MetLife 2013 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

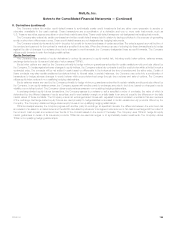

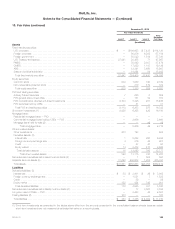

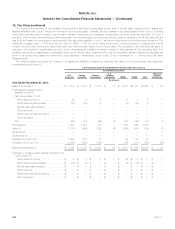

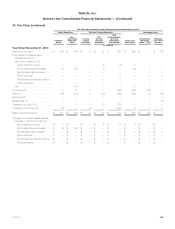

10. Fair Value (continued)

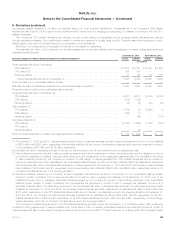

December 31, 2012

Fair Value Hierarchy

Level 1 Level 2 Level 3

Total

Estimated

Fair Value

(In millions)

Assets

Fixed maturity securities:

U.S. corporate .................................................................... $ — $106,693 $ 7,433 $114,126

Foreign corporate ................................................................. — 60,976 6,208 67,184

Foreign government ............................................................... — 55,522 1,814 57,336

U.S. Treasury and agency ........................................................... 27,441 20,455 71 47,967

RMBS .......................................................................... — 35,442 2,037 37,479

CMBS .......................................................................... — 17,982 1,147 19,129

ABS............................................................................ — 12,341 3,656 15,997

State and political subdivision ........................................................ — 14,994 54 15,048

Total fixed maturity securities ....................................................... 27,441 324,405 22,420 374,266

Equity securities:

Common stock ................................................................... 932 1,040 190 2,162

Non-redeemable preferred stock ..................................................... — 310 419 729

Total equity securities ............................................................. 932 1,350 609 2,891

FVO and trading securities:

Actively Traded Securities ........................................................... 7 646 6 659

FVO general account securities ...................................................... — 151 32 183

FVO contractholder-directed unit-linked investments ...................................... 9,103 5,425 937 15,465

FVO securities held by CSEs ........................................................ — 41 — 41

Total FVO and trading securities ..................................................... 9,110 6,263 975 16,348

Short-term investments (1) ........................................................... 9,426 6,295 429 16,150

Mortgage loans:

Residential mortgage loans — FVO ................................................... — — — —

Commercial mortgage loans held by CSEs — FVO ....................................... — 2,666 — 2,666

Mortgage loans held-for-sale (2) ...................................................... — — 49 49

Total mortgage loans .......................................................... — 2,666 49 2,715

Other invested assets:

Other investments ................................................................. 303 123 — 426

Derivative assets: (3)

Interest rate ..................................................................... 1 9,648 206 9,855

Foreign currency exchange rate ..................................................... 4 819 44 867

Credit ......................................................................... — 47 43 90

Equity market ................................................................... 14 2,478 473 2,965

Total derivative assets ........................................................... 19 12,992 766 13,777

Total other invested assets ..................................................... 322 13,115 766 14,203

Net embedded derivatives within asset host contracts (4) ................................... — 1 505 506

Separate account assets (5) .......................................................... 31,620 202,568 1,205 235,393

Total assets ...................................................................... $78,851 $556,663 $26,958 $662,472

Liabilities

Derivative liabilities: (3)

Interest rate ...................................................................... $ 38 $ 3,001 $ 29 $ 3,068

Foreign currency exchange rate ...................................................... — 1,521 7 1,528

Credit .......................................................................... — 39 — 39

Equity market ..................................................................... 132 424 345 901

Total derivative liabilities ........................................................... 170 4,985 381 5,536

Net embedded derivatives within liability host contracts (4) ................................... — 17 3,667 3,684

Long-term debt of CSEs — FVO ....................................................... — 2,483 44 2,527

Trading liabilities (6) ................................................................. 163 — — 163

Total liabilities ..................................................................... $ 333 $ 7,485 $ 4,092 $ 11,910

(1) Short-term investments as presented in the tables above differ from the amounts presented in the consolidated balance sheets because certain

short-term investments are not measured at estimated fair value on a recurring basis.

MetLife, Inc. 149