MetLife 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

1. Business, Basis of Presentation and Summary of Significant Accounting Policies (continued)

Securities Lending Program

Securities lending transactions, whereby blocks of securities are loaned to third parties, primarily brokerage firms and commercial banks, are

treated as financing arrangements and the associated liability is recorded at the amount of cash received. The Company obtains collateral at the

inception of the loan, usually cash, in an amount generally equal to 102% of the estimated fair value of the securities loaned, and maintains it at a level

greater than or equal to 100% for the duration of the loan. The Company is liable to return to the counterparties the cash collateral received. Security

collateral on deposit from counterparties in connection with the securities lending transactions may not be sold or repledged, unless the counterparty

is in default, and is not reflected in the financial statements. The Company monitors the estimated fair value of the securities loaned on a daily basis

and additional collateral is obtained as necessary. Income and expenses associated with securities lending transactions are reported as investment

income and investment expense, respectively, within net investment income.

Derivatives

Freestanding Derivatives

Freestanding derivatives are carried in the Company’s balance sheets either as assets within other invested assets or as liabilities within other

liabilities at estimated fair value. The Company does not offset the fair value amounts recognized for derivatives executed with the same counterparty

under the same master netting agreement.

Accruals on derivatives are generally recorded in accrued investment income or within other liabilities. However, accruals that are not scheduled to

settle within one year are included with the derivatives carrying value in other invested assets or other liabilities.

If a derivative is not designated as an accounting hedge or its use in managing risk does not qualify for hedge accounting, changes in the

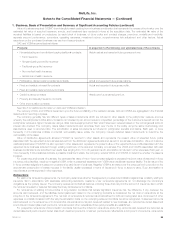

estimated fair value of the derivative are reported in net derivative gains (losses) except as follows:

Statement of Operations Presentation: Derivative:

Policyholder benefits and claims ‰Economic hedges of variable annuity guarantees included in future

policy benefits

Net investment income ‰Economic hedges of equity method investments in joint ventures

‰All derivatives held in relation to trading portfolios

‰Derivatives held within contractholder-directed unit-linked

investments

Other revenues ‰Derivatives held in connection with the Company’s previous

mortgage banking activities

Hedge Accounting

To qualify for hedge accounting, at the inception of the hedging relationship, the Company formally documents its risk management objective and

strategy for undertaking the hedging transaction, as well as its designation of the hedge. Hedge designation and financial statement presentation of

changes in estimated fair value of the hedging derivatives are as follows:

• Fair value hedge (a hedge of the estimated fair value of a recognized asset or liability) — in net derivative gains (losses), consistent with the

change in fair value of the hedged item attributable to the designated risk being hedged.

• Cash flow hedge (a hedge of a forecasted transaction or of the variability of cash flows to be received or paid related to a recognized asset or

liability) — effectiveness in OCI (deferred gains or losses on the derivative are reclassified into the statement of operations when the Company’s

earnings are affected by the variability in cash flows of the hedged item); ineffectiveness in net derivative gains (losses).

• Net investment in a foreign operation hedge — effectiveness in OCI, consistent with the translation adjustment for the hedged net investment in

the foreign operation; ineffectiveness in net derivative gains (losses).

The changes in estimated fair values of the hedging derivatives are exclusive of any accruals that are separately reported in the statement of

operations within interest income or interest expense to match the location of the hedged item. Accruals on derivatives in net investment hedges are

recognized in OCI.

In its hedge documentation, the Company sets forth how the hedging instrument is expected to hedge the designated risks related to the hedged

item and sets forth the method that will be used to retrospectively and prospectively assess the hedging instrument’s effectiveness and the method

that will be used to measure ineffectiveness. A derivative designated as a hedging instrument must be assessed as being highly effective in offsetting

the designated risk of the hedged item. Hedge effectiveness is formally assessed at inception and at least quarterly throughout the life of the

designated hedging relationship. Assessments of hedge effectiveness and measurements of ineffectiveness are also subject to interpretation and

estimation and different interpretations or estimates may have a material effect on the amount reported in net income.

The Company discontinues hedge accounting prospectively when: (i) it is determined that the derivative is no longer highly effective in offsetting

changes in the estimated fair value or cash flows of a hedged item; (ii) the derivative expires, is sold, terminated, or exercised; (iii) it is no longer

probable that the hedged forecasted transaction will occur; or (iv) the derivative is de-designated as a hedging instrument.

When hedge accounting is discontinued because it is determined that the derivative is not highly effective in offsetting changes in the estimated

fair value or cash flows of a hedged item, the derivative continues to be carried in the balance sheets at its estimated fair value, with changes in

estimated fair value recognized in net derivative gains (losses). The carrying value of the hedged recognized asset or liability under a fair value hedge

is no longer adjusted for changes in its estimated fair value due to the hedged risk, and the cumulative adjustment to its carrying value is amortized

into income over the remaining life of the hedged item. Provided the hedged forecasted transaction is still probable of occurrence, the changes in

estimated fair value of derivatives recorded in OCI related to discontinued cash flow hedges are released into the statements of operations when the

Company’s earnings are affected by the variability in cash flows of the hedged item.

96 MetLife, Inc.