MetLife 2013 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

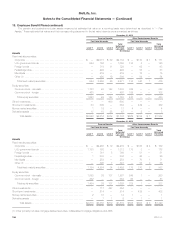

18. Employee Benefit Plans (continued)

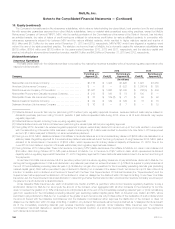

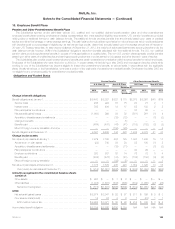

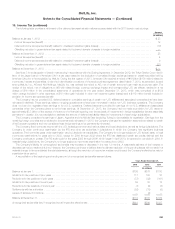

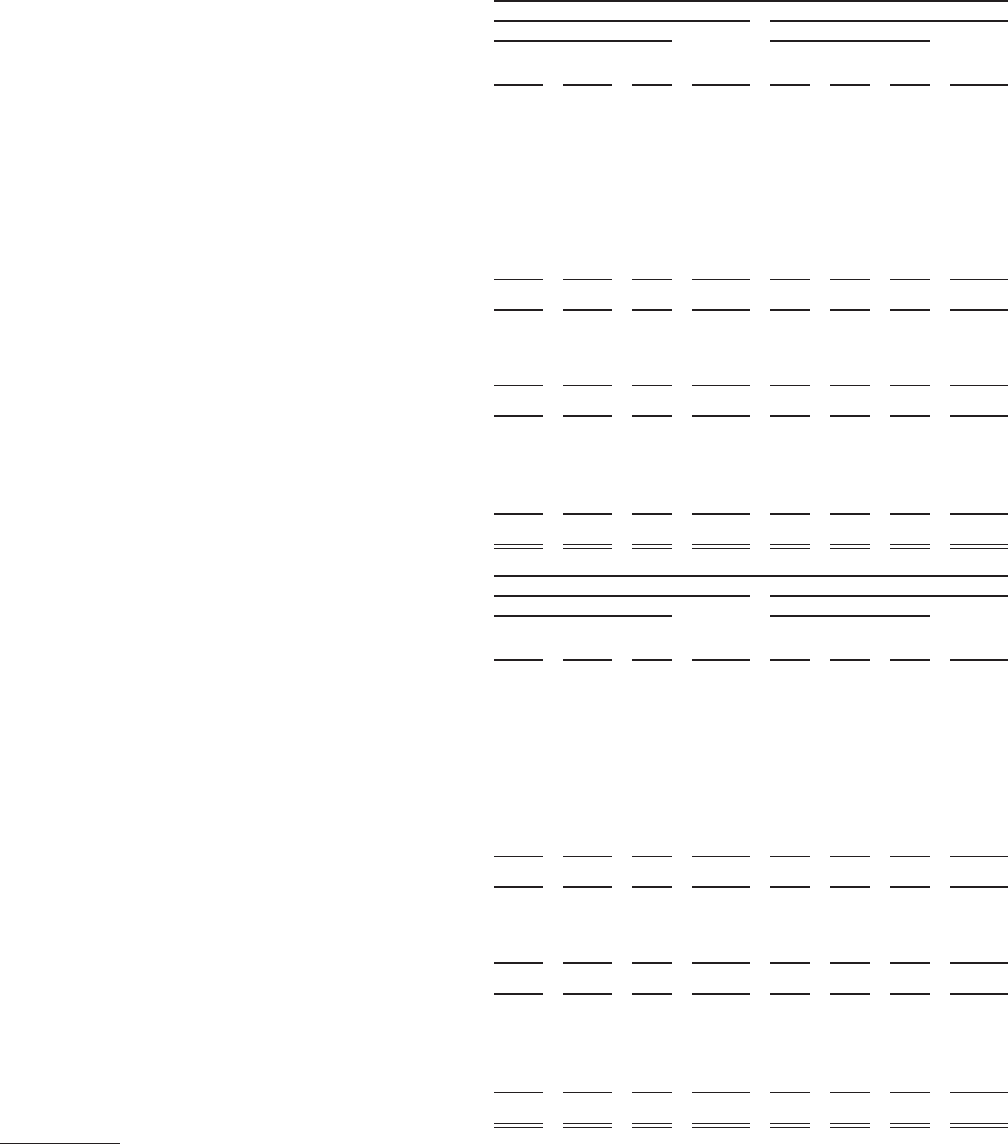

The pension and postretirement plan assets measured at estimated fair value on a recurring basis were determined as described in “— Plan

Assets.” These estimated fair values and their corresponding placement in the fair value hierarchy are summarized as follows:

December 31, 2013

Pension Benefits Other Postretirement Benefits

Fair Value Hierarchy Fair Value Hierarchy

Level 1 Level 2 Level 3

Total

Estimated

Fair Value Level 1 Level 2 Level 3

Total

Estimated

Fair Value

(In millions)

Assets

Fixed maturity securities:

Corporate .............................................. $ — $2,073 $ 59 $2,132 $ — $170 $ 1 $ 171

U.S. government bonds ................................... 924 166 — 1,090 135 5 — 140

Foreign bonds ........................................... — 718 11 729 — 63 — 63

Federal agencies ......................................... — 292 — 292 — 33 — 33

Municipals .............................................. — 219 — 219 — 15 — 15

Other (1) ............................................... — 490 19 509 — 54 — 54

Total fixed maturity securities .............................. 924 3,958 89 4,971 135 340 1 476

Equity securities:

Common stock - domestic ................................. 1,133 22 148 1,303 328 — — 328

Common stock - foreign ................................... 460 — — 460 102 — — 102

Total equity securities ................................... 1,593 22 148 1,763 430 — — 430

Other investments .......................................... — — 600 600 — — — —

Short-term investments ...................................... 53 309 — 362 — 439 — 439

Money market securities ..................................... 1 12 — 13 4 — — 4

Derivative assets ........................................... 17 15 35 67 — 3 — 3

Total assets ......................................... $2,588 $4,316 $872 $7,776 $569 $782 $ 1 $1,352

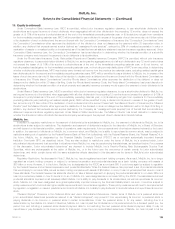

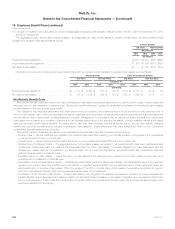

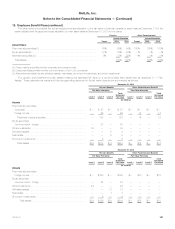

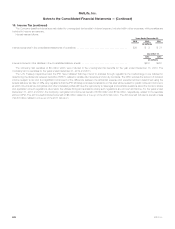

December 31, 2012

Pension Benefits Other Postretirement Benefits

Fair Value Hierarchy Fair Value Hierarchy

Level 1 Level 2 Level 3

Total

Estimated

Fair Value Level 1 Level 2 Level 3

Total

Estimated

Fair Value

(In millions)

Assets

Fixed maturity securities:

Corporate .............................................. $ — $2,260 $ 19 $2,279 $ — $165 $ 4 $ 169

U.S. government bonds ................................... 1,153 160 — 1,313 175 3 — 178

Foreign bonds ........................................... — 761 8 769 — 51 — 51

Federal agencies ......................................... 1 335 — 336 — 26 — 26

Municipals .............................................. — 258 — 258 — 70 1 71

Other (1) ............................................... — 490 7 497 — 55 3 58

Total fixed maturity securities .............................. 1,154 4,264 34 5,452 175 370 8 553

Equity securities:

Common stock - domestic ................................. 1,092 38 137 1,267 249 1 — 250

Common stock - foreign ................................... 362 — — 362 83 — — 83

Total equity securities ................................... 1,454 38 137 1,629 332 1 — 333

Other investments .......................................... — 117 447 564 — — — —

Short-term investments ...................................... — 214 — 214 — 432 — 432

Money market securities ..................................... 2 10 — 12 1 — — 1

Derivative assets ........................................... — 7 1 8 — 1 — 1

Total assets ......................................... $2,610 $4,650 $619 $7,879 $508 $804 $ 8 $1,320

(1) Other primarily includes mortgage-backed securities, collateralized mortgage obligations and ABS.

194 MetLife, Inc.