MetLife 2013 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

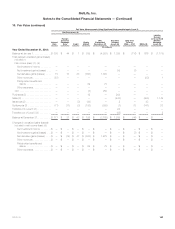

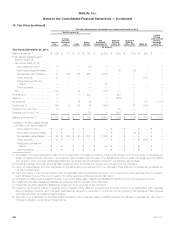

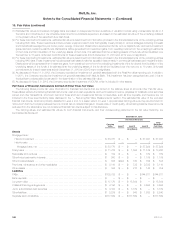

10. Fair Value (continued)

Fair Value Option

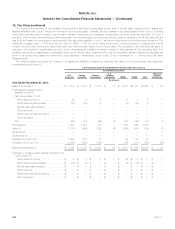

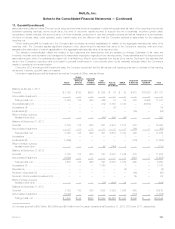

The following table presents information for certain assets and liabilities accounted for under the FVO. These assets and liabilities were initially

measured at fair value.

Residential Mortgage

Loans — FVO (1)

Certain Assets

and Liabilities

of CSEs (2)

December 31, December 31,

2013 2012 2013 2012

(In millions)

Assets

Unpaid principal balance ................................................................... $508 $— $1,528 $2,539

Difference between estimated fair value and unpaid principal balance ................................ (170) — 70 127

Carrying value at estimated fair value ....................................................... $338 $— $1,598 $2,666

Loans in non-accrual status ................................................................ $ — $— $ — $ —

Loans more than 90 days past due .......................................................... $ 81 $— $ — $ —

Loans in non-accrual status or more than 90 days past due, or both — difference between aggregate

estimated fair value and unpaid principal balance .............................................. $ (82) $— $ — $ —

Liabilities

Contractual principal balance ............................................................... $1,445 $2,430

Difference between estimated fair value and contractual principal balance ............................. 10 97

Carrying value at estimated fair value ....................................................... $1,455 $2,527

(1) Interest income, changes in estimated fair value and gains or losses on sales are recognized in net investment income. Changes in estimated fair

value for these loans were due to the following: Years Ended

December 31,

2013 2012 2011

(In millions)

Instrument-specific credit risk based on changes in credit spreads for non-agency loans and adjustments in individual loan

quality .............................................................................................. $(1) $— $—

Other changes in estimated fair value ....................................................................... 1 — —

Total gains (losses) recognized in net investment income ...................................................... $— $— $—

(2) These assets and liabilities are comprised of commercial mortgage loans and long-term debt. Changes in estimated fair value on these assets and

liabilities and gains or losses on sales of these assets are recognized in net investment gains (losses). Interest income on commercial mortgage

loans held by CSEs — FVO is recognized in net investment income. Interest expense from long-term debt of CSEs — FVO is recognized in other

expenses.

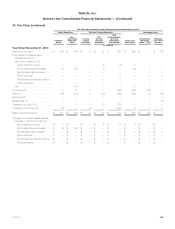

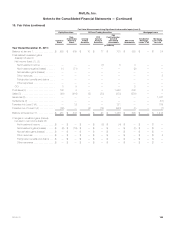

The Company also held $49 million of mortgage loans held-for-sale — FVO at December 31, 2012. Changes in estimated fair value are recognized

as gains in other revenues. Changes in fair value due to instrument-specific credit risk were less than ($1) million, ($1) million, and ($3) million for the

years ended December 31, 2013, 2012 and 2011, respectively. Other changes in estimated fair value were less than $1 million, $68 million and

$511 million for the years ended December 31, 2013, 2012 and 2011, respectively.

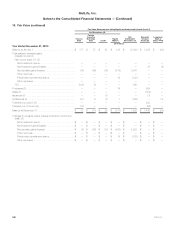

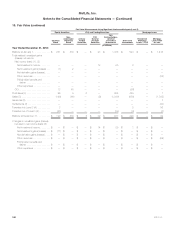

Nonrecurring Fair Value Measurements

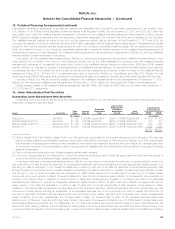

The following table presents information for assets measured at estimated fair value on a nonrecurring basis during the periods and still held at the

reporting dates; that is, they are not measured at fair value on a recurring basis but are subject to fair value adjustments only in certain circumstances

(for example, when there is evidence of impairment). The estimated fair values for these assets were determined using significant unobservable

inputs (Level 3).

At December 31, Years Ended

December 31,

2013 2012 2011 2013 2012 2011

Carrying Value After

Measurement Gains (Losses)

(In millions)

Mortgage loans: (1)

Held-for-investment .............................................................. $211 $428 $151 $ 20 $ (11) $(15)

Held-for-sale ................................................................... $ 3 $319 $ 58 $ — $ (31) $ (3)

Other limited partnership interests (2) .................................................. $ 77 $ 54 $ 13 $(46) $ (33) $ (5)

Real estate joint ventures (3) ......................................................... $ 3 $ 10 $ — $ (2) $ (6) $ —

Goodwill (4) ...................................................................... $ — $ — $ — $— $(1,868) $(65)

Other assets (5) .................................................................. $ — $ 32 $ — $ — $ (77) $ —

MetLife, Inc. 167