MetLife 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

3. Acquisitions and Dispositions (continued)

2010 Acquisition of ALICO

Description of Transaction

On November 1, 2010, MetLife, Inc. acquired all of the issued and outstanding capital stock of American Life Insurance Company (“American Life”) from

AM Holdings LLC (formerly known as ALICO Holdings LLC) (“AM Holdings”), a subsidiary of American International Group, Inc. (“AIG”), and Delaware American

Life Insurance Company (“DelAm”) from AIG (American Life, together with DelAm, collectively, “ALICO”) (the “ALICO Acquisition”) for a total purchase price of

$16.4 billion. The ALICO Acquisition significantly broadened the Company’s diversification by product, distribution and geography, meaningfully accelerated

MetLife’s global growth strategy, and provides the opportunity to build an international franchise leveraging the key strengths of ALICO.

Branch Restructuring

On March 4, 2010, American Life entered into a closing agreement (the “Closing Agreement”) with the Commissioner of the Internal Revenue

Service (“IRS”) with respect to a U.S. withholding tax issue arising as a result of payments made by its foreign branches. The Closing Agreement

provides that American Life’s foreign branches will not be required to withhold U.S. income tax on the income portion of payments made pursuant to

American Life’s life insurance and annuity contracts (“Covered Payments”) for any tax periods beginning on January 1, 2005 and ending on

December 31, 2013 (the “Deferral Period”). The Closing Agreement required that American Life submit a plan to the IRS within 90 days after the close

of the ALICO Acquisition, indicating the steps American Life would take (on a country by country basis) to ensure that no substantial amount of

U.S. withholding tax will arise from Covered Payments made by American Life’s foreign branches to foreign customers after the Deferral Period. Such

plan, which was submitted to the IRS on January 29, 2011, involves the transfer of businesses from certain of the foreign branches of American Life to

one or more existing or newly-formed subsidiaries of MetLife, Inc. or American Life. See Note 19 for additional information regarding the valuation

allowance related to branch restructuring.

A liability of $277 million was recognized in purchase accounting at November 1, 2010 for the anticipated and estimated costs associated with

restructuring American Life’s foreign branches into subsidiaries in connection with the Closing Agreement. This liability has been reduced based on

payments through December 31, 2013. In addition, based on revised estimates of anticipated costs, this liability was reduced by $29 million for the

year ended December 31, 2013, which was recorded as a reduction in other expenses in the consolidated statement of operations, resulting in a

liability of $11 million at December 31, 2013.

See Notes 11 and 17 for additional information on goodwill and other expenses, respectively, related to the ALICO Acquisition.

Discontinued Operations

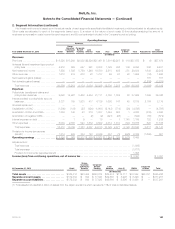

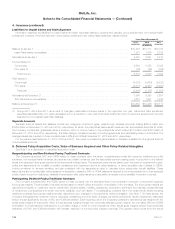

The following table summarizes the amounts that have been reflected as discontinued operations in the consolidated statements of operations.

Income (loss) from discontinued operations includes real estate classified as held-for-sale or sold.

Years Ended December 31,

2013 2012 2011

(In millions)

Total revenues ................................................................................... $ 3 $74 $484

Total expenses .................................................................................. — — 363

Income (loss) before provision for income tax ........................................................... 3 74 121

Provision for income tax expense (benefit) ............................................................. 1 26 33

Income (loss) from operations of discontinued operations, net of income tax ................................... 2 48 88

Gain (loss) on disposal of operations, net of income tax ................................................... — — (64)

Income (loss) from discontinued operations, net of income tax .............................................. $ 2 $48 $ 24

4. Insurance

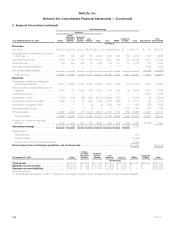

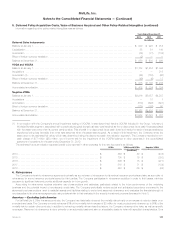

Insurance Liabilities

Insurance liabilities are comprised of future policy benefits, PABs and other policy-related balances. Information regarding insurance liabilities by

segment, as well as Corporate & Other, was as follows at:

December 31,

2013 2012

(In millions)

Retail ............................................................................................... $134,915 $138,082

Group, Voluntary & Worksite Benefits ...................................................................... 29,521 29,996

Corporate Benefit Funding .............................................................................. 112,591 117,065

Latin America ........................................................................................ 16,162 16,055

Asia ................................................................................................ 93,066 103,064

EMEA .............................................................................................. 21,657 20,200

Corporate & Other .................................................................................... 8,129 9,173

Total ............................................................................................. $416,041 $433,635

108 MetLife, Inc.