MetLife 2013 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

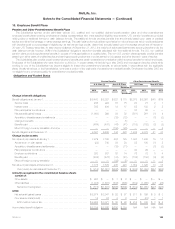

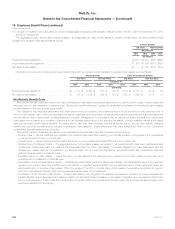

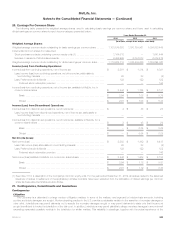

18. Employee Benefit Plans (continued)

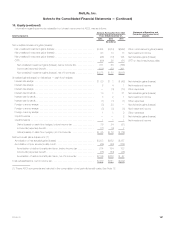

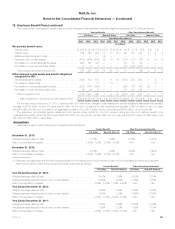

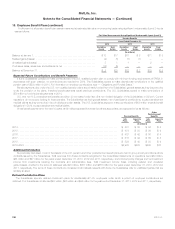

Fair Value Measurements Using Significant

Unobservable Inputs (Level 3)

Other Postretirement Benefits

Fixed Maturity

Securities:

Corporate Municipals Other (1) Derivative

Assets

(In millions)

Year Ended December 31, 2012:

Balance at January 1, .................................................................. $ 4 $ 1 $ 5 $ 1

Realized gains (losses) ................................................................. — — (2) 2

Unrealized gains (losses) ................................................................ — — 2 (2)

Purchases, sales, issuances and settlements, net ............................................ — — (2) (1)

Transfers into and/or out of Level 3 ....................................................... — — — —

Balance at December 31, ............................................................... $ 4 $ 1 $ 3 $—

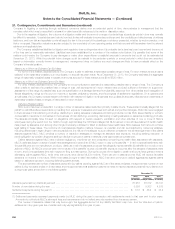

Fair Value Measurements Using Significant Unobservable Inputs (Level 3)

Pension Benefits

Fixed Maturity

Securities: Equity

Securities:

Corporate Foreign

Bonds Other (1)

Common

Stock -

Domestic Other

Investments Derivative

Assets

(In millions)

Year Ended December 31, 2011:

Balance at January 1, ................................................ $49 $ 4 $2 $240 $471 $—

Realized gains (losses) ............................................... — — (1) (59) 85 2

Unrealized gains (losses) ............................................. (4) (1) 1 118 45 4

Purchases, sales, issuances and settlements, net .......................... (13) 2 (1) (93) (70) (2)

Transfers into and/or out of Level 3 ..................................... — — 1 — — —

Balance at December 31, ............................................. $32 $ 5 $2 $206 $531 $ 4

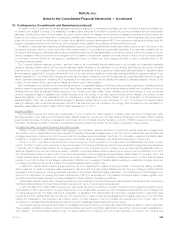

Fair Value Measurements Using Significant

Unobservable Inputs (Level 3)

Other Postretirement Benefits

Fixed Maturity

Securities:

Corporate Municipals Other (1) Derivative

Assets

(In millions)

Year Ended December 31, 2011:

Balance at January 1, .................................................................. $ 4 $ 1 $ 6 $—

Realized gains (losses) ................................................................. — — (1) —

Unrealized gains (losses) ................................................................ — — 1 1

Purchases, sales, issuances and settlements, net ............................................ — — (1) —

Transfers into and/or out of Level 3 ....................................................... — — — —

Balance at December 31, ............................................................... $ 4 $ 1 $ 5 $ 1

(1) Other includes ABS and collateralized mortgage obligations.

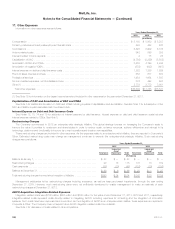

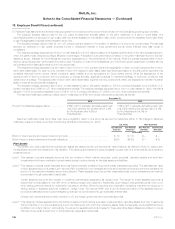

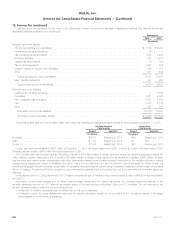

Non-U.S. Plans

Pension benefits are provided utilizing either a traditional formula or cash balance formula, similar to the U.S. plans. The investment objectives are

also similar, subject to local regulations. Generally, these international pension plans invest directly in high quality equity and fixed maturity securities.

The assets of the non-U.S. pension plans are comprised of short-term investments, equity and fixed maturity securities, real estate and hedge fund

investments.

The assets of the non-U.S. pension plans, other than those held in participant directed investment accounts, are managed in accordance with

investment policies consistent with the longer-term nature of related benefit obligations and within prudent risk parameters and consistent with the

policies, goals and derivative instrument risk management guidelines described above for the U.S. plans.

196 MetLife, Inc.