MetLife 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

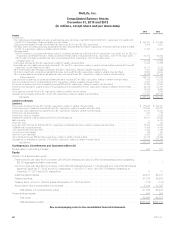

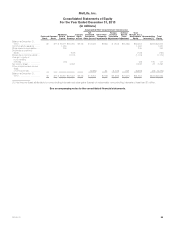

MetLife, Inc.

Notes to the Consolidated Financial Statements

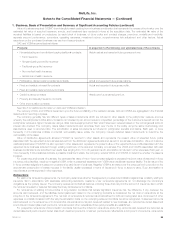

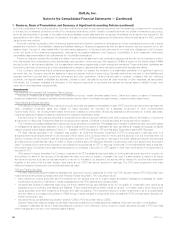

1. Business, Basis of Presentation and Summary of Significant Accounting Policies

Business

“MetLife” or the “Company” refers to MetLife, Inc., a Delaware corporation incorporated in 1999, its subsidiaries and affiliates. MetLife is a leading

global provider of insurance, annuities and employee benefit programs throughout the United States, Japan, Latin America, Asia, Europe and the Middle

East. MetLife offers life insurance, annuities, property & casualty insurance, and other financial services to individuals, as well as group insurance and

retirement & savings products and services to corporations and other institutions.

MetLife is organized into six segments: Retail; Group, Voluntary & Worksite Benefits; Corporate Benefit Funding; and Latin America (collectively, the

“Americas”); Asia; and Europe, the Middle East and Africa (“EMEA”).

Basis of Presentation

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires

management to adopt accounting policies and make estimates and assumptions that affect amounts reported in the consolidated financial statements.

In applying these policies and estimates, management makes subjective and complex judgments that frequently require assumptions about matters that

are inherently uncertain. Many of these policies, estimates and related judgments are common in the insurance and financial services industries; others

are specific to the Company’s business and operations. Actual results could differ from estimates.

Consolidation

The accompanying consolidated financial statements include the accounts of MetLife, Inc. and its subsidiaries, as well as partnerships and joint

ventures in which the Company has control, and variable interest entities (“VIEs”) for which the Company is the primary beneficiary. Intercompany

accounts and transactions have been eliminated.

Certain international subsidiaries have a fiscal year-end of November 30. Accordingly, the Company’s consolidated financial statements reflect the

assets and liabilities of such subsidiaries as of November 30, 2013 and 2012 and the operating results of such subsidiaries for the years ended

November 30, 2013, 2012 and 2011.

Discontinued Operations

The results of operations of a component of the Company that has either been disposed of or is classified as held-for-sale are reported in

discontinued operations if certain criteria are met. In order to qualify for a discontinued operation, the operations and cash flows of the component have

been or will be eliminated from the ongoing operations of the Company, and the Company will not have any significant continuing involvement in the

operations of the component after the disposal transaction.

Separate Accounts

Separate accounts are established in conformity with insurance laws and are generally not chargeable with liabilities that arise from any other

business of the Company. Separate account assets are subject to general account claims only to the extent the value of such assets exceeds the

separate account liabilities. The Company reports separately, as assets and liabilities, investments held in separate accounts and liabilities of the

separate accounts if:

‰such separate accounts are legally recognized;

‰assets supporting the contract liabilities are legally insulated from the Company’s general account liabilities;

‰investments are directed by the contractholder; and

‰all investment performance, net of contract fees and assessments, is passed through to the contractholder.

The Company reports separate account assets at their fair value which is based on the estimated fair values of the underlying assets comprising

the individual separate account portfolios. Investment performance (including investment income, net investment gains (losses) and changes in

unrealized gains (losses)) and the corresponding amounts credited to contractholders of such separate accounts are offset within the same line in the

statements of operations. Separate accounts credited with a contractual investment return are combined on a line-by-line basis with the Company’s

general account assets, liabilities, revenues and expenses and the accounting for these investments is consistent with the methodologies described

herein for similar financial instruments held within the general account. Unit-linked separate account investments that are directed by contractholders

but do not meet one or more of the other above criteria are included in fair value option (“FVO”) and trading securities.

The Company’s revenues reflect fees charged to the separate accounts, including mortality charges, risk charges, policy administration fees,

investment management fees and surrender charges. Such fees are included in universal life and investment-type product policy fees in the

statements of operations.

Reclassifications

Certain amounts in the prior years’ consolidated financial statements and related footnotes thereto have been reclassified to conform with the

current year presentation as discussed throughout the Notes to the Consolidated Financial Statements.

90 MetLife, Inc.