MetLife 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

bankruptcy and failure to pay on borrowed money. For European corporate issuers, credit events typically also include involuntary restructuring. With

respect to credit default contracts on Western European sovereign debt, credit events typically include failure to pay debt obligations, repudiation,

moratorium, or involuntary restructuring. In each case, payout on a credit default swap is triggered only after the Credit Derivatives Determinations

Committee of the International Swaps and Derivatives Association deems that a credit event has occurred.

Current Environment

The global economy and markets continue to be affected by stress and volatility, which has adversely affected the financial services sector, in

particular, and global capital markets. As a global insurance company, we are also affected by the monetary policy of central banks around the world.

Financial markets have also been affected by concerns over the direction of U.S. fiscal and monetary policy. See “— Industry Trends — Financial and

Economic Environment” for information on the most recent debt ceiling crisis. The Federal Reserve Board has taken a number of policy actions in recent

years to spur economic activity, by keeping interest rates low and, more recently, through its asset purchase programs. See “— Industry Trends —

Impact of a Sustained Low Interest Rate Environment” for information on actions taken by the Federal Reserve Board and central banks around the

world to support the economic recovery. See “— Industry Trends — Financial and Economic Environment” for information on actions taken by Japan’s

central government and the Bank of Japan to end deflation and achieve sustainable economic growth in Japan. The Federal Reserve may take further

actions to influence interest rates in the future, which may have an impact on the pricing levels of risk-bearing investments and may adversely impact the

level of product sales.

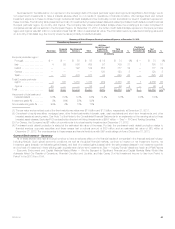

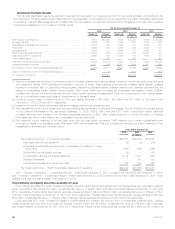

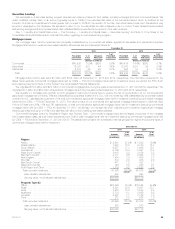

European Region Investments

Excluding Europe’s perimeter region and Cyprus which is discussed below, our holdings of sovereign debt, corporate debt and perpetual hybrid

securities in certain EU member states and other countries in the region that are not members of the EU (collectively, the “European Region”) were

concentrated in the U.K., Germany, France, the Netherlands, Poland, Norway and Sweden. The sovereign debt of these countries continues to

maintain investment grade credit ratings from all major rating agencies. In the European Region, we have proactively mitigated risk in both direct and

indirect exposures by investing in a diversified portfolio of high quality investments with a focus on the higher-rated countries. Sovereign debt issued by

countries outside of Europe’s perimeter region and Cyprus comprised $9.0 billion, or 99% of our European Region sovereign fixed maturity securities,

at estimated fair value, at December 31, 2013. The European Region corporate securities (fixed maturity and perpetual hybrid securities classified as

non-redeemable preferred stock) are invested in a diversified portfolio of primarily non-financial services securities, which comprised $24.8 billion, or

74% of European Region total corporate securities, at estimated fair value, at December 31, 2013. Of these European Region sovereign fixed maturity

and corporate securities, 91% were investment grade and, for the 9% that were below investment grade, the majority were non-financial services

corporate securities at December 31, 2013. European Region financial services corporate securities, at estimated fair value, were $8.8 billion,

including $6.6 billion within the banking sector, with 94% invested in investment grade rated corporate securities, at December 31, 2013.

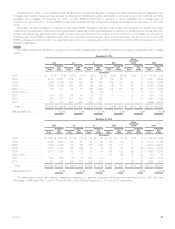

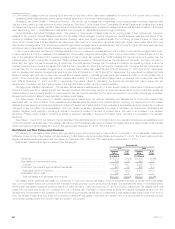

Europe’s Perimeter Region and Cyprus

Concerns about the economic conditions, capital markets and the solvency of certain EU member states, including Europe’s perimeter region and

Cyprus, and of financial institutions that have significant direct or indirect exposure to debt issued by these countries, have been a cause of elevated

levels of market volatility, and has affected the performance of various asset classes during 2013. However, after several tumultuous years, economic

conditions in Europe’s perimeter region seem to be stabilizing or improving, as evidenced by the stabilization of downward credit ratings momentum,

particularly in Spain, Portugal and Ireland. This, combined with greater ECB support and improving macroeconomic conditions at the country level, has

reduced the risk of default on the sovereign debt of Europe’s perimeter region and Cyprus and the risk of possible withdrawal of one or more countries

from the Euro zone.

The March 2012 restructuring of Greece sovereign debt securities had an adverse impact on the capital level of Cyprus’ largest financial

institutions, which triggered downgrades of Cyprus sovereign debt. In April 2013, the EU approved a €10 billion financial support program for Cyprus,

the first tranche of which was released in May 2013. This official support program includes financing to cover Cyprus government’s needs over a three

year period. It also includes a restructuring of Cyprus banking, tax and financial systems. These restructurings, which adversely impact private

investors, private creditors and uninsured depositors of the two largest banks, are intended to avoid a default of Cyprus sovereign debt.

40 MetLife, Inc.