MetLife 2013 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

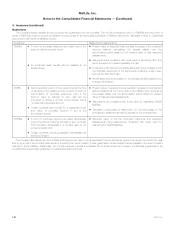

5. Deferred Policy Acquisition Costs, Value of Business Acquired and Other Policy-Related Intangibles (continued)

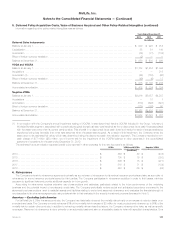

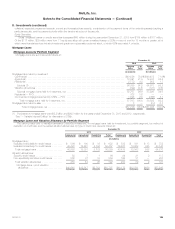

Information regarding other policy-related intangibles was as follows:

Years Ended December 31,

2013 2012 2011

(In millions)

Deferred Sales Inducements

Balance at January 1, .............................................................................. $ 930 $ 926 $ 918

Capitalization ..................................................................................... 58 81 140

Amortization ..................................................................................... (36) (77) (132)

Effect of foreign currency translation ................................................................... (2) — —

Balance at December 31, ........................................................................... $ 950 $ 930 $ 926

VODA and VOCRA

Balance at January 1, .............................................................................. $1,108 $1,264 $1,094

Acquisitions ..................................................................................... — — 213

Amortization (1) ................................................................................... (84) (150) (60)

Effect of foreign currency translation ................................................................... (49) (6) 17

Balance at December 31, ........................................................................... $ 975 $1,108 $1,264

Accumulated amortization ........................................................................... $ 418 $ 334 $ 184

Negative VOBA

Balance at January 1, .............................................................................. $2,916 $3,657 $4,287

Acquisitions ..................................................................................... — 10 7

Amortization ..................................................................................... (579) (622) (697)

Effect of foreign currency translation ................................................................... (175) (129) 60

Balance at December 31, ........................................................................... $2,162 $2,916 $3,657

Accumulated amortization ........................................................................... $1,962 $1,383 $ 761

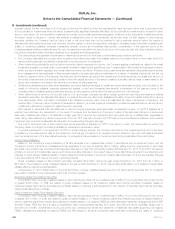

(1) In connection with the Company’s annual impairment testing of VOCRA, it was determined that the VOCRA included in the Group, Voluntary &

Worksite Benefits segment, associated with a previously acquired dental business, was impaired as the undiscounted future cash flows associated

with the asset were lower than its current carrying value. This shortfall in undiscounted future cash flows is primarily the result of actual persistency

experience being less favorable than what was assumed when the asset was acquired. As a result of this impairment, the Company wrote the

asset down to its estimated fair value, which was determined using the discounted cash flow valuation approach. The Company recorded a non-

cash charge of $77 million ($50 million, net of income tax) for the impairment of the VOCRA balance to other expenses in the consolidated

statement of operations for the year ended December 31, 2012.

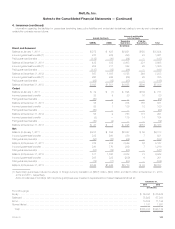

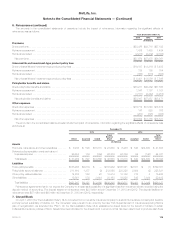

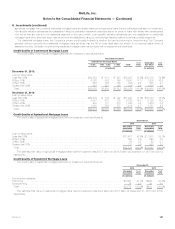

The estimated future amortization expense (credit) to be reported in other expenses for the next five years is as follows:

VOBA VODA and VOCRA Negative VOBA

(In millions)

2014 ................................................................ $ 846 $ 80 $ (438)

2015 ................................................................ $ 700 $ 79 $ (353)

2016 ................................................................ $ 596 $ 75 $ (271)

2017 ................................................................ $ 516 $ 71 $ (154)

2018 ................................................................ $ 448 $ 66 $ (68)

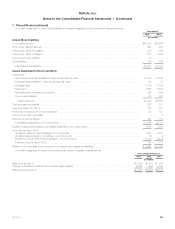

6. Reinsurance

The Company enters into reinsurance agreements primarily as a purchaser of reinsurance for its various insurance products and also as a provider of

reinsurance for some insurance products issued by third parties. The Company participates in reinsurance activities in order to limit losses, minimize

exposure to significant risks and provide additional capacity for future growth.

Accounting for reinsurance requires extensive use of assumptions and estimates, particularly related to the future performance of the underlying

business and the potential impact of counterparty credit risks. The Company periodically reviews actual and anticipated experience compared to the

aforementioned assumptions used to establish assets and liabilities relating to ceded and assumed reinsurance and evaluates the financial strengthof

counterparties to its reinsurance agreements using criteria similar to that evaluated in the security impairment process discussed in Note 8.

Americas — Excluding Latin America

For its Retail Life & Other insurance products, the Company has historically reinsured the mortality risk primarily on an excess of retention basis or on

a quota share basis. The Company currently reinsures 90% of the mortality risk in excess of $2 million for most products and reinsures up to 90% of the

mortality risk for certain other products. In addition to reinsuring mortality risk as described above, the Company reinsures other risks, as well as specific

coverages. Placement of reinsurance is done primarily on an automatic basis and also on a facultative basis for risks with specified characteristics.Ona

MetLife, Inc. 117