MetLife 2013 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

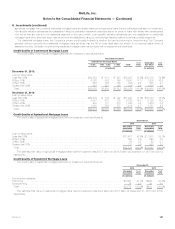

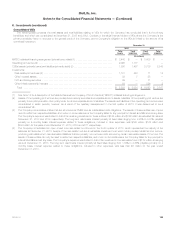

8. Investments (continued)

(1) The noncredit loss component of OTTI losses for foreign corporate securities was in an unrealized gain position of $1 million at December 31,

2012, due to increases in estimated fair value subsequent to initial recognition of noncredit losses on such securities. See also “— Net Unrealized

Investment Gains (Losses).”

The Company held non-income producing fixed maturity securities with an estimated fair value of $74 million and $85 million with unrealized

gains (losses) of $23 million and $11 million at December 31, 2013 and 2012, respectively.

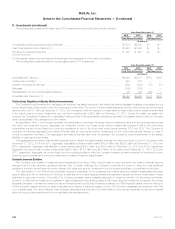

Methodology for Amortization of Premium and Accretion of Discount on Structured Securities

Amortization of premium and accretion of discount on structured securities considers the estimated timing and amount of prepayments of the

underlying loans. Actual prepayment experience is periodically reviewed and effective yields are recalculated when differences arise between the

originally anticipated and the actual prepayments received and currently anticipated. Prepayment assumptions for single class and multi-class

mortgage-backed and ABS are estimated using inputs obtained from third-party specialists and based on management’s knowledge of the current

market. For credit-sensitive mortgage-backed and ABS and certain prepayment-sensitive securities, the effective yield is recalculated on a prospective

basis. For all other mortgage-backed and ABS, the effective yield is recalculated on a retrospective basis.

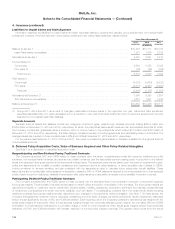

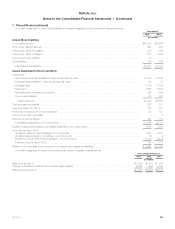

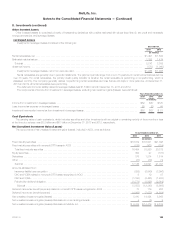

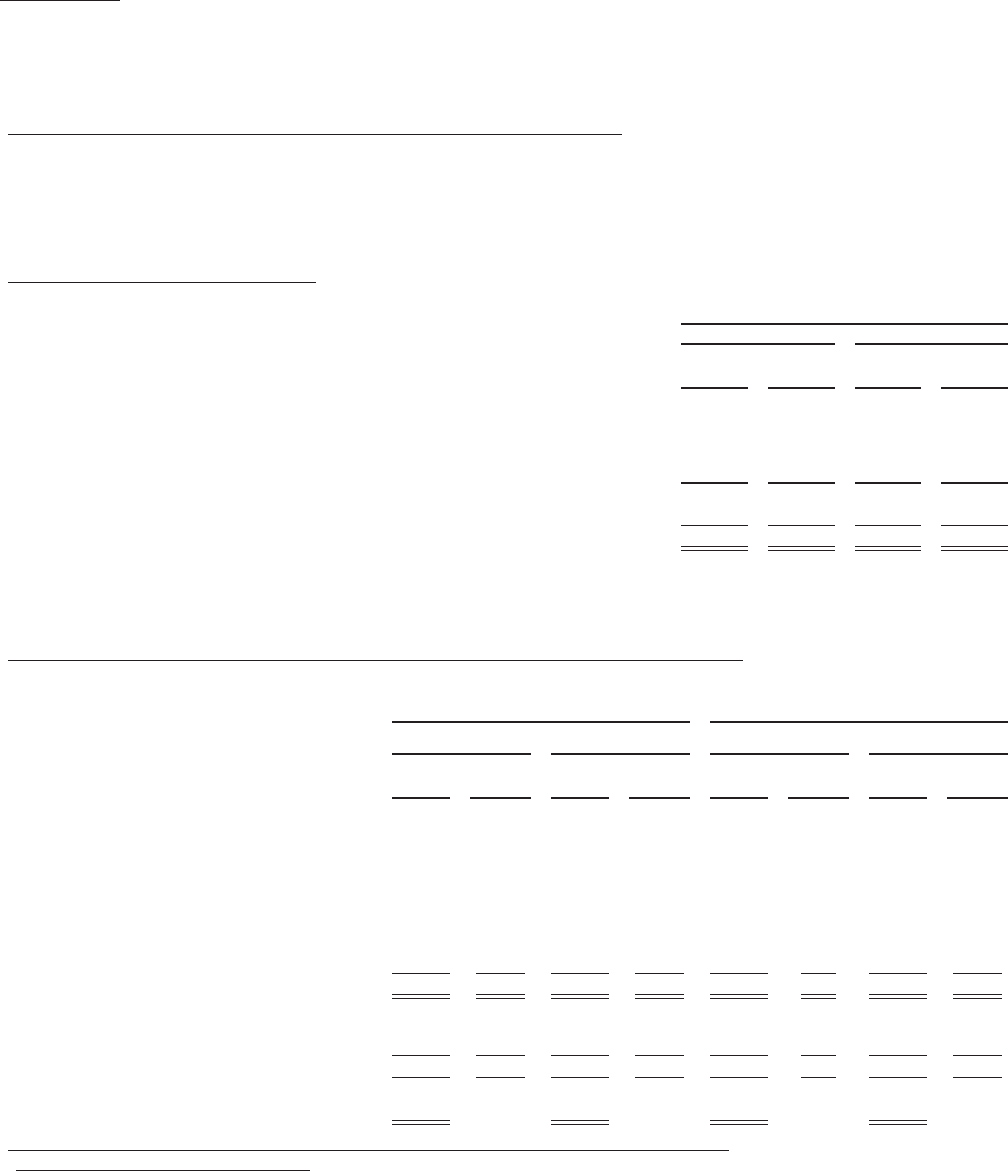

Maturities of Fixed Maturity Securities

The amortized cost and estimated fair value of fixed maturity securities, by contractual maturity date, were as follows at:

December 31,

2013 2012

Amortized

Cost

Estimated

Fair

Value Amortized

Cost

Estimated

Fair

Value

(In millions)

Due in one year or less ............................................................ $ 15,828 $ 16,030 $ 24,177 $ 24,394

Due after one year through five years ................................................. 70,467 74,229 66,973 70,759

Due after five years through ten years ................................................. 78,159 83,223 82,376 91,975

Due after ten years ............................................................... 103,405 109,529 97,739 114,533

Subtotal....................................................................... 267,859 283,011 271,265 301,661

Structured securities (RMBS, CMBS and ABS) .......................................... 65,740 67,176 69,605 72,605

Total fixed maturity securities ...................................................... $333,599 $350,187 $340,870 $374,266

Actual maturities may differ from contractual maturities due to the exercise of call or prepayment options. Fixed maturity securities not due at a

single maturity date have been presented in the year of final contractual maturity. RMBS, CMBS and ABS are shown separately, as they are not due at

a single maturity.

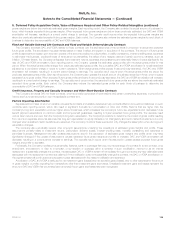

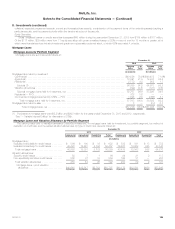

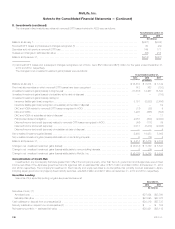

Continuous Gross Unrealized Losses for Fixed Maturity and Equity Securities AFS by Sector

The following table presents the estimated fair value and gross unrealized losses of fixed maturity and equity securities AFS in an unrealized loss

position, aggregated by sector and by length of time that the securities have been in a continuous unrealized loss position.

December 31, 2013 December 31, 2012

Less than 12 Months Equal to or Greater

than 12 Months Less than 12 Months Equal to or Greater

than 12 Months

Estimated

Fair

Value

Gross

Unrealized

Losses

Estimated

Fair

Value

Gross

Unrealized

Losses

Estimated

Fair

Value

Gross

Unrealized

Losses

Estimated

Fair

Value

Gross

Unrealized

Losses

(In millions, except number of securities)

Fixed maturity securities

U.S. corporate ................................ $13,889 $ 808 $ 3,807 $ 421 $ 3,799 $ 88 $ 3,695 $ 342

Foreign corporate .............................. 9,019 402 2,320 163 2,783 96 2,873 180

Foreign government ............................ 5,052 336 1,846 51 1,431 22 543 49

U.S. Treasury and agency ....................... 15,225 1,037 357 19 1,951 11 — —

RMBS ....................................... 10,754 363 2,302 333 735 31 4,098 633

CMBS ....................................... 3,696 142 631 28 842 11 577 46

ABS ........................................ 3,772 59 978 124 1,920 30 1,410 139

State and political subdivision ..................... 3,109 225 351 81 260 4 251 66

Total fixed maturity securities .................... $64,516 $3,372 $12,592 $1,220 $13,721 $293 $13,447 $1,455

Equity securities

Common stock ................................ $ 81 $ 4 $ 16 $ 1 $ 201 $ 18 $ 14 $ 1

Non-redeemable preferred stock .................. 364 65 191 47 — — 295 140

Total equity securities .......................... $ 445 $ 69 $ 207 $ 48 $ 201 $ 18 $ 309 $ 141

Total number of securities in an unrealized loss

position .................................... 4,480 1,571 1,941 1,335

Evaluation of AFS Securities for OTTI and Evaluating Temporarily Impaired AFS Securities

Evaluation and Measurement Methodologies

Management considers a wide range of factors about the security issuer and uses its best judgment in evaluating the cause of the decline in the

estimated fair value of the security and in assessing the prospects for near-term recovery. Inherent in management’s evaluation of the security are

assumptions and estimates about the operations of the issuer and its future earnings potential. Considerations used in the impairment evaluation

MetLife, Inc. 123