MetLife 2013 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

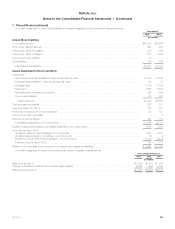

8. Investments (continued)

collateral, expected prepayment speeds, current and forecasted loss severity, consideration of the payment terms of the underlying assets backing a

particular security, and the payment priority within the tranche structure of the security.

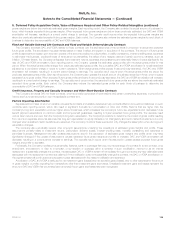

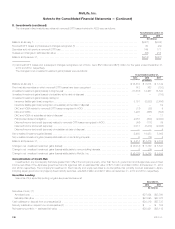

Equity Securities

Gross unrealized losses on equity securities decreased $42 million during the year ended December 31, 2013 from $159 million to $117 million.

Of the $117 million, $39 million were from 11 equity securities with gross unrealized losses of 20% or more of cost for 12 months or greater, all of

which were financial services industry investment grade non-redeemable preferred stock, of which 65% were rated A or better.

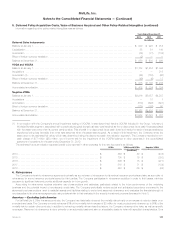

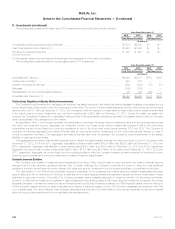

Mortgage Loans

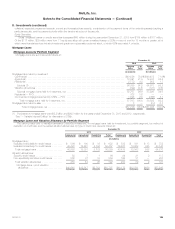

Mortgage Loans by Portfolio Segment

Mortgage loans are summarized as follows at:

December 31,

2013 2012

Carrying % of Carrying % of

Value Total Value Total

(In millions) (In millions)

Mortgage loans held-for-investment:

Commercial ............................................................................. $40,926 70.9% $40,472 71.0%

Agricultural .............................................................................. 12,391 21.5 12,843 22.5

Residential .............................................................................. 2,772 4.8 958 1.7

Subtotal (1) ............................................................................ 56,089 97.2 54,273 95.2

Valuation allowances ...................................................................... (322) (0.6) (347) (0.6)

Subtotal mortgage loans held-for-investment, net .............................................. 55,767 96.6 53,926 94.6

Residential — FVO ........................................................................ 338 0.6 — —

Commercial mortgage loans held by CSEs — FVO .............................................. 1,598 2.8 2,666 4.7

Total mortgage loans held-for-investment, net ............................................... 57,703 100.0 56,592 99.3

Mortgage loans held-for-sale .................................................................. 3 — 414 0.7

Total mortgage loans, net ............................................................. $57,706 100.0% $57,006 100.0%

(1) Purchases of mortgage loans were $2.2 billion and $205 million for the years ended December 31, 2013 and 2012, respectively.

See “— Variable Interest Entities” for discussion of CSEs.

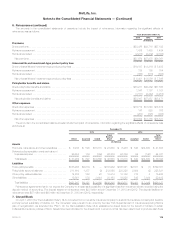

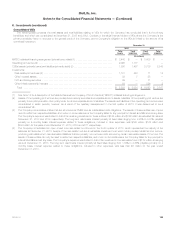

Mortgage Loans and Valuation Allowance by Portfolio Segment

The carrying value prior to valuation allowance (“recorded investment”) in mortgage loans held-for-investment, by portfolio segment, by method of

evaluation of credit loss, and the related valuation allowances, by type of credit loss, were as follows at:

December 31,

2013 2012

Commercial Agricultural Residential Total Commercial Agricultural Residential Total

(In millions)

Mortgage loans:

Evaluated individually for credit losses ........ $ 506 $ 100 $ 16 $ 622 $ 539 $ 181 $ 13 $ 733

Evaluated collectively for credit losses ........ 40,420 12,291 2,756 55,467 39,933 12,662 945 53,540

Total mortgage loans .................... 40,926 12,391 2,772 56,089 40,472 12,843 958 54,273

Valuation allowances:

Specific credit losses ..................... 58 7 1 66 94 21 2 117

Non-specifically identified credit losses ....... 200 37 19 256 199 31 — 230

Total valuation allowances ................ 258 44 20 322 293 52 2 347

Mortgage loans, net of valuation

allowance ........................... $40,668 $12,347 $2,752 $55,767 $40,179 $12,791 $956 $53,926

MetLife, Inc. 125