MetLife 2013 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chairman’s Letter

To my fellow shareholders:

When I became CEO in May of 2011, my mandate was clear: Improve the profitability and risk profile of the business.

MetLife was the largest life insurer in the United States with a great brand and a nearly 145-year history of keeping its

promises to policyholders, but we had taken on too much risk in certain parts of our business and our profitability was in

the middle of the pack relative to industry peers.

The first order of business for the executive group in 2011 was to develop a strategy to achieve our goal. It is not

easy to turn a ship as large as MetLife, especially in an industry where profits emerge slowly over time. The strategy we

launched in 2012 was not a one- or two-year strategy. It was a five-year strategy to raise our return on equity, reduce our

cost of equity, and return capital to shareholders.

Even though we have faced both economic and regulatory headwinds along the way, I am pleased to report that we

are ahead of schedule on our plan to increase the profitability of MetLife’s business while also decreasing its level of risk.

A Very Good Year

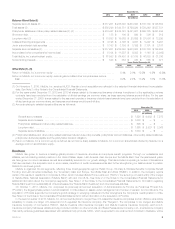

Our progress was clearly evident in 2013. Operating earnings increased 11% over the prior year, exceeding our

plan.1Premiums, fees and other revenues increased 2% on a reported basis and 5% on a constant currency basis –

solid top-line growth in light of our efforts to improve MetLife’s risk profile. And most important, operating return on equity

in 2013 came in at 12%, hitting the low end of our 2016 target range three years ahead of schedule.

The four cornerstones of MetLife’s strategy have held constant: Refocus the U.S. Business; Grow Emerging Markets;

Build a Global Employee Benefits Business; and Drive Toward Customer Centricity and a Global Brand. We have made

significant progress on implementing the strategy over the past year:

‰We have refocused and de-risked the U.S. business while increasing operating earnings by more than 40% from

2011.

‰We are well on our way toward our 2016 goal of having emerging markets contribute 20% of MetLife’s operating

earnings and believe the high-growth, high-return potential of these businesses is a key differentiator relative to

peers.

‰We are on track to achieve our target of $1 billion in gross expense saves while reinvesting $400 million in the

business, much of it in technology to improve the customer experience – an imperative to realize our goal of

becoming a world-class organization.

One element of our 2013 performance requires a word of explanation. While operating earnings grew by 11%,

operating earnings per share increased by 7%. Our growth on a per-share basis was dampened by the conversion of

equity units issued in 2010 to fund the acquisition of Alico. Of the $3 billion in equity units issued to help fund the deal,

$2 billion have now converted into common shares, with the final $1 billion scheduled to convert in 2014.

We originally anticipated repurchasing these shares as they converted, but we have grown more cautious due to

uncertainty over the level of capital MetLife will be required to hold if we are named a non-bank systemically important

financial institution (SIFI). Even though we are holding more capital, the strength of our franchise and strong execution of

our strategy have lifted operating return on equity from 9.8% in 2010 to 12% in 2013.

1See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP and Other Financial Disclosures” for

non-GAAP definitions and financial information.