MetLife 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

from discontinued real estate operations, (iii) excludes post-tax operating earnings adjustments relating to insurance joint ventures accounted for

under the equity method, (iv) excludes certain amounts related to contractholder-directed unit-linked investments, and (v) excludes certain

amounts related to securitization entities that are VIEs consolidated under GAAP; and

‰Other revenues are adjusted for settlements of foreign currency earnings hedges.

The following additional adjustments are made to GAAP expenses, in the line items indicated, in calculating operating expenses:

‰Policyholder benefits and claims and policyholder dividends excludes: (i) changes in the policyholder dividend obligation related to net investment

gains (losses) and net derivative gains (losses), (ii) inflation-indexed benefit adjustments associated with contracts backed by inflation-indexed

investments and amounts associated with periodic crediting rate adjustments based on the total return of a contractually referenced pool of assets

and other pass through adjustments (iii) benefits and hedging costs related to GMIBs (“GMIB Costs”), and (iv) market value adjustments

associated with surrenders or terminations of contracts (“Market Value Adjustments”);

‰Interest credited to policyholder account balances includes adjustments for scheduled periodic settlement payments and amortization of premium

on derivatives that are hedges of PABs but do not qualify for hedge accounting treatment and excludes amounts related to net investment income

earned on contractholder-directed unit-linked investments;

‰Amortization of DAC and VOBA excludes amounts related to: (i) net investment gains (losses) and net derivative gains (losses), (ii) GMIB Fees and

GMIB Costs, and (iii) Market Value Adjustments;

‰Amortization of negative VOBA excludes amounts related to Market Value Adjustments;

‰Interest expense on debt excludes certain amounts related to securitization entities that are VIEs consolidated under GAAP; and

‰Other expenses excludes costs related to: (i) noncontrolling interests, (ii) implementation of new insurance regulatory requirements, and

(iii) acquisition and integration costs.

Operating earnings also excludes the recognition of certain contingent assets and liabilities that could not be recognized at acquisition or adjusted

for during the measurement period under GAAP business combination accounting guidance.

In addition, operating return on common equity is defined as operating earnings available to common shareholders, divided by average GAAP

common equity.

All references to “operating earnings per share,” “operating return on equity” and “premiums, fees and other revenues” should be read as references to

“operating earnings available to common shareholder per diluted common share,” “operating return on common equity, excluding AOCI” and “operating

premiums, fees and other revenues.” “Operating premiums, fees and other revenues” is defined as GAAP premium, fees and other revenues less the

applicable adjustments made to GAAP revenues in calculating operating revenues, as described above. See “Selected Financial Data” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information.

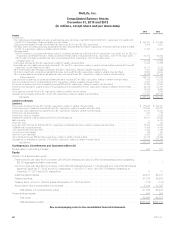

We believe the presentation of operating earnings and operating earnings available to common shareholders as we measure it for management purposes

enhances the understanding of our performance by highlighting the results of operations and the underlying profitability drivers of our business. Operating

revenues, operating expenses, operating earnings, operating earnings available to common shareholders, operating return on MetLife, Inc.’s common equity

and operating return on MetLife, Inc.’s common equity, excluding AOCI, should not be viewed as substitutes for the following financial measures calculated in

accordance with GAAP: GAAP revenues, GAAP expenses, income (loss) from continuing operations, net of income tax, net income (loss) available to MetLife,

Inc.’s common shareholders, return on MetLife, Inc.’s common equity and return on MetLife, Inc.’s common equity, excluding AOCI, respectively.

Reconciliations of these measures to the most directly comparable GAAP measures are included in “— Results of Operations.”

In this discussion, we sometimes refer to sales activity for various products. These sales statistics do not correspond to revenues under GAAP, but

are used as relevant measures of business activity. Additionally, the impact of changes in our foreign currency exchange rates is calculated using the

average foreign currency exchange rates for the current year and is applied to each of the comparable years.

In this discussion, we also provide forward-looking guidance on an operating, or non-GAAP, basis. A reconciliation of these non-GAAP measures to

the most directly comparable GAAP measures is not accessible on a forward-looking basis because we believe it is not possible to provide other than a

range of net investment gains and losses and net derivative gains and losses, which can fluctuate significantly within or outside the range and from

period to period and may have a significant impact on GAAP net income.

Subsequent Events

See Note 23 of the Notes to the Consolidated Financial Statements.

Quantitative and Qualitative Disclosures About Market Risk

Risk Management

We have developed an integrated process for managing risk, which we conduct through multiple Board and senior management committees

(financial and non-financial) within our GRM, ALM Unit, Treasury Department and Investments Department. The risk committee structure is designed to

provide a consolidated enterprise-wide assessment and management of risk. The ERC is responsible for reviewing all material risks to the enterprise and

deciding on actions, if necessary, in the event risks exceed desired targets, taking into consideration industry best practices and the current

environment to resolve or mitigate those risks. Additional committees at the MetLife, Inc. and subsidiary insurance company level that manage capital

and risk positions, approve ALM strategies and establish corporate business standards, report to the ERC.

Global Risk Management

Independent from the lines of business, the centralized GRM, led by the CRO collaborates and coordinates across all committees to ensure that all

material risks are properly identified, measured, aggregated and reported across the Company. The CRO reports to the CEO and is primarily

responsible for maintaining and communicating the Company’s enterprise risk policies and for monitoring and analyzing all material risks.

GRM considers and monitors a full range of risks against the Company’s solvency, liquidity, earnings, business operations and reputation. GRM’s

primary responsibilities consist of:

‰implementing a corporate risk framework, which outlines our enterprise approach for managing risk;

‰developing policies and procedures for managing, measuring, monitoring and controlling those risks identified in the corporate risk framework;

‰establishing appropriate corporate risk tolerance levels;

‰deploying capital on an economic basis;

‰recommending capital allocations on an economic capital basis; and

‰reporting to (i) the Finance and Risk Committee of MetLife, Inc.’s Board of Directors; (ii) the Investment Committee of MLIC’s Board of Directors,

which assists MetLife, Inc.’s Board of Directors in overseeing certain investment activities of the enterprise; and (iii) the financial and non-financial

senior management committees on various aspects of risk.

72 MetLife, Inc.