MetLife 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

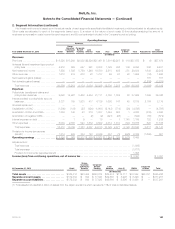

2. Segment Information (continued)

Corporate Benefit Funding

The Corporate Benefit Funding segment offers a broad range of annuity and investment products, including guaranteed interest products and other

stable value products, income annuities, and separate account contracts for the investment management of defined benefit and defined contribution

plan assets. This segment also includes structured settlements and certain products to fund postretirement benefits and company-, bank- or trust-

owned life insurance used to finance non-qualified benefit programs for executives.

Latin America

The Latin America segment offers a broad range of products to both individuals and corporations, as well as other institutions and their respective

employees, which include life insurance, accident and health insurance, group medical, dental, credit insurance, endowment and retirement & savings

products written in Latin America. Starting in the first quarter of 2013, the Latin America segment includes U.S. sponsored direct business, comprised

of group and individual products sold through sponsoring organizations and affinity groups. Products included are life, dental, group short- and long-

term disability, accidental death & dismemberment coverages, property & casualty and other accident and health coverages, as well as non-insurance

products such as identity protection.

Asia

The Asia segment offers a broad range of products to both individuals and corporations, as well as other institutions and their respective employees,

which include whole life, term life, variable life, universal life, accident and health insurance, fixed and variable annuities, credit insurance and endowment

products.

EMEA

The EMEA segment offers a broad range of products to both individuals and corporations, as well as other institutions and their respective

employees, which include life insurance, accident and health insurance, credit insurance, annuities, endowment and retirement & savings products.

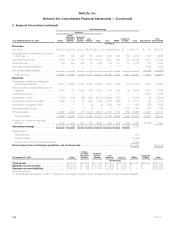

Corporate & Other

Corporate & Other contains the excess capital not allocated to the segments, external integration costs, internal resource costs for associates

committed to acquisitions, enterprise-wide strategic initiative restructuring charges, and various start-up and certain run-off businesses. Start-up

businesses include expatriate benefits insurance, as well as direct and digital marketing products. Corporate & Other also includes assumed

reinsurance of certain variable annuity products from the Company’s former operating joint venture in Japan. Under this in-force reinsurance agreement,

the Company reinsures living and death benefit guarantees issued in connection with variable annuity products. Corporate & Other also includes our

investment management business through which we offer fee-based investment management services to institutional clients. Additionally, Corporate &

Other includes interest expense related to the majority of the Company’s outstanding debt and expenses associated with certain legal proceedings and

income tax audit issues. Corporate & Other also includes the elimination of intersegment amounts, which generally relate to intersegment loans, which

bear interest rates commensurate with related borrowings.

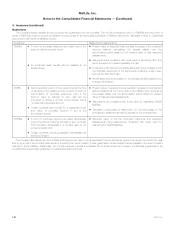

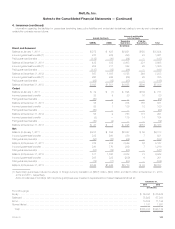

Financial Measures and Segment Accounting Policies

Operating earnings is the measure of segment profit or loss the Company uses to evaluate segment performance and allocate resources.

Consistent with GAAP guidance for segment reporting, operating earnings is the Company’s measure of segment performance and is reported below.

Operating earnings should not be viewed as a substitute for income (loss) from continuing operations, net of income tax. The Company believes the

presentation of operating earnings as the Company measures it for management purposes enhances the understanding of its performance by

highlighting the results of operations and the underlying profitability drivers of the business.

Operating earnings is defined as operating revenues less operating expenses, both net of income tax.

Operating revenues and operating expenses exclude results of discontinued operations and other businesses that have been or will be sold or

exited by MetLife. Operating revenues also excludes net investment gains (losses) and net derivative gains (losses). Operating expenses also excludes

goodwill impairments.

The following additional adjustments are made to GAAP revenues, in the line items indicated, in calculating operating revenues:

‰Universal life and investment-type product policy fees excludes the amortization of unearned revenue related to net investment gains (losses) and

net derivative gains (losses) and certain variable annuity GMIB fees (“GMIB Fees”);

‰Net investment income: (i) includes amounts for scheduled periodic settlement payments and amortization of premium on derivatives that are

hedges of investments or that are used to replicate certain investments, but do not qualify for hedge accounting treatment, (ii) includes income

from discontinued real estate operations, (iii) excludes post-tax operating earnings adjustments relating to insurance joint ventures accounted for

under the equity method, (iv) excludes certain amounts related to contractholder-directed unit-linked investments, and (v) excludes certain

amounts related to securitization entities that are VIEs consolidated under GAAP; and

‰Other revenues are adjusted for settlements of foreign currency earnings hedges.

The following additional adjustments are made to GAAP expenses, in the line items indicated, in calculating operating expenses:

‰Policyholder benefits and claims and policyholder dividends excludes: (i) changes in the policyholder dividend obligation related to net investment

gains (losses) and net derivative gains (losses), (ii) inflation-indexed benefit adjustments associated with contracts backed by inflation-indexed

investments and amounts associated with periodic crediting rate adjustments based on the total return of a contractually referenced pool of assets

and other pass through adjustments, (iii) benefits and hedging costs related to GMIBs (“GMIB Costs”), and (iv) market value adjustments

associated with surrenders or terminations of contracts (“Market Value Adjustments”);

‰Interest credited to policyholder account balances includes adjustments for scheduled periodic settlement payments and amortization of premium

on derivatives that are hedges of PABs but do not qualify for hedge accounting treatment and excludes amounts related to net investment income

earned on contractholder-directed unit-linked investments;

‰Amortization of DAC and VOBA excludes amounts related to: (i) net investment gains (losses) and net derivative gains (losses), (ii) GMIB Fees and

GMIB Costs, and (iii) Market Value Adjustments;

MetLife, Inc. 101