to the credit quality designations of the Nationally Recognized Statistical Ratings Organizations ("NRSROs") for marketable fixed maturity securities, called "rating agency designations," except for certain structured... -

Page 52

... asset sectors. The following table presents selected information about certain fixed maturity securities held at: December 31, 2011 2010 (In millions) Below investment grade or non-rated fixed maturity securities: Estimated fair value ...Net unrealized gains (losses) ...Non-income producing fixed... -

Page 53

... fixed maturity securities across industries and issuers. This portfolio does not have an exposure to any single issuer in excess of 1% of total investments. The tables below present information for U.S. and foreign corporate securities at: December 31, 2011 Estimated Fair Value (In millions... -

Page 54

..., improved credit enhancement levels and higher residential property price appreciation. Approximately 69% and 66% of this portfolio was rated NAIC 2 or better at December 31, 2011 and 2010, respectively. The slowing U.S. housing market, greater use of affordable mortgage products and relaxed... -

Page 55

... sections within Note 3 of the Notes to the Consolidated Financial Statements for information about the evaluation of fixed maturity securities and equity securities available-for-sale for OTTI: ‰ Evaluating available-for-sale securities for other-than-temporary impairment; MetLife, Inc. 51 -

Page 56

... for certain insurance products. FVO Securities also include contractholder-directed investments supporting unit-linked variable annuity type liabilities which do not qualify for presentation as separate account summary total assets and liabilities. These investments are primarily mutual funds and... -

Page 57

... the Consolidated Financial Statements for a table of the invested assets on deposit, held in trust and pledged as collateral at December 31, 2011 and 2010. Mortgage Loans The Company's mortgage loans are principally collateralized by commercial real estate, agricultural real estate and residential... -

Page 58

... types of commercial mortgage loans held-for-investment at: December 31, 2011 Amount % of Total 2010 Amount % of Total (In millions) Region(1): South Atlantic ...Pacific ...Middle Atlantic ...International ...West South Central ...East North Central ...New England ...Mountain ...East South Central... -

Page 59

...performing. (6) The valuation allowance on and the related carrying value of certain residential mortgage loans held-for-investment was transferred to held-for-sale in connection with the pending disposition of certain operations of MetLife Bank. See Note 2 of the Notes to the Consolidated Financial... -

Page 60

... that present the Company's valuation allowances, by type of credit loss, by portfolio segment, at December 31, 2011 and 2010. Impairments to estimated fair value included within net investment gains (losses) for impaired mortgage loans were $18 million and $17 million for the year ended December 31... -

Page 61

... assets by type at December 31, 2011 and 2010 and related information. Short-term Investments and Cash Equivalents The carrying value of short-term investments, which includes securities and other investments with remaining maturities of one year or less, but greater than three months, at the time... -

Page 62

...the amounts reported above. Credit Risk. See Note 4 of the Notes to Consolidated Financial Statements for information about how the Company manages credit risk related to its freestanding derivatives, including the use of master netting agreements and collateral arrangements. The Company's policy is... -

Page 63

... "Net Investment Gains (Losses)" in Note 3 of the Notes to the Consolidated Financial Statements for information on the investment income, investment expense, gains and losses from such investments. See also "Fixed Maturity and Equity Securities Available-forSale," "Mortgage Loans," "Real Estate and... -

Page 64

...account of variable life insurance policies, specialized life insurance products for benefit programs and general account universal life policies. PABs are credited interest at a rate set by the Company, which are influenced by current market rates. The majority of the PABs have a guaranteed minimum... -

Page 65

... interest crediting rates are generally tied to an external index, most commonly (1-month or 3-month) LIBOR. MetLife is exposed to interest rate risks, and foreign exchange risk when guaranteeing payment of interest and return of principal at the contractual maturity date. The Company may invest in... -

Page 66

... net income associated with these liabilities. Derivative instruments used are primarily equity futures, treasury futures and interest rate swaps. Included in policyholder benefits and claims associated with the hedging of the guarantees in future policy benefits for the year ended December 31, 2011... -

Page 67

... general account institutional pension products (generally group annuities, including funding agreements, and certain deposit fund liabilities) sold to employee benefit plan sponsors. Certain of these provisions prevent the customer from making withdrawals prior to the maturity date of the product... -

Page 68

...position is managed to maintain its financial strength and credit ratings and is supported by its ability to generate strong cash flows at the operating companies, borrow funds at competitive rates and raise additional capital to meet its operating and growth needs. The Company was able to issue new... -

Page 69

...cash used in investing activities ...Net cash used for changes in policyholder account balances ...Net cash used for changes in payables for collateral under securities loaned and other transactions ...Net cash used for changes in bank deposits ...Net cash used for short-term debt repayments ...Long... -

Page 70

... Bank's cash flows giving rise to short-term liquidity needs. Should these needs arise, the Company will provide MetLife Bank with temporary liquidity support through a possible combination of internally and externally sourced funds. See " - MetLife, Inc. - Capital." ‰ The Company issues fixed... -

Page 71

... Financial Statements for a description of the terms of the junior subordinated debt securities. In May 2009, MetLife, Inc. issued $1.3 billion of senior notes due June 1, 2016. The senior notes bear interest at a fixed rate of 6.75%, payable semi-annually. In connection with the offering, MetLife... -

Page 72

... of the closing. MetLife, Inc. may also be required to make payments to the unaffiliated financial institution, for deposit into the trusts, related to any decline in the estimated fair value of the assets held by the trusts, as well as amounts outstanding upon maturity or early termination... -

Page 73

.... During the years ended December 31, 2011 and 2010, general account surrenders and withdrawals from annuity products were $4.1 billion and $3.8 billion, respectively. In Corporate Benefit Funding, which includes pension closeouts, bank-owned life insurance and other fixed annuity contracts, as... -

Page 74

... Form 10-K. Residential Mortgage Loans Held-for-Sale. At December 31, 2011 and 2010, the Company held $15.2 billion and $3.3 billion, respectively, in residential mortgage loans held-for-sale. From time to time, MetLife Bank has an increased cash need to fund mortgage loans that it holds generally... -

Page 75

... formal offering programs, funding agreements, individual and group annuities, total control accounts, individual and group universal life, variable universal life and company-owned life insurance. Included within PABs are contracts where the amount and timing of the payment is essentially fixed and... -

Page 76

... not reported claims and claims payable on group term life, long-term disability, LTC and dental; policyholder dividends left on deposit and policyholder dividends due and unpaid related primarily to traditional life and group life and health; and premiums received in advance. Liabilities related to... -

Page 77

... herein and those otherwise provided for in the Company's consolidated financial statements, have arisen in the course of the Company's business, including, but not limited to, in connection with its activities as an insurer, mortgage lending bank, employer, investor, investment advisor and taxpayer... -

Page 78

... such credit ratings. See "- The Company - Capital - Rating Agencies." Liquidity is monitored through the use of internal liquidity risk metrics, including the composition and level of the liquid asset portfolio, timing differences in short-term cash flow obligations, access to the financial markets... -

Page 79

... to the Consolidated Financial Statements. Liquid Assets. An integral part of MetLife, Inc.'s liquidity management is the amount of liquid assets it holds. Liquid assets include cash and cash equivalents, short-term investments and publicly-traded securities, excluding: (i) cash collateral received... -

Page 80

... liquidity and capital to enable MetLife, Inc. to make payments on debt, make cash dividend payments on its common and preferred stock, contribute capital to its subsidiaries, pay all general operating expenses and meet its cash needs. Acquisitions. During the years ended December 31, 2011 and 2009... -

Page 81

...Note 11 of the Notes to the Consolidated Financial Statements. MetLife, Inc., in connection with MRV's reinsurance of certain universal life and term life insurance risks, committed to the Vermont Department of Banking, Insurance, Securities and Health Care Administration to take necessary action to... -

Page 82

... Exchange Rates Could Negatively Affect Our Profitability" in the 2011 Form 10-K. Equity Market. The Company has exposure to equity market risk through certain liabilities that involve long-term guarantees on equity performance such as net embedded derivatives on variable annuities with guaranteed... -

Page 83

...as variable annuities with guaranteed minimum benefit and equity securities. These derivatives include exchange-traded equity futures, equity index options contracts and equity variance swaps. The Company also employs reinsurance to manage these exposures. Hedging Activities. MetLife uses derivative... -

Page 84

(interest rate, equity market and foreign currency exchange rate) relating to its trading and non trading assets and liabilities. The Company modeled the impact of changes in market rates and prices on the estimated fair values of its market sensitive assets and liabilities as follows: ‰ the net ... -

Page 85

...Assets: Fixed maturity securities ...Equity securities ...Trading and other securities ...Mortgage loans: Held-for-investment ...Held-for-sale ...Mortgage loans, net ...Policy loans ...Real estate joint ventures(1) ...Other limited partnership interests(1) ...Short-term investments ...Other invested... -

Page 86

... Fair Value(1) (In millions) Assuming a 10% Increase in the Foreign Exchange Rate Notional Amount Assets: Fixed maturity securities ...Equity securities ...Trading and other securities ...Mortgage loans: Held-for-investment ...Held-for-sale ...Mortgage loans, net ...Policy loans ...Other limited... -

Page 87

...Value(1) (In millions) Assuming a 10% Increase in Equity Prices Notional Amount Assets: Equity securities ...Other invested assets: ...Net embedded derivatives within asset host contracts(2) ...Total Assets ...Liabilities: Policyholder account balances ...Bank deposits ...Other liabilities: ...Net... -

Page 88

...and consolidated financial statement schedules is included at page 204. Attestation Report of the Company's Registered Public Accounting Firm The Company's independent registered public accounting firm, Deloitte & Touche LLP, has issued their attestation report on management's internal control over... -

Page 89

... regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company's internal control over financial reporting includes those policies and procedures that (1) pertain to the... -

Page 90

...Index to Consolidated Financial Statements and Schedules Page Report of Independent Registered Public Accounting Firm ...Financial Statements at December 31, 2011 and 2010 and for the Years Ended December 31, 2011, 2010, and 2009: Consolidated Balance Sheets ...Consolidated Statements of Operations... -

Page 91

... and 2010, and the related consolidated statements of operations, equity, and cash flows for each of the three years in the period ended December 31, 2011. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on the... -

Page 92

...Equity Liabilities Future policy benefits ...Policyholder account balances ...Other policy-related balances ...Policyholder dividends payable ...Policyholder dividend obligation ...Payables for collateral under securities loaned and other transactions ...Bank deposits ...Short-term debt ...Long-term... -

Page 93

... 2009 (In millions, except per share data) 2011 2010 2009 Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses): ...Other-than-temporary impairments on fixed maturity securities ...Other-than-temporary... -

Page 94

... stock redemption premium ...Common stock issuance - newly issued shares ...Stock-based compensation ...Dividends on preferred stock ...Dividends on common stock ...Change in equity of noncontrolling interests ...Comprehensive income (loss): ...Net income (loss) ...Other comprehensive income (loss... -

Page 95

... issued shares related to business acquisition ...Issuance of stock purchase contracts related to common equity units ...Stock-based compensation ...Dividends on preferred stock ...Dividends on common stock ...Change in equity of noncontrolling interests ...Comprehensive income (loss): ...Net income... -

Page 96

... Total Equity Balance at December 31, 2008 ...Cumulative effect of change in accounting principle, net of income tax (Note 1) ...Common stock issuance - newly issued shares ...Treasury stock transactions, net ...Stock-based compensation ...Dividends on preferred stock ...Dividends on common stock... -

Page 97

... sales of businesses, net ...(Income) loss from equity method investments, net of dividends or distributions ...Interest credited to policyholder account balances ...Interest credited to bank deposits ...Universal life and investment-type product policy fees ...Change in trading and other securities... -

Page 98

...) 2011 2010 2009 Cash flows from financing activities Policyholder account balances: Deposits ...Withdrawals ...Net change in payables for collateral under securities loaned and other transactions ...Net change in bank deposits ...Net change in short-term debt ...Long-term debt issued ...Long-term... -

Page 99

...America, Asia Pacific, Europe and the Middle East. Through its subsidiaries and affiliates, MetLife offers life insurance, annuities, auto and homeowners insurance, mortgage and deposit products and other financial services to individuals, as well as group insurance and retirement & savings products... -

Page 100

...scheduled interest and principal payments; the quality and amount of any credit enhancements; the security's position within the capital structure of the issuer; possible corporate restructurings or asset sales by the issuer; and changes to the rating of the security or the issuer by rating agencies... -

Page 101

...to the Consolidated Financial Statements - (Continued) certain insurance products. FVO Securities also include contractholder-directed investments supporting unit-linked variable annuity type liabilities which do not qualify for presentation and reporting as separate account summary total assets and... -

Page 102

... financial statements. Policy Loans. Policy loans are stated at unpaid principal balances. Interest income on such loans is recorded as earned in net investment income using the contractually agreed upon interest rate. Generally, interest is capitalized on the policy's anniversary date. Valuation... -

Page 103

... value of the mortgage loan at the date of foreclosure. Real Estate Joint Ventures and Other Limited Partnership Interests. The Company uses the equity method of accounting for investments in real estate joint ventures and other limited partnership interests consisting of leveraged buy-out funds... -

Page 104

... or its use in managing risk does not qualify for hedge accounting, changes in the estimated fair value of the derivative are generally reported in net derivative gains (losses) except for those (i) in policyholder benefits and claims for economic hedges of variable annuity guarantees included in... -

Page 105

... with the host contract and changes in their estimated fair value are generally reported in net derivative gains (losses) except for those in policyholder benefits and claims related to ceded reinsurance of guaranteed minimum income benefits ("GMIB"). If the Company is unable to properly identify... -

Page 106

...acquisition date. The estimated fair value of the acquired liabilities is based on actuarially determined projections, by each block of business, of future policy and contract charges, premiums, mortality and morbidity, separate account performance, surrenders, operating expenses, investment returns... -

Page 107

... Company also periodically reviews other long-term assumptions underlying the projections of estimated gross margins and profits. These include investment returns, policyholder dividend scales, interest crediting rates, mortality, persistency and expenses to administer business. Management annually... -

Page 108

... of business, long-term growth rates, comparative market multiples, the account value of in-force business, projections of new and renewal business, as well as margins on such business, the level of interest rates, credit spreads, equity market levels and the discount rate that the Company believes... -

Page 109

..., universal life-type policies and certain guaranteed minimum benefits. Investment-type contracts principally include traditional individual fixed annuities in the accumulation phase and non-variable group annuity contracts. PABs for these contracts are equal to: (i) policy account values, which... -

Page 110

... gross profits and margins, similar to DAC. Such amortization is recorded in universal life and investment-type product policy fees. The Company accounts for the prepayment of premiums on its individual life, group life and health contracts as premium received in advance and applies the cash... -

Page 111

... period in which services are performed. Other revenues also include changes in account value relating to corporate-owned life insurance ("COLI"). Under certain COLI contracts, if the Company reports certain unlikely adverse results in its consolidated financial statements, withdrawals would not be... -

Page 112

... a percentage of eligible pay, as well as earnings credits, determined annually based upon the average annual rate of interest on 30-year U.S. Treasury securities, for each account balance. The non-U.S. pension plans generally provide benefits based either upon years of credited service and earnings... -

Page 113

... value of such assets exceeds the separate account liabilities. Assets within the Company's separate accounts primarily include: mutual funds, fixed maturity and equity securities, mortgage loans, derivatives, hedge funds, other limited partnership interests, short-term investments and cash and cash... -

Page 114

..., investment management fees and surrender charges. Such fees are included in universal life and investment-type product policy fees in the consolidated statements of operations. Adoption of New Accounting Pronouncements Financial Instruments Effective July 1, 2011, the Company adopted new guidance... -

Page 115

... This update provides guidance for evaluating whether to account for a transfer of a financial asset and repurchase financing as a single transaction or as two separate transactions. The adoption did not have a material impact on the Company's consolidated financial statements. Business Combinations... -

Page 116

... of International Financial Reporting Standards ("IFRS"). The Company is currently evaluating the impact of this guidance on its consolidated financial statements and related disclosures. In December 2011, the FASB issued new guidance regarding derecognition of in substance real estate (ASU 2011-10... -

Page 117

...-line method of allocation unless another method better allocates the fee over the calendar year that it is payable. The Company is currently evaluating the impact of this guidance on its consolidated financial statements. In June 2011, the FASB issued new guidance regarding comprehensive income... -

Page 118

... preferred stock received as consideration by AM Holdings from MetLife in connection with the Acquisition. See Note 18. ALICO is an international life insurance company, providing consumers and businesses with products and services for life insurance, accident and health insurance, retirement and... -

Page 119

..., MetLife, Inc. issued 68.6 million shares of common stock and used the gross proceeds to repurchase and cancel the convertible preferred stock. On the same date, AM Holdings sold, in a public offering, all the Equity Units it received as consideration from MetLife in connection with the Acquisition... -

Page 120

... the Acquisition Date to December 31, 2011 was recorded in net derivative gains (losses) in the consolidated statement of operations. Branch Restructuring On March 4, 2010, American Life entered into a closing agreement (the "Closing Agreement") with the Commissioner of the Internal Revenue Service... -

Page 121

..., Inc. Notes to the Consolidated Financial Statements - (Continued) provides that American Life's foreign branches will not be required to withhold U.S. income tax on the income portion of payments made pursuant to American Life's life insurance and annuity contracts ("Covered Payments") for any tax... -

Page 122

..., comprised of cash of $14 million and fixed maturity securities, mortgage loans and other assets totaling $245 million. At the date of the assumption reinsurance agreement, the carrying value of insurance liabilities transferred was $267 million, resulting in a gain of $5 million, net of income tax... -

Page 123

...Inc. Notes to the Consolidated Financial Statements - (Continued) The Company held non-income producing fixed maturity securities with an estimated fair value of $62 million and $130 million with unrealized gains (losses) of ($19) million and ($23) million at December 31, 2011 and 2010, respectively... -

Page 124

... fixed maturity securities ...Equity securities ...Derivatives ...Other ...Subtotal ...Amounts allocated from: Insurance liability loss recognition ...DAC and VOBA related to noncredit OTTI losses recognized in accumulated other comprehensive income (loss) ...DAC and VOBA ...Policyholder dividend... -

Page 125

... Financial Statements - (Continued) The changes in net unrealized investment gains (losses) were as follows: Years Ended December 31, 2011 2010 (In millions) 2009 Balance, beginning of period ...Cumulative effect of change in accounting principles, net of income tax ...Fixed maturity securities... -

Page 126

...to the Consolidated Financial Statements - (Continued) Continuous Gross Unrealized Losses and OTTI Losses for Fixed Maturity and Equity Securities Available-for-Sale by Sector The following tables present the estimated fair value and gross unrealized losses of fixed maturity and equity securities in... -

Page 127

... Available-for-Sale Securities" below, all of the equity securities with gross unrealized losses of 20% or more for twelve months or greater at December 31, 2011 were financial services industry investment grade non-redeemable preferred stock, of which 71% were rated A or better. MetLife, Inc. 123 -

Page 128

... concerns over the financial services industry sector, unemployment levels and valuations of residential real estate supporting non-agency RMBS. As explained further in Note 1, management evaluates these U.S. and foreign corporate securities based on factors such as expected cash flows and the... -

Page 129

... the Consolidated Financial Statements - (Continued) consideration of the payment terms of the underlying assets backing a particular security, and the payment priority within the tranche structure of the security. See "- Aging of Gross Unrealized Losses and OTTI Losses for Fixed Maturity and Equity... -

Page 130

...net gains (losses) on sales and disposals ...Total gains (losses) on fixed maturity securities ...Other net investment gains (losses): Equity securities ...Trading and other securities - FVO general account securities - changes in estimated fair value ...Mortgage loans ...Real estate and real estate... -

Page 131

...Years Ended December 31, 2011 2010 (In millions) 2009 Sector: Non-redeemable preferred stock ...Common stock ...Total ...Industry: Financial services industry: Perpetual hybrid securities ...Common and remaining non-redeemable preferred stock ...Total financial services industry ...Other industries... -

Page 132

... 31, 2011 2010 (In millions) 2009 Investment income: Fixed maturity securities ...Equity securities ...Trading and other securities - Actively Traded Securities and FVO general account securities(1) ...Mortgage loans ...Policy loans ...Real estate and real estate joint ventures ...Other limited... -

Page 133

... for cash and cash equivalents, short-term investments, fixed maturity securities, equity securities, and trading and other securities and at carrying value for mortgage loans. December 31, 2011 2010 (In millions) Invested assets on deposit(1) ...Invested assets held in trust(2) ...Invested assets... -

Page 134

MetLife, Inc. Notes to the Consolidated Financial Statements - (Continued) Mortgage Loans Mortgage loans are summarized as follows at: December 31, 2011 Carrying Value % of Total 2010 Carrying Value % of Total (In millions) Mortgage loans held-for-investment: Commercial ...Agricultural ...... -

Page 135

... in mortgage loans held for investment, by portfolio segment, by method of evaluation of credit loss, and the related valuation allowances, by type of credit loss, at: Commercial Agricultural Residential Total (In millions) December 31, 2011: Mortgage loans: Evaluated individually for credit losses... -

Page 136

... fair value of such mortgage loans by the indicated loan-to-value ratio categories at: Commercial Recorded Investment Debt Service Coverage Ratios >1.20x 1.00x - 1.20x < 1.00x Total (In millions) % of Total Estimated Fair Value (In millions) % of Total December 31, 2011: Loan-to-value ratios... -

Page 137

..., and the related interest income, by portfolio segment, for the years ended December 31, 2011 and 2010, respectively, and for all mortgage loans for the year ended December 31, 2009, was: Impaired Mortgage Loans Average Investment Interest Income Recognized Cash Basis (In millions) Accrual Basis... -

Page 138

... ranging from the development of properties to the operation of income-producing properties; as well as its investments in real estate private equity funds. From time to time, the Company transfers investments from these joint ventures to traditional real estate, if the Company retains an interest... -

Page 139

... in its equity method investments using a three-month lag methodology and within net investment income. Aggregate net investment income from these equity method real estate joint ventures, real estate funds and other limited partnership interests exceeded 10% of the Company's consolidated pre-tax... -

Page 140

... as net investment income. Decreases in cash flows expected to be collected can result in OTTI or the recognition of mortgage loan valuation allowances (see Note 1). The table below presents the purchased credit impaired investments, by invested asset class, held at: Fixed Maturity Securities 2011... -

Page 141

MetLife, Inc. Notes to the Consolidated Financial Statements - (Continued) The following table presents activity for the accretable yield on purchased credit impaired investments for: Fixed Maturity Securities 2011 2010 (In millions) Mortgage Loans 2011 2010 Years Ended December 31, Accretable ... -

Page 142

... to Loss(1) (In millions) Fixed maturity securities available-for-sale: RMBS(2) ...CMBS(2) ...ABS(2) ...U.S. corporate securities ...Foreign corporate securities ...Other limited partnership interests ...Other invested assets ...Trading and other securities ...Mortgage loans ...Real estate joint... -

Page 143

...The maximum exposure to loss relating to mortgage loans is equal to the carrying amounts plus any unfunded commitments of the Company. For certain of its investments in other invested assets, the Company's return is in the form of income tax credits which are guaranteed by a creditworthy third party... -

Page 144

... that provide for a single net payment to be made by the counterparty at each due date. The Company utilizes interest rate swaps in fair value, cash flow and non-qualifying hedging relationships. The Company also enters into basis swaps to better match the cash flows from assets and related... -

Page 145

... as U.S. Treasury securities, agency securities or other fixed maturity securities. The Company also enters into certain credit default swaps held in relation to trading portfolios for the purpose of generating profits on short-term differences in price. These credit default swaps are not designated... -

Page 146

...index options are used by the Company primarily to hedge minimum guarantees embedded in certain variable annuity products offered by the Company. To hedge against adverse changes in equity indices, the Company enters into contracts to sell the equity index within a limited time at a contracted price... -

Page 147

... 31, 2011 2010 (In millions) 2009 Qualifying hedges: Net investment income ...Interest credited to policyholder account balances ...Other expenses ...Non-qualifying hedges: Net investment income ...Other revenues ...Net derivative gains (losses) ...Policyholder benefits and claims ...Total ... $ 98... -

Page 148

MetLife, Inc. Notes to the Consolidated Financial Statements - (Continued) Fair Value Hedges The Company designates and accounts for the following as fair value hedges when they have met the requirements of fair value hedging: (i) interest rate swaps to convert fixed rate investments to floating ... -

Page 149

... swaps, forwards and options, to hedge portions of its net investments in foreign operations against adverse movements in exchange rates. The Company measures ineffectiveness on these contracts based upon the change in forward rates. In addition, the Company may also use non-derivative financial... -

Page 150

... variable annuity products; (v) swap spreadlocks to economically hedge invested assets against the risk of changes in credit spreads; (vi) interest rate forwards to buy and sell securities to economically hedge its exposure to interest rates; (vii) credit default swaps, TRRs and structured interest... -

Page 151

... Gains (Losses) Net Investment Income(1) Policyholder Benefits and Claims(2) (In millions) Other Revenues(3) Other Expenses(4) For the Year Ended December 31, 2011: Interest rate swaps ...Interest rate floors ...Interest rate caps ...Interest rate futures ...Equity futures ...Foreign currency swaps... -

Page 152

...directed unitlinked investments. (2) Changes in estimated fair value related to economic hedges of variable annuity guarantees included in future policy benefits. (3) Changes in estimated fair value related to derivatives held in connection with the Company's mortgage banking activities. (4) Changes... -

Page 153

... contracts is limited to the net positive estimated fair value of derivative contracts at the reporting date after taking into consideration the existence of netting agreements and any collateral received pursuant to credit support annexes. The Company manages its credit risk related to OTC... -

Page 154

... direct guaranteed minimum benefits, have been conformed to the current period presentation. The following table presents changes in estimated fair value related to embedded derivatives: Years Ended December 31, 2011 2010 (In millions) 2009 Net derivative gains (losses)(1) ...Policyholder benefits... -

Page 155

... stock ...Total equity securities ...Trading and other securities: Actively Traded Securities ...FVO general account securities ...FVO contractholder-directed unit-linked investments ...FVO securities held by CSEs ...Total trading and other securities ...Short-term investments(1) ...Mortgage loans... -

Page 156

... stock ...Total equity securities ...Trading and other securities: Actively Traded Securities ...FVO general account securities ...FVO contractholder-directed unit-linked investments ...FVO securities held by CSEs ...Total trading and other securities ...Short-term investments(1) ...Mortgage loans... -

Page 157

..., fixed maturity securities and equity securities included embedded derivatives of $5 million and ($62) million, respectively. (5) Separate account assets are measured at estimated fair value. Investment performance related to separate account assets is fully offset by corresponding amounts credited... -

Page 158

... Inc. Notes to the Consolidated Financial Statements - (Continued) The methods and assumptions used to estimate the fair value of financial instruments are summarized as follows: Fixed Maturity Securities, Equity Securities, Trading and Other Securities and Short-term Investments When available, the... -

Page 159

... or bond indexed crediting rates within certain funding agreements. Embedded derivatives are recorded at estimated fair value with changes in estimated fair value reported in net income. The Company issues and assumes certain variable annuity products with guaranteed minimum benefits. GMWBs, GMABs... -

Page 160

... similar publicly traded or privately traded issues that incorporate the credit quality and industry sector of the issuer. This level also includes certain below investment grade privately placed fixed maturity securities priced by independent pricing services that use observable inputs. Structured... -

Page 161

... published publicly. Valuation of the mutual funds and hedge funds is based upon quoted prices or reported NAV provided by the fund managers. Long-term Debt of CSEs The estimated fair value of the long-term debt of the Company's CSEs is based on quoted prices when traded as assets in active markets... -

Page 162

... based on very limited trading activity. Common and non-redeemable preferred stock. These securities, including privately held securities and financial services industry hybrid securities classified within equity securities, are principally valued using the market and income approaches. Valuations... -

Page 163

..., equity securities and derivative assets referred to above. Separate account assets within this level also include mortgage loans and other limited partnership interests. The estimated fair value of mortgage loans is determined by discounting expected future cash flows, using current interest rates... -

Page 164

... Fixed Maturity Securities RMBS CMBS ABS Year Ended December 31, 2011: Balance, January 1, ...Total realized/unrealized gains (losses) included in: Earnings:(1), (2) Net investment income ...Net investment gains (losses) ...Net derivative gains (losses) ...Other revenues ...Policyholder benefits... -

Page 165

... Account Securities FVO Contractholderdirected Unit-linked Investments (In millions) Residential Mortgage Loans Heldfor-sale Securitized Reverse Residential Mortgage Loans Common Stock Actively Traded Securities Short-term Investments Year Ended December 31, 2011: Balance, January 1, ...Total... -

Page 166

...Interest Rate Contracts Foreign Currency Contracts Credit Contracts Equity Market Contracts Net Embedded Derivatives(8) Separate Account Assets(9) Long-term Debt of CSEs Liability Related to Securitized Reverse Mortgage Loans (In millions) Year Ended December 31, 2011: Balance, January 1, ...Total... -

Page 167

...Other revenues ...Policyholder benefits and claims ...Other expenses ...Other comprehensive income (loss) ...Purchases, sales, issuances and settlements(3) Transfers into Level 3(4) ...Transfers out of Level 3(4) ...Balance, December 31, ...Changes in unrealized gains (losses) relating to assets and... -

Page 168

... 3) Equity Securities: Nonredeemable Preferred Stock Trading and Other Securities: FVO General Account Securities FVO Contractholderdirected Unit-linked Investments Residential Mortgage Loans Heldfor-sale Common Stock Actively Traded Securities Short-term Investments MSRs (5),(6) (In millions... -

Page 169

... Financial Statements - (Continued) Fair Value Measurements Using Significant Unobservable Inputs (Level 3) Net Derivatives:(7) Interest Rate Contracts Foreign Currency Contracts Credit Contracts Equity Market Contracts (In millions) Net Embedded Derivatives(8) Separate Account Assets(9) Long-term... -

Page 170

... (losses) ...Other revenues ...Policyholder benefits and claims ...Other expenses ...Other comprehensive income (loss) ...Purchases, sales, issuances and settlements(3) Transfers into and/or out of level 3(4) ...Balance, December 31, ...Changes in unrealized gains (losses) relating to assets and... -

Page 171

... Financial Statements - (Continued) Fair Value Measurements Using Significant Unobservable Inputs (Level 3) Equity Securities: Nonredeemable Preferred Stock Trading and Other Securities Residential Mortgage Loans Held- forsale Common Stock Short-term Investments MSRs(5),(6) (In millions) Year... -

Page 172

... include financial instruments acquired from ALICO as follows: $5.4 billion of fixed maturity securities, $68 million of equity securities, $582 million of trading and other securities, $216 million of short-term investments, ($10) million of net derivatives, $244 million of separate account assets... -

Page 173

...for-sale accounted for under the FVO are initially measured at estimated fair value. Interest income on residential mortgage loans held-for-sale is recorded based on the stated rate of the loan and is recorded in net investment income. Gains and losses from initial measurement, subsequent changes in... -

Page 174

... securities held by CSEs is recorded in net investment income. Interest expense on long-term debt of CSEs is recorded in other expenses. Gains and losses from initial measurement, subsequent changes in estimated fair value and gains or losses on sales of both the commercial mortgage loans and long... -

Page 175

...: Mortgage loans:(1) Held-for-investment ...Held-for-sale ...Mortgage loans, net ...Policy loans ...Real estate joint ventures(2) ...Other limited partnership interests(2) ...Short-term investments(3) ...Other invested assets(2) ...Cash and cash equivalents ...Accrued investment income ...Premiums... -

Page 176

... estimated fair value on a recurring basis include: fixed maturity securities, equity securities, trading and other securities, certain short-term investments, mortgage loans held by CSEs, mortgage loans held-for-sale accounted for under the FVO, MSRs, derivative assets and liabilities, net embedded... -

Page 177

... of insurance contracts and are not considered financial instruments. The investment contracts primarily include certain funding agreements, fixed deferred annuities, modified guaranteed annuities, fixed term payout annuities and total control accounts. The fair values for these investment contracts... -

Page 178

... to group life contracts and certain contracts that provide for benefit funding. Separate account liabilities are recognized in the consolidated balance sheets at an equivalent value of the related separate account assets. Separate account assets, which equal net deposits, net investment income and... -

Page 179

...Consolidated Financial Statements - (Continued) 6. Deferred Policy Acquisition Costs and Value of Business Acquired Information regarding DAC and VOBA was as follows: DAC VOBA (In millions) Total Balance at January 1, 2009 ...Capitalizations ...Subtotal ...Amortization related to: ...Net investment... -

Page 180

...life ...Individual life ...Non-medical health ...Total Insurance Products ...Retirement Products ...Corporate Benefit Funding ...Auto & Home ...Total U.S. Business ...International: Japan ...Other International Regions: ...Latin America ...Asia Pacific ...Europe ...Middle East ...Total International... -

Page 181

...as follows: Future Policy Benefits 2011 2010 Policyholder Account Balances December 31, 2011 (In millions) 2010 2011 2010 Other Policy-Related Balances U.S. Business: Insurance Products ...Retirement Products ...Corporate Benefit Funding ...Auto & Home ...Total U.S. Business ...International: Japan... -

Page 182

MetLife, Inc. Notes to the Consolidated Financial Statements - (Continued) Value of Distribution Agreements and Customer Relationships Acquired Information regarding VODA and VOCRA, which are reported in other assets, was as follows: Amount (In millions) Balance at January 1, 2009 ...Acquisitions ... -

Page 183

... 31, 2011 and 2010, respectively. For the years ended December 31, 2011, 2010 and 2009, there were no investment gains (losses) on transfers of assets from the general account to the separate accounts. Obligations Under Funding Agreements The Company issues fixed and floating rate funding agreements... -

Page 184

... annuities"). These guarantees include benefits that are payable in the event of death, maturity or at annuitization. The Company also issues universal and variable life contracts where the Company contractually guarantees to the contractholder a secondary guarantee or a guaranteed paid-up benefit... -

Page 185

... of guarantees relating to annuity contracts and universal and variable life contracts was as follows: December 31, 2011 In the Event of Death At Annuitization 2010 In the Event of Death At Annuitization (In millions) Annuity Contracts(1) Return of Net Deposits Separate account value ...Net amount... -

Page 186

... base policy liabilities) relating to annuity and universal and variable life contracts was as follows: Annuity Contracts Guaranteed Death Benefits Guaranteed Annuitization Benefits Universal and Variable Life Contracts Secondary Guarantees (In millions) Paid-Up Guarantees Total Direct and... -

Page 187

... certain client arrangements. The Company's Retirement Products segment reinsures a portion of the living and death benefit guarantees issued in connection with its variable annuities. Under these reinsurance agreements, the Company pays a reinsurance premium generally based on fees associated with... -

Page 188

...Information regarding the effect of reinsurance was as follows: Years Ended December 31, 2011 2010 (In millions) 2009 Premiums: Direct premiums ...Reinsurance assumed ...Reinsurance ceded ...Net premiums ...Universal life and investment-type product policy fees: Direct universal life and investment... -

Page 189

... funds to make guaranteed policy benefit payments, such payments will be made from assets outside of the closed block. The closed block will continue in effect as long as any policy in the closed block remains in-force. The expected life of the closed block is over 100 years. The Company uses... -

Page 190

... Closed Block Investments: ...Fixed maturity securities available-for-sale, at estimated fair value ...Equity securities available-for-sale, at estimated fair value ...Mortgage loans ...Policy loans ...Real estate and real estate joint ventures held-for-investment ...Short-term investments ...Other... -

Page 191

...impact on the Company's consolidated financial statements. MLIC charges the closed block with federal income taxes, state and local premium taxes and other additive state or local taxes, as well as investment management expenses relating to the closed block as provided in the Plan. MLIC also charges... -

Page 192

... been capitalized and included in other assets. These costs are being amortized over the term of the senior notes. In March 2009, MetLife, Inc. issued $397 million of floating rate senior notes due June 29, 2012 under the Federal Deposit Insurance Corporation's Temporary Liquidity Guarantee Program... -

Page 193

... mortgage loans held-for-sale, commercial mortgage loans and mortgage-backed securities with estimated fair values of $8.7 billion and $7.8 billion at December 31, 2011 and 2010, respectively. Collateralized Borrowing from the Federal Reserve Bank of New York MetLife Bank is a depository institution... -

Page 194

..., MRC issued, to investors placed by an unaffiliated financial institution, $2.5 billion in aggregate principal amount of 35-year surplus notes to provide statutory reserve support for the assumed closed block liabilities. Interest on the surplus notes accrues at an annual rate of three-month LIBOR... -

Page 195

... rate of return to the unaffiliated financial institution of three-month LIBOR plus 0.70%, payable quarterly. MetLife, Inc. may also be required to make payments to the unaffiliated financial institution, for deposit into the trusts, related to any decline in the estimated fair value of the assets... -

Page 196

... the fair value of the Purchase Contracts discussed below. On March 8, 2011, AM Holdings sold, in a public offering, all the Equity Units it received as consideration from MetLife in connection with the Acquisition. The Equity Units are listed on the New York Stock Exchange. Purchase Contracts... -

Page 197

... made. For the year ended December 31, 2010, no contract payments were made. Debt Securities The Debt Securities are senior, unsecured notes of MetLife, Inc. which, in the aggregate, pay quarterly distributions at an initial average annual rate of 1.98% and are included in long-term debt (see Note... -

Page 198

... anticipated restructuring of American Life's foreign branches and filing of the income tax return. The Company also has recorded a valuation allowance increase related to tax benefits of $20 million related to certain state and foreign net operating loss carryforwards, $1 million related to certain... -

Page 199

... $20 million resulted from the acquisition of American Life. The U.S. Treasury Department and the IRS have indicated that they intend to address through regulations the methodology to be followed in determining the dividends received deduction ("DRD"), related to variable life insurance and annuity... -

Page 200

... dates and the approximate total settlement payments made to resolve asbestos personal injury claims at or during those years are set forth in the following table: December 31, 2011 2010 2009 (In millions, except number of claims) Asbestos personal injury claims at year end ...Number of new claims... -

Page 201

..., through its affiliate, MetLife Bank, has significantly increased its mortgage servicing activities by acquiring servicing portfolios. Currently, MetLife Bank services approximately 1% of the aggregate principal amount of the mortgage loans serviced in the U.S. State and federal regulatory and law... -

Page 202

... U.S. Social Security Administration's Death Master File or a similar database to identify instances where death benefits under life insurance policies, annuities, and retained asset accounts are payable, to locate and pay beneficiaries under such contracts, and to report the results of the use of... -

Page 203

... contract claim arising from MLIC's use of the TCA to pay life insurance benefits under the Federal Employees' Group Life Insurance program ("FEGLI"). As damages, plaintiffs seek disgorgement of the difference between the interest paid to the account holders and the investment earnings on the assets... -

Page 204

... and those otherwise provided for in the Company's consolidated financial statements, have arisen in the course of the Company's business, including, but not limited to, in connection with its activities as an insurer, mortgage lending bank, employer, investor, investment advisor and taxpayer... -

Page 205

... holds a receivable from the seller of a prior acquisition in accordance with the purchase agreement. On September 1, 2011, the New York State Department of Financial Services filed a liquidation plan for Executive Life Insurance Company of New York ("ELNY"), which had been under rehabilitation by... -

Page 206

... under these indemnities in the future. The Company has also guaranteed minimum investment returns on certain international retirement funds in accordance with local laws. Since these guarantees are not subject to limitation with respect to duration or amount, the Company does not believe that it is... -

Page 207

...a percentage of eligible pay, as well as earnings credits, determined annually based upon the average annual rate of interest on 30-year U.S. Treasury securities, for each account balance. At December 31, 2011, the majority of active participants were accruing benefits under the cash balance formula... -

Page 208

...' contributions ...Net actuarial (gains) losses ...Acquisition, divestitures and curtailments ...Change in benefits ...Prescription drug subsidy ...Benefits paid ...Transfers ...Effect of foreign currency translation ...Benefit obligations at December 31, ...Change in plan assets: Fair value of plan... -

Page 209

...' expected years of future services or benefit accruals. iv) Expected Return on Plan Assets - Expected return on plan assets is the assumed return earned by the accumulated pension and other postretirement fund assets in a particular year. v) Amortization of Net Actuarial Gains (Losses) - Actuarial... -

Page 210

... RDS each year. The RDS program provides the subsidy through cash payments made by Medicare to the Company, resulting in smaller net claims paid by the Company. A summary of the reduction to the APBO and the related reduction to the components of net periodic other postretirement benefits plan costs... -

Page 211

... future performance is based on long-term historical returns of the plan assets by sector, adjusted for the Subsidiaries' long-term expectations on the performance of the markets. While the precise expected rate of return derived using this approach will fluctuate from year to year, the policy of... -

Page 212

... group annuity and life insurance contracts supporting the pension and other postretirement benefit plans assets, which are invested primarily in separate accounts. The underlying assets of the separate accounts are principally comprised of cash and cash equivalents, short-term investments, fixed... -

Page 213

... bonds ...1,007 Total fixed maturity securities ...Equity securities: Common stock - domestic ...Common stock - foreign ...Total equity securities ...Money market securities ...Pass-through securities ...Derivative securities ...Short-term investments ...Other invested assets ...Other receivables... -

Page 214

MetLife, Inc. Notes to the Consolidated Financial Statements - (Continued) December 31, 2010 Pension Benefits Fair Value Measurements at Reporting Date Using Other Postretirement Benefits Fair Value Measurements at Reporting Date Using Quoted Quoted Prices Prices in Active in Active Markets Markets... -

Page 215

... Securities Securities (In millions) Year Ended December 31, 2011: Balance, January 1, ...Total realized/unrealized gains (losses) included in: ...Earnings: Net investment income ...Net investment gains (losses) ...Net derivative gains (losses) ...Other revenues ...Policyholder benefits and claims... -

Page 216

MetLife, Inc. Notes to the Consolidated Financial Statements - (Continued) Fair Value Measurements Using Significant Unobservable Inputs (Level 3) Pension Benefits Fixed Maturity Securities: Foreign Bonds Equity Securities: Common Stock Domestic PassOther Through Derivative Invested Securities ... -

Page 217

... 31, 2011 for the Invested Plans: Defined Benefit Plan Target Range Actual Allocation 2011 2010 Postretirement Medical Target Range Actual Allocation 2011 2010 Postretirement Life Target Range Actual Allocation 2011 2010 Asset Class: Fixed maturity securities: Corporate ...Federal agency ...Foreign... -

Page 218

...3) Fair Value (In millions) Assets: Fixed maturity securities: Foreign bonds ...Total fixed maturity securities ...Equity securities: Common stock - foreign ...Total equity securities ...Derivative securities ...Short-term investments ...Other invested assets ...Real estate ...Total assets ... 19... -

Page 219

...Fair Value Measurements Using Significant Unobservable Inputs (Level 3) Pension Benefits Derivative Securities (In millions) Real Estate Year Ended December 31, 2011: Balance, January 1, ...Total realized/unrealized gains (losses) included in: Earnings: Net investment income ...Net investment gains... -

Page 220

... Current regulations do not require funding for these benefits. The Subsidiaries use their general assets, net of participant's contributions, to pay postretirement medical claims as they come due in lieu of utilizing any plan assets. The U.S. Subsidiaries expect to make contributions of $75 million... -

Page 221

...assets of the U.S. pension and other postretirement benefit plans are held in group annuity and life insurance contracts issued by the Subsidiaries. Total revenues from these contracts recognized in the consolidated statements of operations were $47 million, $46 million and $45 million for the years... -

Page 222

.... issued 68,570,000 new shares of its common stock in a public offering at a price of $43.25 per share for gross proceeds of $3.0 billion. In connection with the offering of common stock, MetLife, Inc. incurred $16 million of issuance costs which have been recorded as a reduction of additional paid... -

Page 223

..., Inc. Notes to the Consolidated Financial Statements - (Continued) financial strength and credit ratings, general market conditions and the market price of MetLife, Inc.'s common stock compared to management's assessment of the stock's underlying value and applicable regulatory approvals, as well... -

Page 224

... common stock traded on the open market. The Company uses a weighted-average of the implied volatility for publicly-traded call options with the longest remaining maturity nearest to the money as of each valuation date and the historical volatility, calculated using monthly closing prices of MetLife... -

Page 225

... accounted for as equity awards, but are not credited with dividendequivalents for actual dividends paid on MetLife, Inc. common stock during the performance period. Accordingly, the estimated fair value of Performance Shares is based upon the closing price of MetLife, Inc. common stock on the date... -

Page 226

... which are payable in cash equal to the closing price of MetLife, Inc. common stock on a date following the last day of the three-year performance period. Performance Units are accounted for as liability awards, but are not credited with dividend-equivalents for actual dividends paid on MetLife, Inc... -

Page 227

... give recognition to purchase accounting adjustments. Statutory net income (loss) (unaudited) was as follows: Years Ended December 31, State of Domicile 2011 2010 (In millions) 2009 Metropolitan Life Insurance Company ...American Life Insurance Company(1) ...MetLife Insurance Company of Connecticut... -

Page 228

... of a stock life insurance company would support the payment of such dividends to its shareholders. Under Delaware State Insurance Law, each of American Life, DelAm and MTL is permitted, without prior insurance regulatory clearance, to pay a stockholder dividend to MetLife, Inc. as long as the... -

Page 229

... stock life insurance company would support the payment of such dividends to its shareholders. Other Comprehensive Income (Loss) The following table sets forth the balance and changes in accumulated other comprehensive income (loss) including reclassification adjustments required for the years ended... -

Page 230

...Volume-related costs ...Interest credited to bank deposits ...Capitalization of DAC ...Amortization of DAC and VOBA ...Amortization of negative VOBA ...Interest expense on debt and debt issuance costs ...Premium taxes, licenses & fees ...Professional services ...Rent, net of sublease income ...Other... -

Page 231

... to changes in estimates for variable incentive compensation, COBRA benefits, employee outplacement services and for employees whose severance status changed. In addition to the above charges, the Company has recognized lease charges of $28 million associated with the consolidation of office space... -

Page 232

... the Company's common equity units. (3) For the year ended December 31, 2009, 4,213,700 shares related to the assumed exercise or issuance of stock-based awards have been excluded from the calculation of diluted earnings per common share as these assumed shares are anti-dilutive. 228 MetLife, Inc... -

Page 233

... interests ...Net income (loss) attributable to MetLife, Inc...Less: Preferred stock dividends ...Preferred stock redemption premium ...Net income (loss) available to MetLife, Inc.'s common shareholders ...Basic earnings per common share: Income (loss) from continuing operations, net of income tax... -

Page 234

... death & dismemberment coverages. Retirement Products offers a variety of variable and fixed annuities. Corporate Benefit Funding offers pension risk solutions, structured settlements, stable value and investment products and other benefit funding products. Auto & Home provides personal lines... -

Page 235

... related to certain variable annuity guarantees and Market Value Adjustments to better conform to the way it manages and assesses its business. Accordingly, such results are no longer reported in operating earnings. Consequently, prior years' results for Retirement Products and total consolidated... -

Page 236

... Business Insurance Products Retirement Products Corporate Benefit Funding Auto & Home International Other International Regions (In millions) Corporate & Other Total Consolidated Year Ended December 31, 2011 Total Japan Total Total Adjustments Revenues Premiums ...$ 16,949 $ Universal life... -

Page 237

... Business Insurance Products Retirement Products Corporate Benefit Funding Auto & Home International Other International Regions (In millions) Corporate & Other Total Consolidated Year Ended December 31, 2010 Total Japan Total Total Adjustments Revenues Premiums ...$ 17,200 $ Universal life... -

Page 238

... U.S. Business Insurance Products Retirement Products Corporate Benefit Funding Auto & Home International Other International Regions (In millions) Corporate & Other Total Consolidated Year Ended December 31, 2009 Total Japan Total Total Adjustments Revenues Premiums ...$17,168 Universal life... -

Page 239

... (In millions) Total assets held-for-sale ...Total liabilities held-for-sale ...Major classes of assets and liabilities included above: ...Total investments ...Total future policy benefits ... $3,331 $3,043 $2,726 $2,461 Texas Life Insurance Company During the fourth quarter of 2008, MetLife, Inc... -

Page 240

... Management LLC Member, Finance and Risk Committee Member, Investment Committee of Metropolitan Life Insurance Company Executive Vice President and Interim Chief Financial Officer WILLIAM J. WHEELER President, The Americas Retired President and Co-Chief Operating Officer, New York Stock Exchange... -

Page 241

... leading global provider of insurance, annuities and employee benefit programs, serving 90 million customers in over 50 countries. Through its subsidiaries and affiliates, MetLife holds leading market positions in the United States, Japan, Latin America, Asia Pacific, Europe and the Middle East. For... -

Page 242

CUMULATIVE TOTAL RETURN Based upon an initial investment of $100 on December 31, 2006 with dividends reinvested $150 $100 $50 $0 31-Dec-06 31-Dec-07 31-Dec-08 31-Dec-09 31-Dec-10 31-Dec-11 MetLife Inc. Source: Capital IQ S&P 500 S&P 500 Insurance S&P 500 Financials 238 MetLife, Inc. -

Page 243

MetLife, Inc. 200 Park Avenue New York, NY 10166-0188 www.metlife.com 0710-6222 © 2012 Peanuts Worldwide LLC